- United Kingdom

- /

- Pharma

- /

- LSE:INDV

A Piece Of The Puzzle Missing From Indivior PLC's (LON:INDV) 35% Share Price Climb

Those holding Indivior PLC (LON:INDV) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

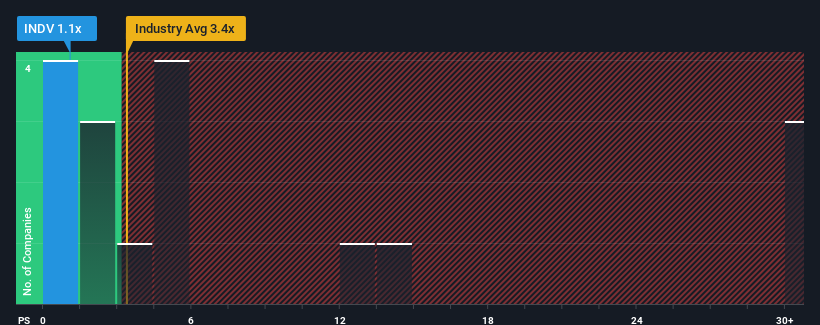

Even after such a large jump in price, Indivior's price-to-sales (or "P/S") ratio of 1.1x might still make it look like a strong buy right now compared to the wider Pharmaceuticals industry in the United Kingdom, where around half of the companies have P/S ratios above 3.9x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Indivior

What Does Indivior's P/S Mean For Shareholders?

Recent revenue growth for Indivior has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Indivior will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Indivior will help you uncover what's on the horizon.How Is Indivior's Revenue Growth Trending?

In order to justify its P/S ratio, Indivior would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 57% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 5.1% per annum during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 6.5% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Indivior's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Shares in Indivior have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Indivior's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Indivior (at least 1 which is significant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:INDV

Indivior

Engages in the development, manufacture, and sale of buprenorphine-based prescription drugs for the treatment of opioid dependence and co-occurring disorders in the United States, the United Kingdom, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives