- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market pressures, there remains interest in exploring investment opportunities beyond the major players. Penny stocks, while an older term, continue to capture attention for their potential value and growth prospects when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.18 | £840.18M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £476.63M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.55 | £191.24M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.20 | £193.46M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.50 | £188.48M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.334 | £208.83M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.53 | £445.31M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.91 | £70.81M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Poolbeg Pharma (AIM:POLB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Poolbeg Pharma PLC is a biopharmaceutical company focused on developing and commercializing medicines for unmet medical needs in the United Kingdom, with a market cap of £44 million.

Operations: Poolbeg Pharma PLC has not reported any specific revenue segments.

Market Cap: £44M

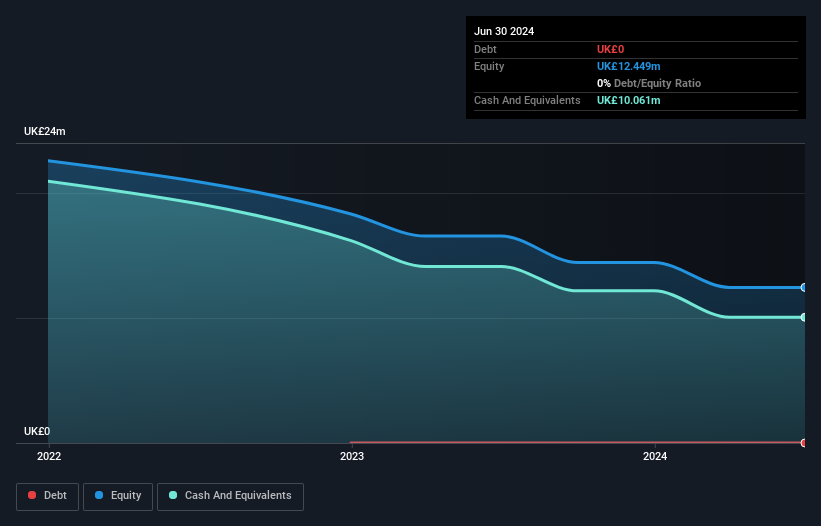

Poolbeg Pharma is a pre-revenue biopharmaceutical company with a market cap of £44 million, making it a potential candidate for penny stock investors. The company recently reported an increased net loss of £2.26 million for the first half of 2024, highlighting its current unprofitable status. Despite having no debt and sufficient short-term assets to cover liabilities, Poolbeg's earnings are forecasted to decline over the next three years. The management team is relatively new with less than one year average tenure, contributing to its high share price volatility and negative return on equity at -35.17%.

- Click here and access our complete financial health analysis report to understand the dynamics of Poolbeg Pharma.

- Review our growth performance report to gain insights into Poolbeg Pharma's future.

Genel Energy (LSE:GENL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market capitalization of £216.20 million.

Operations: The company generates revenue from its production segment, amounting to $74.4 million.

Market Cap: £216.2M

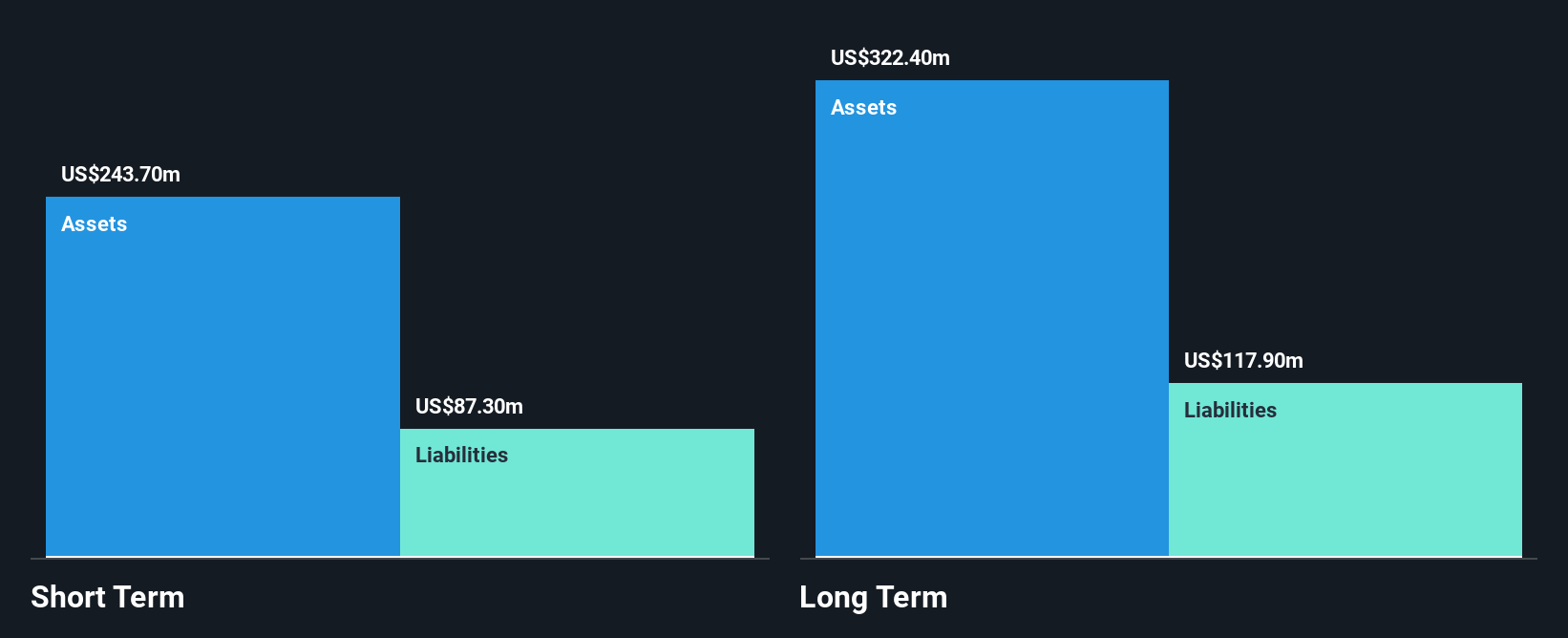

Genel Energy, with a market cap of £216.20 million, offers potential for penny stock investors despite its unprofitable status. The company reported a net loss of US$21.9 million for the first half of 2024, although losses have decreased from US$40.7 million the previous year. With short-term assets of $400.6M exceeding both short and long-term liabilities, and more cash than debt, Genel maintains financial stability while trading at 46.7% below estimated fair value. Recent board appointments bring experienced leadership that may influence future strategic directions positively amidst stable weekly volatility at 6%.

- Click to explore a detailed breakdown of our findings in Genel Energy's financial health report.

- Learn about Genel Energy's future growth trajectory here.

Pharos Energy (LSE:PHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharos Energy plc is an independent energy company involved in the exploration, development, and production of oil and gas properties in Vietnam, Egypt, and China with a market cap of £94.46 million.

Operations: Pharos Energy generates its revenue primarily from two geographical segments, with $19.6 million coming from Egypt and $127.4 million from Southeast Asia.

Market Cap: £94.46M

Pharos Energy, with a market cap of £94.46 million, presents a mixed picture for penny stock investors. Despite being unprofitable, the company has improved its financial position by reducing debt from 18.5% to 4.9% over five years and maintaining a cash runway exceeding three years with positive free cash flow. Recent earnings showed a net income of US$15.3 million for H1 2024 compared to a prior loss, though sales declined to US$60.1 million from US$79.9 million year-on-year. The stock trades significantly below estimated fair value but faces challenges like substantial insider selling and uncovered dividends at 4.65%.

- Click here to discover the nuances of Pharos Energy with our detailed analytical financial health report.

- Assess Pharos Energy's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Navigate through the entire inventory of 472 UK Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GENL

Genel Energy

Through its subsidiaries, operates as an independent oil and gas exploration and production company.

Reasonable growth potential with adequate balance sheet.