- United Kingdom

- /

- Pharma

- /

- AIM:HCM

HUTCHMED (China) Limited's (LON:HCM) P/S Still Appears To Be Reasonable

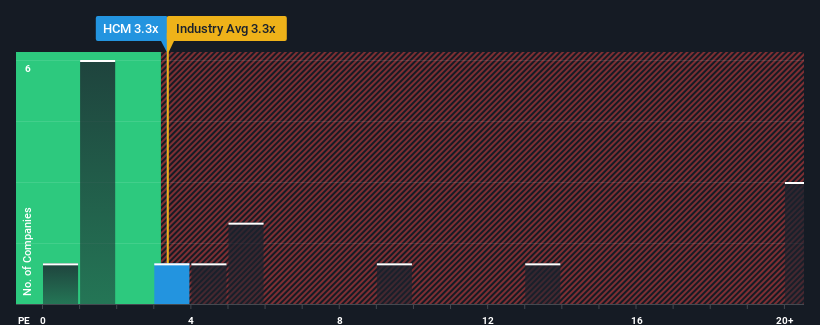

With a median price-to-sales (or "P/S") ratio of close to 3.3x in the Pharmaceuticals industry in the United Kingdom, you could be forgiven for feeling indifferent about HUTCHMED (China) Limited's (LON:HCM) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for HUTCHMED (China)

What Does HUTCHMED (China)'s P/S Mean For Shareholders?

Recent times have been advantageous for HUTCHMED (China) as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on HUTCHMED (China) will help you uncover what's on the horizon.How Is HUTCHMED (China)'s Revenue Growth Trending?

HUTCHMED (China)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 97% last year. Pleasingly, revenue has also lifted 268% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 7.4% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.1% each year, which is not materially different.

With this information, we can see why HUTCHMED (China) is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A HUTCHMED (China)'s P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Pharmaceuticals industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for HUTCHMED (China) you should know about.

If you're unsure about the strength of HUTCHMED (China)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HUTCHMED (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HCM

HUTCHMED (China)

HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies for cancer and immunological diseases in Hong Kong and internationally.

High growth potential with adequate balance sheet.