- United Kingdom

- /

- Pharma

- /

- AIM:HCM

With HUTCHMED (China) Limited (LON:HCM) It Looks Like You'll Get What You Pay For

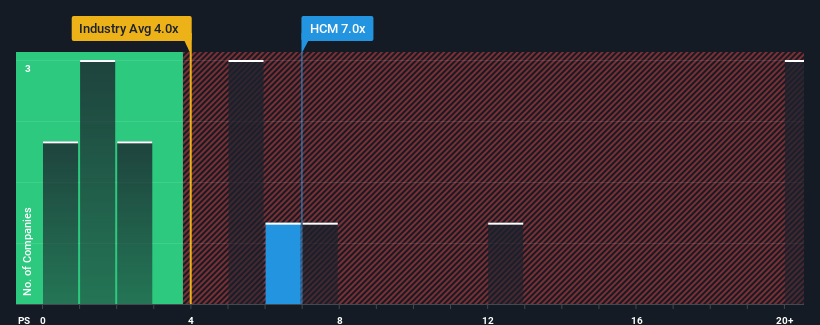

With a price-to-sales (or "P/S") ratio of 7x HUTCHMED (China) Limited (LON:HCM) may be sending bearish signals at the moment, given that almost half of all Pharmaceuticals companies in the United Kingdom have P/S ratios under 5.4x and even P/S lower than 1.9x are not unusual. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for HUTCHMED (China)

How HUTCHMED (China) Has Been Performing

There hasn't been much to differentiate HUTCHMED (China)'s and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HUTCHMED (China).What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as HUTCHMED (China)'s is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. Pleasingly, revenue has also lifted 108% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 31% per year over the next three years. That's shaping up to be materially higher than the 6.8% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why HUTCHMED (China)'s P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that HUTCHMED (China) maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with HUTCHMED (China) (including 1 which shouldn't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HUTCHMED (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HCM

HUTCHMED (China)

HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies for cancer and immunological diseases in Hong Kong and internationally.

High growth potential with adequate balance sheet.