- United Kingdom

- /

- Life Sciences

- /

- AIM:IXI

Did Business Growth Power IXICO's (LON:IXI) Share Price Gain of 146%?

IXICO plc (LON:IXI) shareholders have seen the share price descend 19% over the month. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 146% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for IXICO

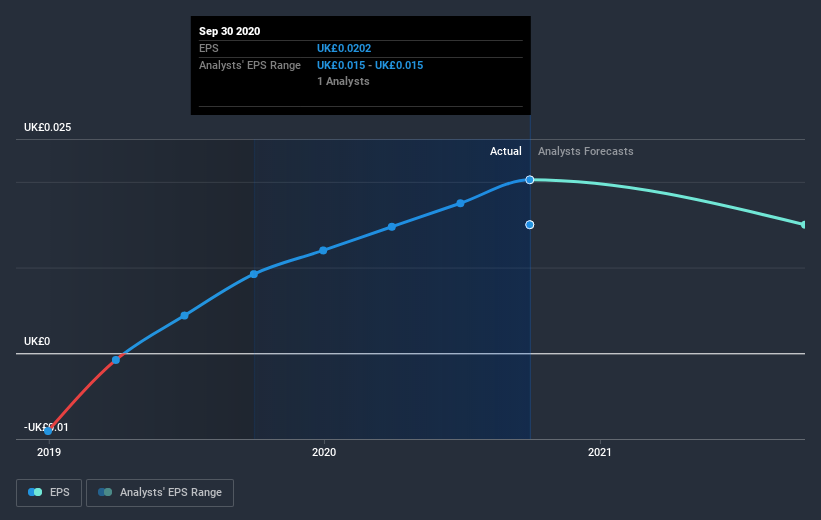

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, IXICO became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that IXICO has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling IXICO stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Although it hurts that IXICO returned a loss of 2.3% in the last twelve months, the broader market was actually worse, returning a loss of 5.6%. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand IXICO better, we need to consider many other factors. For instance, we've identified 2 warning signs for IXICO that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading IXICO or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IXI

IXICO

Provides data analytics services to the biopharmaceutical industry in the United Kingdom, Switzerland, the Netherlands, Ireland, rest of Europe, and the United States.

Flawless balance sheet slight.