- United Kingdom

- /

- Biotech

- /

- AIM:SNG

Pebble Group And 2 Other UK Penny Stocks Worth Watching

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. In such a climate, investors might find value in exploring penny stocks—smaller or newer companies that can offer unique opportunities despite their vintage-sounding name. These stocks often present a mix of affordability and growth potential, especially when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Supreme (AIM:SUP) | £1.815 | £211.65M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £68.92M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.35 | £208.21M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.485 | £189.12M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.31 | £111.84M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.35 | £207.28M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.46 | $267.41M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Pebble Group (AIM:PEBB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Pebble Group plc provides digital commerce, products, and services to the promotional merchandise industry globally, with a market cap of £81.92 million.

Operations: The company generates revenue through its Facilis Group segment, contributing £17.63 million, and its Brand Addition segment, which accounts for £103.98 million.

Market Cap: £81.92M

Pebble Group plc, with a market cap of £81.92 million, operates in the promotional merchandise industry and has demonstrated financial stability with no debt and short-term assets (£53.2M) exceeding liabilities (£27.4M). Despite negative earnings growth over the past year, it has achieved profitability over five years with high-quality earnings. Recent events include a share buyback and stable half-year earnings at £60.75 million sales and net income of £2.27 million compared to last year’s figures. The appointment of Anne de Kerckhove as Non-Executive Chair signals strategic leadership changes aimed at leveraging her extensive experience in technology and innovation sectors.

- Take a closer look at Pebble Group's potential here in our financial health report.

- Review our growth performance report to gain insights into Pebble Group's future.

Reabold Resources (AIM:RBD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Reabold Resources Plc is an investment holding company focused on the development, appraisal, exploration, and evaluation of oil and gas projects, with a market cap of £6.12 million.

Operations: Reabold Resources Plc does not have any reported revenue segments.

Market Cap: £6.12M

Reabold Resources Plc, with a market cap of £6.12 million, is pre-revenue and currently unprofitable, reporting a net loss of £1.96 million for the half year ended June 30, 2024. The company has no debt and maintains sufficient cash runway for over a year based on its free cash flow. While shareholders experienced dilution with shares outstanding increasing by 3.2%, the management team and board are seasoned with an average tenure of 7.1 years. Despite high volatility in share price over recent months, Reabold's short-term assets significantly exceed both its short-term and long-term liabilities.

- Click here to discover the nuances of Reabold Resources with our detailed analytical financial health report.

- Examine Reabold Resources' past performance report to understand how it has performed in prior years.

Synairgen (AIM:SNG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Synairgen plc is a company focused on discovering and developing drugs for respiratory diseases, with a market cap of £9.77 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: £9.77M

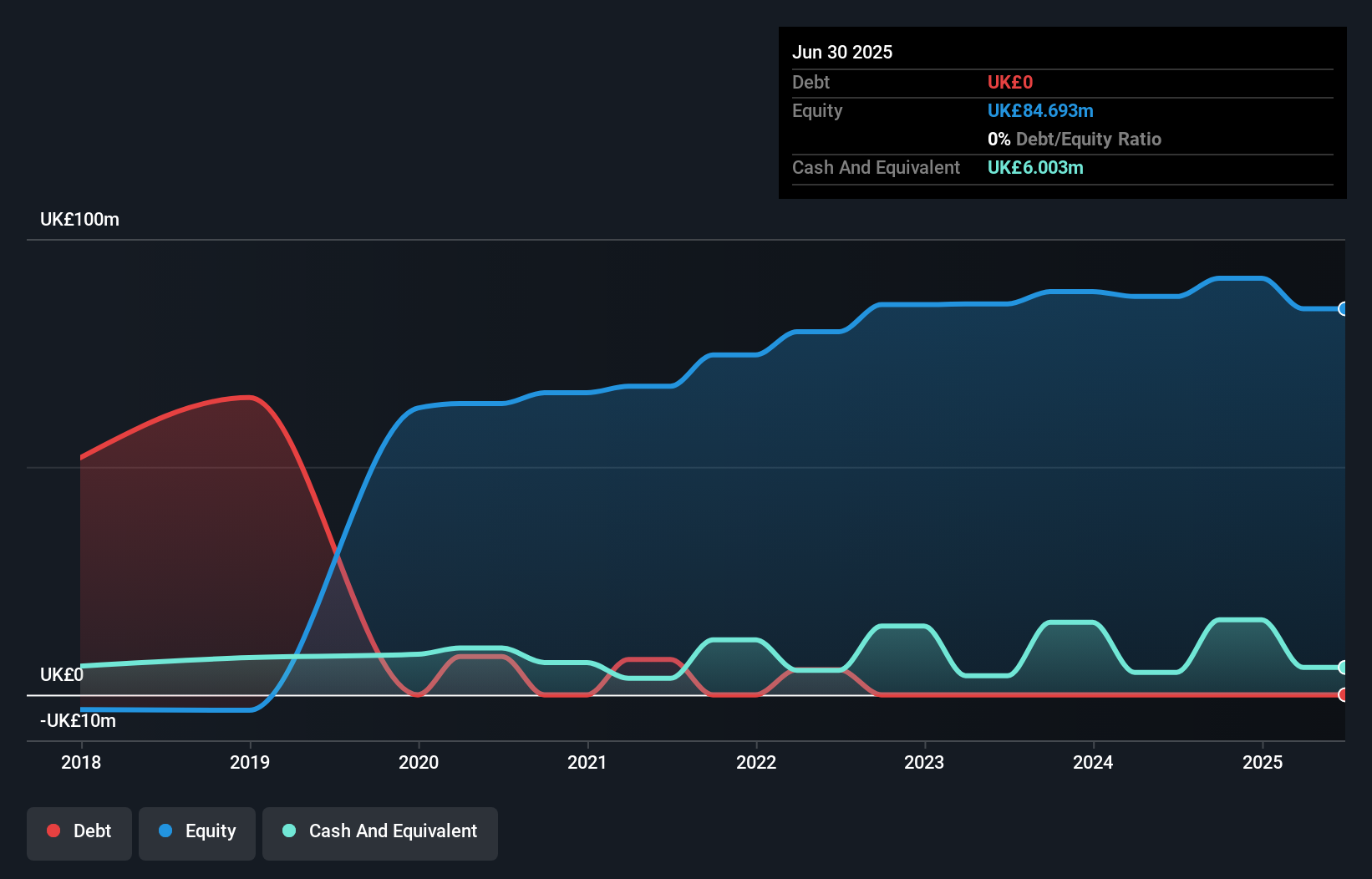

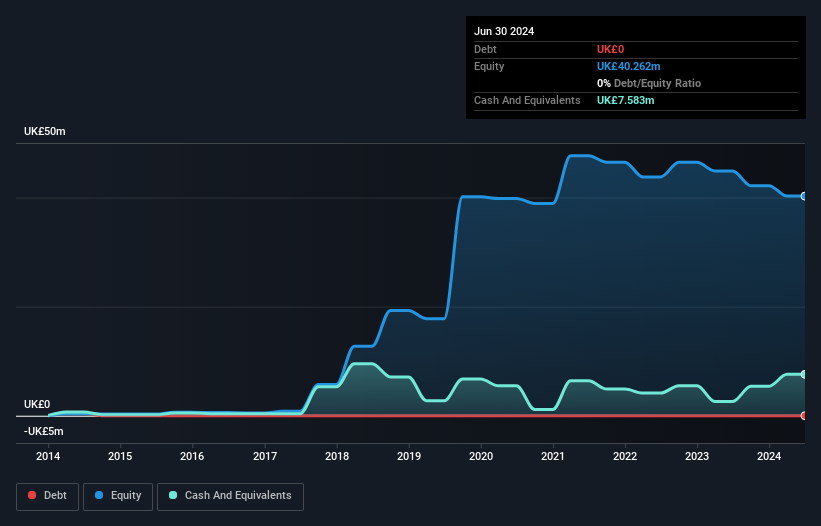

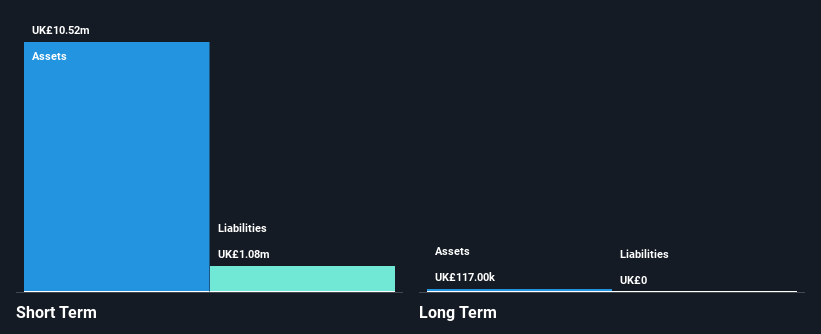

Synairgen plc, with a market cap of £9.77 million, is pre-revenue and unprofitable, reporting a net loss of £3.26 million for the half year ended June 30, 2024. The company has no debt and its short-term assets (£10.5M) comfortably cover short-term liabilities (£1.1M). Despite high volatility in its share price over recent months, Synairgen maintains a stable cash runway for more than a year based on current free cash flow levels. Recent board changes include appointing Mark Parry-Billings as Chairman, bringing extensive experience in respiratory therapeutics to guide Synairgen's strategic direction.

- Unlock comprehensive insights into our analysis of Synairgen stock in this financial health report.

- Understand Synairgen's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Click here to access our complete index of 470 UK Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SNG

Synairgen

Synairgen plc discovers and develops drugs for respiratory diseases.

Flawless balance sheet slight.