- United Kingdom

- /

- Auto Components

- /

- AIM:JNEO

UK Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China. Despite these broader market pressures, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. While the term "penny stocks" might seem outdated, these investments can still offer significant potential when backed by solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.02 | £761.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £420.84M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.085 | £92.7M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.04 | £192.68M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.26 | £194.33M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

Click here to see the full list of 440 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FIH group (AIM:FIH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FIH group plc, with a market cap of £32.55 million, operates in the Falkland Islands and the United Kingdom offering services in retailing, property, automotive, insurance, tourism shipping, and fishing agency through its subsidiaries.

Operations: The company's revenue is derived from three main segments: Ferry Services in Portsmouth generating £4.27 million, General Trading in the Falkland Islands contributing £19.97 million, and Art Logistics and Storage in the United Kingdom with revenues of £19.68 million.

Market Cap: £32.55M

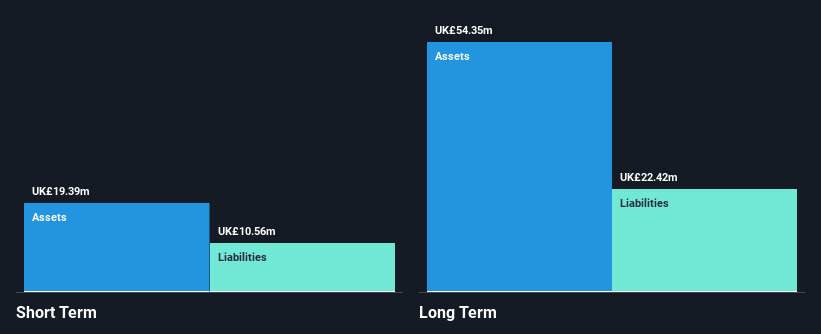

FIH group plc, with a market cap of £32.55 million, operates across diverse sectors in the Falkland Islands and the UK. Despite its unprofitability, FIH has managed to reduce losses by 34.2% annually over five years and maintains stable shareholder equity with minimal dilution. The company recently reported a net loss of £4.37 million for the half-year ending September 2024, yet continues to pay dividends at 1.25 pence per share, indicating confidence in future prospects despite current challenges. Its debt levels are satisfactory with a net debt to equity ratio of 8.2%, although short-term assets do not fully cover long-term liabilities.

- Click to explore a detailed breakdown of our findings in FIH group's financial health report.

- Assess FIH group's previous results with our detailed historical performance reports.

Journeo (AIM:JNEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Journeo plc offers solutions for capturing, processing, and displaying essential transport information to improve journeys in the UK and mainland Europe, with a market cap of £48.19 million.

Operations: The company's revenue is derived from three main segments: Infotec (£18.85 million), Fleet Systems (£17.69 million), and Passenger Systems (£9.62 million).

Market Cap: £48.19M

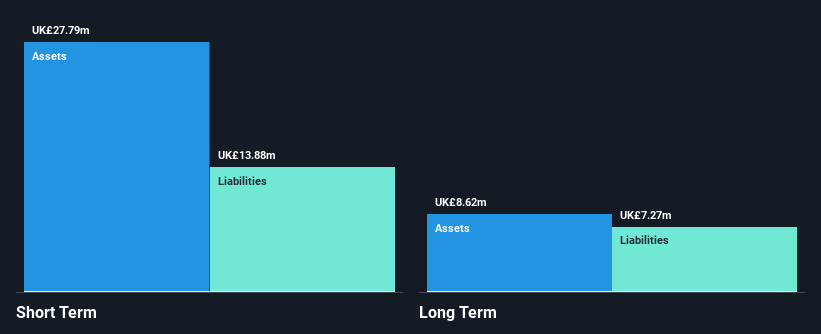

Journeo plc, with a market cap of £48.19 million, has shown strong financial health and growth potential in the penny stock arena. Recent contracts, such as a £1.1 million order from Cardiff Council and a £1.4 million award from Stoke City Council, bolster its revenue visibility and highlight its role in enhancing public transport information systems across the UK. The company's short-term assets comfortably cover both short- and long-term liabilities, while operating cash flow significantly exceeds debt obligations. Despite high non-cash earnings impacting quality metrics, Journeo's profitability has improved markedly over five years with robust earnings growth of 91.1% last year.

- Dive into the specifics of Journeo here with our thorough balance sheet health report.

- Evaluate Journeo's prospects by accessing our earnings growth report.

Transense Technologies (AIM:TRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Transense Technologies plc develops and supplies specialist sensor systems across multiple regions including the United Kingdom, North America, South America, Australia, and Europe with a market cap of £24.73 million.

Operations: The company's revenue is derived from three segments: SAW (£0.45 million), Translogik (£1.12 million), and Itrack Royalties (£2.61 million).

Market Cap: £24.73M

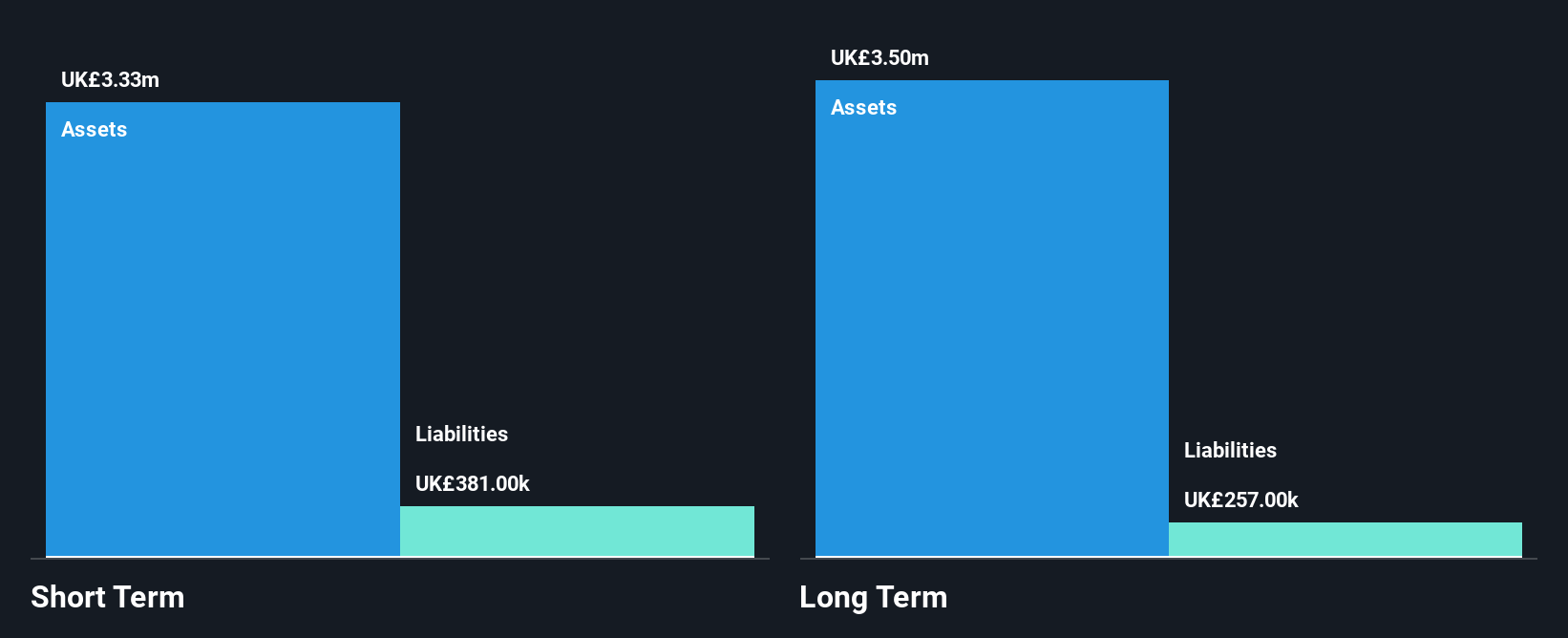

Transense Technologies plc, with a market cap of £24.73 million, stands out in the penny stock space due to its strategic alliance with TIRETASK GmbH, enhancing its Translogik segment through an integrated tyre management solution. This collaboration targets fleet operators and tyre dealers across multiple regions via a subscription model. Financially, the company boasts high return on equity at 28.1%, is debt-free, and has stable weekly volatility of 6%. Its short-term assets (£3.1 million) comfortably cover both short- (£593K) and long-term liabilities (£304K), though recent profit margins have slightly dipped from last year.

- Unlock comprehensive insights into our analysis of Transense Technologies stock in this financial health report.

- Review our historical performance report to gain insights into Transense Technologies' track record.

Turning Ideas Into Actions

- Dive into all 440 of the UK Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JNEO

Journeo

Provides solutions to the transport community that captures, processes, and displays essential information to enhance journeys in the United Kingdom and mainland Europe.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives