- United Kingdom

- /

- Pharma

- /

- LSE:AZN

What AstraZeneca’s 15% Rally Means for Investors After Paused UK Investment Plans

Reviewed by Bailey Pemberton

If you are eyeing AstraZeneca and wondering whether to hold, buy in, or tap out, you are not alone. The pharmaceutical giant’s stock has been drawing plenty of attention lately, and for good reason. In just the past week, AstraZeneca shares surged 15.0%, cementing a strong year-to-date climb of 19.0%. For long-term holders, the five-year return stands at a hefty 68.4%, showing the power of patience with this stock.

So what is behind these moves? Recent news has certainly put AstraZeneca in the spotlight. There have been near-daily calls between pharma executives and White House officials, which always stirs investor curiosity about what deals or industry shifts might be brewing. Political developments around drug price negotiations and the company’s significant decisions, such as pausing a $270 million investment in Britain, are playing into both risk perception and growth potential. The overall mood seems to be a mix of optimism for future opportunities and caution as the policy landscape shifts.

But here is what really has investors buzzing: AstraZeneca scores a 3 out of 6 on a commonly used valuation checklist, signaling the company passes half of the standard undervaluation tests. That may suggest real opportunity depends on which checks matter most to you, or maybe you are skeptical, and for good reason. Up next, we will break down each widely used valuation approach and see how AstraZeneca stacks up. And if you are searching for a smarter take, stay tuned; there is a more nuanced perspective on value waiting at the end of this analysis.

Approach 1: AstraZeneca Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting those projections back to today's value. This helps investors gauge what the company is truly worth based on the cash it is expected to generate, rather than just current profits or assets.

For AstraZeneca, the analysis starts with its latest reported Free Cash Flow (FCF) of $8.7 Billion. Analysts expect this figure to keep rising, forecasting that by 2029, annual FCF could reach nearly $19.5 Billion. Notably, while analyst estimates cover up to five years, future projections beyond that are based on extrapolations to provide a ten-year outlook.

According to this DCF approach, AstraZeneca’s intrinsic value is estimated at $237.99 per share. With the current share price trading at a 46.8% discount to this estimate, the market appears to be pricing the stock significantly below its calculated fair value. This suggests that, at least through the lens of discounted cash flows, the stock is meaningfully undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AstraZeneca is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AstraZeneca Price vs Earnings

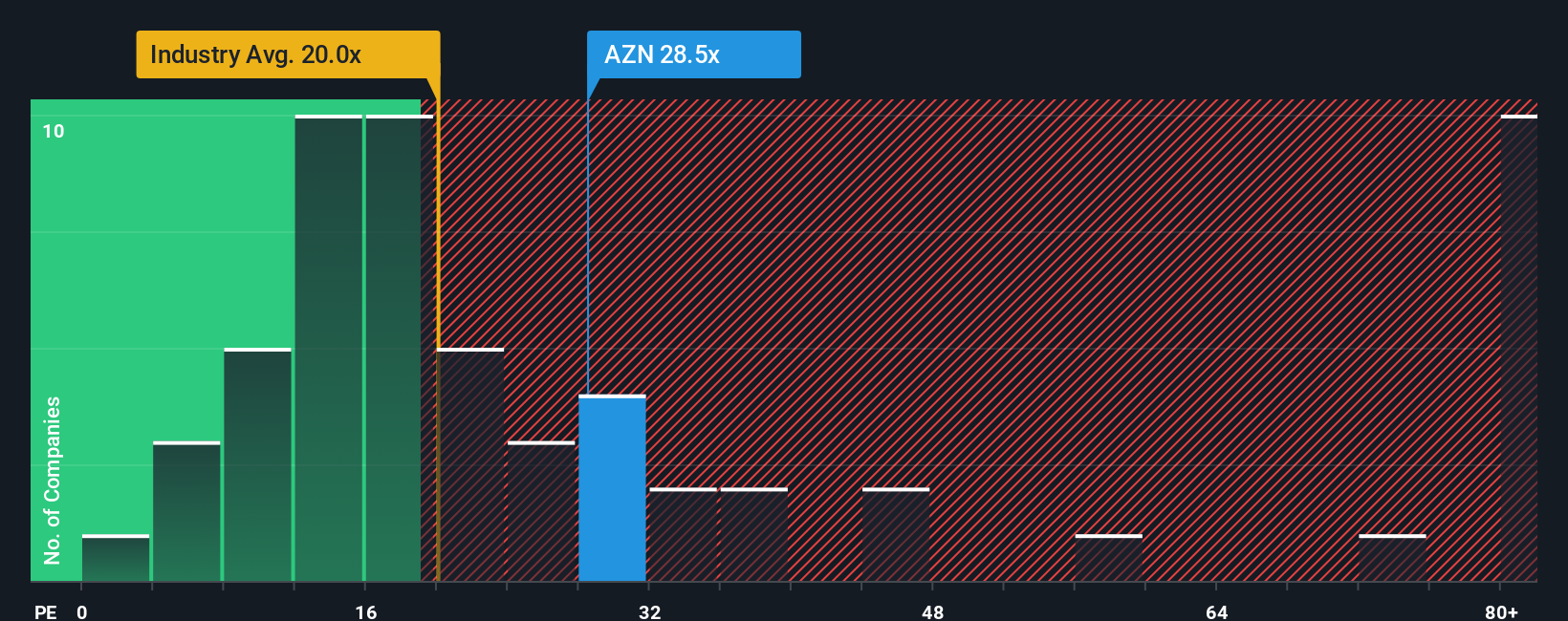

The Price-to-Earnings (PE) ratio is widely considered the go-to valuation tool for profitable companies like AstraZeneca. It helps investors gauge how much the market is willing to pay today for each pound of the company’s earnings. When a company is generating reliable profits, the PE ratio gives a clearer picture of investor sentiment and future expectations than other methods.

However, what counts as a “normal” or “fair” PE can vary widely. Faster-growing companies and those with lower perceived risk often command higher PE multiples, reflecting optimism for continued earnings expansion. On the other hand, slow growth or larger risks typically mean lower PE ratios are justified by the market.

Currently, AstraZeneca trades on a PE ratio of 31.9x. That stands well above the Pharmaceuticals industry average of 24.7x and the average for its global peers of 14.9x. Rather than stopping with simple comparisons, it is worth considering the “Fair Ratio,” a proprietary measure developed by Simply Wall St. This Fair Ratio (33.3x) incorporates much more than just competitors' numbers. It factors in AstraZeneca’s earnings outlook, profit margins, risks, industry profile, and market cap to deliver a truly tailored benchmark. That is why the Fair Ratio can offer a more precise view of whether the stock's current valuation makes sense.

With a Fair Ratio of 33.3x and AstraZeneca’s actual PE at 31.9x, the stock appears to be valued about right on this measure, neither offering a clear bargain nor looking obviously expensive.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AstraZeneca Narrative

Earlier, we mentioned there is an even better way to understand valuation, so now let us introduce you to Narratives. A Narrative is simply your story behind a company—a way for you to connect your personal insights, expectations for revenue, margins, and fair value together into a clear investment thesis. Instead of relying solely on numbers or ratios, Narratives allow you to pair AstraZeneca’s financial forecasts with your reasoning, making your own fair value estimate that evolves as new information emerges.

This approach links the company’s underlying story to quantitative forecasts, then straight to a fair value, helping you judge whether it is time to buy, hold, or sell by comparing your Fair Value to today’s Price. Creating a Narrative is straightforward and accessible. Simply Wall St makes this tool available to millions of investors on the Community page, where Narratives are kept up to date automatically when news or earnings arrive, ensuring your view never falls behind.

For example, if you believe AstraZeneca’s pipeline success and global expansion justify a bullish view, your Narrative may set fair value at £180.93 per share. A more cautious analyst, focused on regulatory risks or margin pressure, could see fair value closer to £108.24. Both views coexist, empowering you with dynamic, story-driven investing.

Do you think there's more to the story for AstraZeneca? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives