- United Kingdom

- /

- Pharma

- /

- AIM:HCM

HUTCHMED (China) (LON:HCM shareholders incur further losses as stock declines 8.0% this week, taking three-year losses to 50%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term HUTCHMED (China) Limited (LON:HCM) shareholders have had that experience, with the share price dropping 50% in three years, versus a market decline of about 12%. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days.

If the past week is anything to go by, investor sentiment for HUTCHMED (China) isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for HUTCHMED (China)

HUTCHMED (China) isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, HUTCHMED (China) saw its revenue grow by 34% per year, compound. That is faster than most pre-profit companies. The share price drop of 14% per year over three years would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. It seems likely that actual growth fell short of shareholders' expectations. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

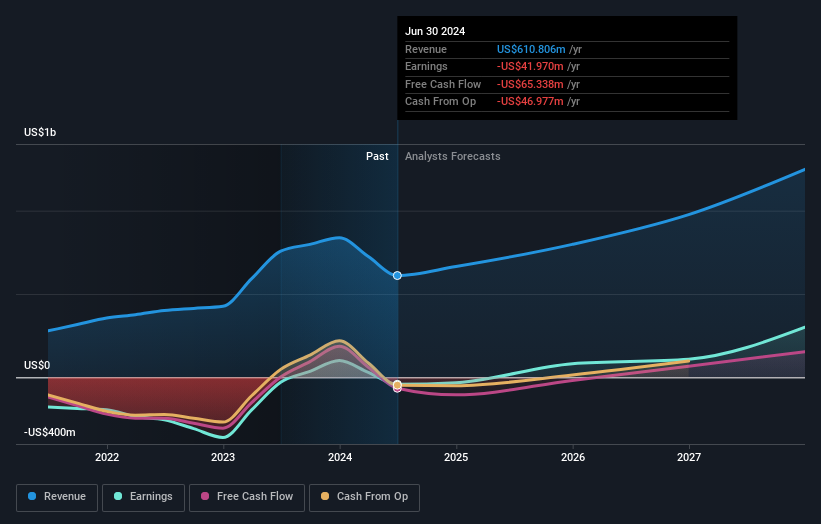

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

HUTCHMED (China) is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 13% in the last year, HUTCHMED (China) shareholders lost 3.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 8% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand HUTCHMED (China) better, we need to consider many other factors. For example, we've discovered 1 warning sign for HUTCHMED (China) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HUTCHMED (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HCM

HUTCHMED (China)

HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies for cancer and immunological diseases in Hong Kong and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives