- United Kingdom

- /

- Pharma

- /

- AIM:HCM

HUTCHMED (China) (LON:HCM investor five-year losses grow to 49% as the stock sheds UK£211m this past week

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. So we wouldn't blame long term HUTCHMED (China) Limited (LON:HCM) shareholders for doubting their decision to hold, with the stock down 49% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 26%. More recently, the share price has dropped a further 18% in a month.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for HUTCHMED (China)

Given that HUTCHMED (China) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, HUTCHMED (China) saw its revenue increase by 15% per year. That's well above most other pre-profit companies. The share price drop of 8% per year over five years would be considered let down. You could say that the market has been harsh, given the top line growth. So now is probably an apt time to look closer at the stock, if you think it has potential.

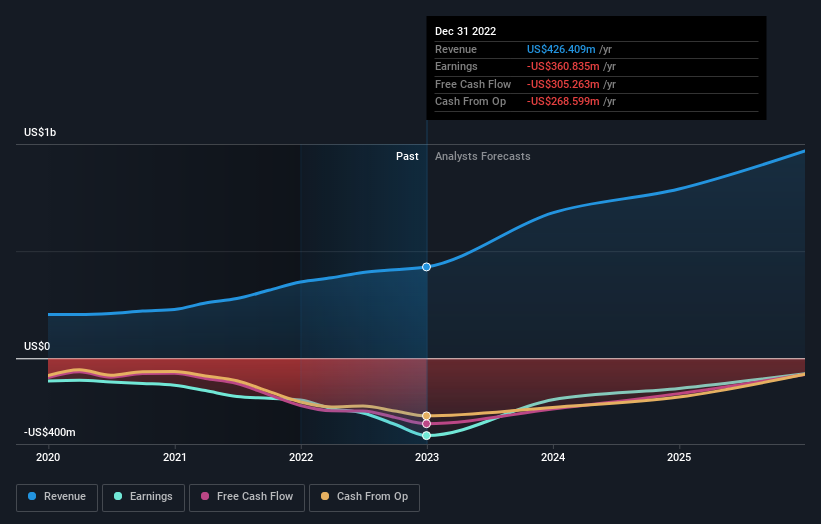

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

HUTCHMED (China) is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for HUTCHMED (China) in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 2.9% in the twelve months, HUTCHMED (China) shareholders did even worse, losing 26%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand HUTCHMED (China) better, we need to consider many other factors. Take risks, for example - HUTCHMED (China) has 3 warning signs we think you should be aware of.

But note: HUTCHMED (China) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HUTCHMED (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HCM

HUTCHMED (China)

HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies to treat cancer and immunological diseases in Hong Kong, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives