- United Kingdom

- /

- Biotech

- /

- AIM:AVCT

Avacta Group (LON:AVCT investor one-year losses grow to 57% as the stock sheds UK£24m this past week

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that Avacta Group Plc (LON:AVCT) stock has had a really bad year. The share price has slid 57% in that time. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 18% in three years. Even worse, it's down 26% in about a month, which isn't fun at all.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Avacta Group

Because Avacta Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Avacta Group grew its revenue by 41% over the last year. That's definitely a respectable growth rate. Unfortunately it seems investors wanted more, because the share price is down 57% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

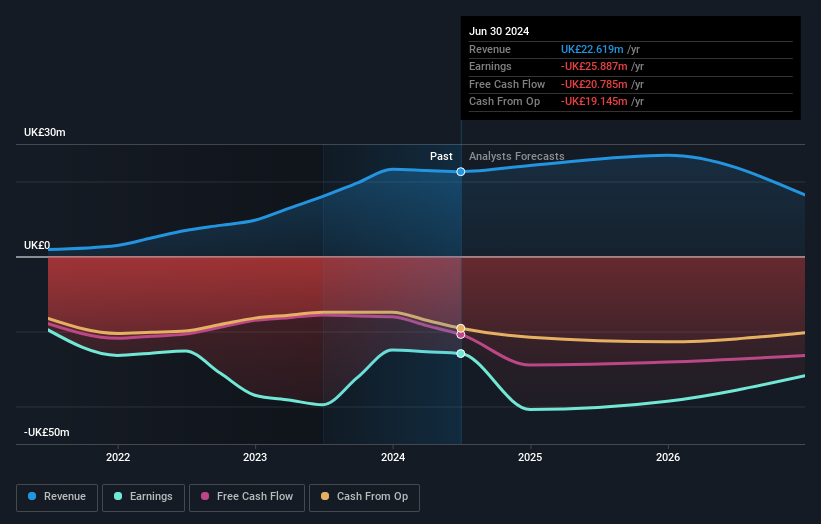

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Avacta Group

A Different Perspective

Avacta Group shareholders are down 57% for the year, but the market itself is up 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Avacta Group you should be aware of, and 1 of them is a bit unpleasant.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AVCT

Avacta Group

Develops cancer drugs and in vitro diagnostics in the United Kingdom, France, North America, South Korea, rest of Europe, and internationally.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives