S4 Capital plc (LON:SFOR) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

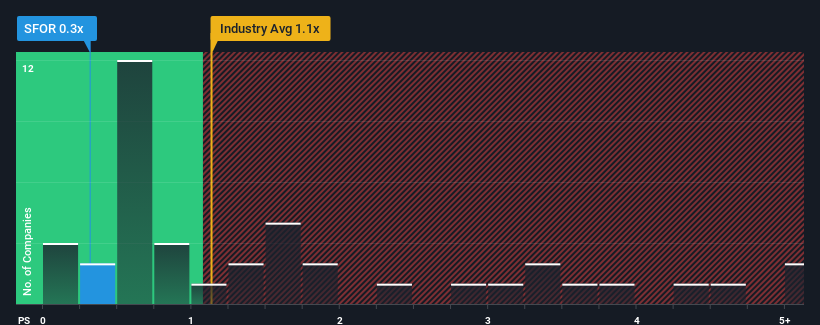

In spite of the firm bounce in price, considering around half the companies operating in the United Kingdom's Media industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider S4 Capital as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for S4 Capital

How Has S4 Capital Performed Recently?

S4 Capital hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think S4 Capital's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

S4 Capital's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 5.4% decrease to the company's top line. Even so, admirably revenue has lifted 195% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 0.7% per year. Meanwhile, the broader industry is forecast to contract by 0.9% per year, which would indicate the company is doing better than the majority of its peers.

With this in consideration, we find it intriguing that S4 Capital's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What We Can Learn From S4 Capital's P/S?

S4 Capital's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that S4 Capital currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for S4 Capital that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SFOR

S4 Capital

Provides digital advertising and marketing services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives