The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines amid concerns over China's economic recovery. Despite these broader market pressures, certain smaller companies continue to offer intriguing investment opportunities. Penny stocks, often overlooked due to their size and historical connotations, can still present value when backed by strong financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £353.13M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.92 | £474.22M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.78 | £207.57M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.86 | £65.13M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.326 | £204.51M | ★★★★★☆ |

| Castings (LSE:CGS) | £2.88 | £125.16M | ★★★★★★ |

| Central Asia Metals (AIM:CAML) | £1.732 | £301.32M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Croma Security Solutions Group (AIM:CSSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Croma Security Solutions Group plc offers a range of security services in the United Kingdom with a market capitalization of £10.53 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: £10.53M

Croma Security Solutions Group, with a market capitalization of £10.53 million, has shown robust earnings growth of 227.1% over the past year, surpassing industry averages despite a five-year decline trend. The company is debt-free and its short-term assets significantly exceed liabilities, indicating strong financial health. However, insider selling in recent months raises some concerns about internal confidence. The board's average tenure is relatively short at 1.6 years, suggesting potential governance challenges. Recent earnings reported sales of £8.74 million and net income of £0.543 million for the year ended June 2024; a final dividend increase has been proposed pending approval in December.

- Click here and access our complete financial health analysis report to understand the dynamics of Croma Security Solutions Group.

- Understand Croma Security Solutions Group's earnings outlook by examining our growth report.

Centaur Media (LSE:CAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaur Media Plc provides business information, training, and specialist consultancy services to professional and commercial markets across the UK, Europe, North America, and internationally with a market cap of £36.64 million.

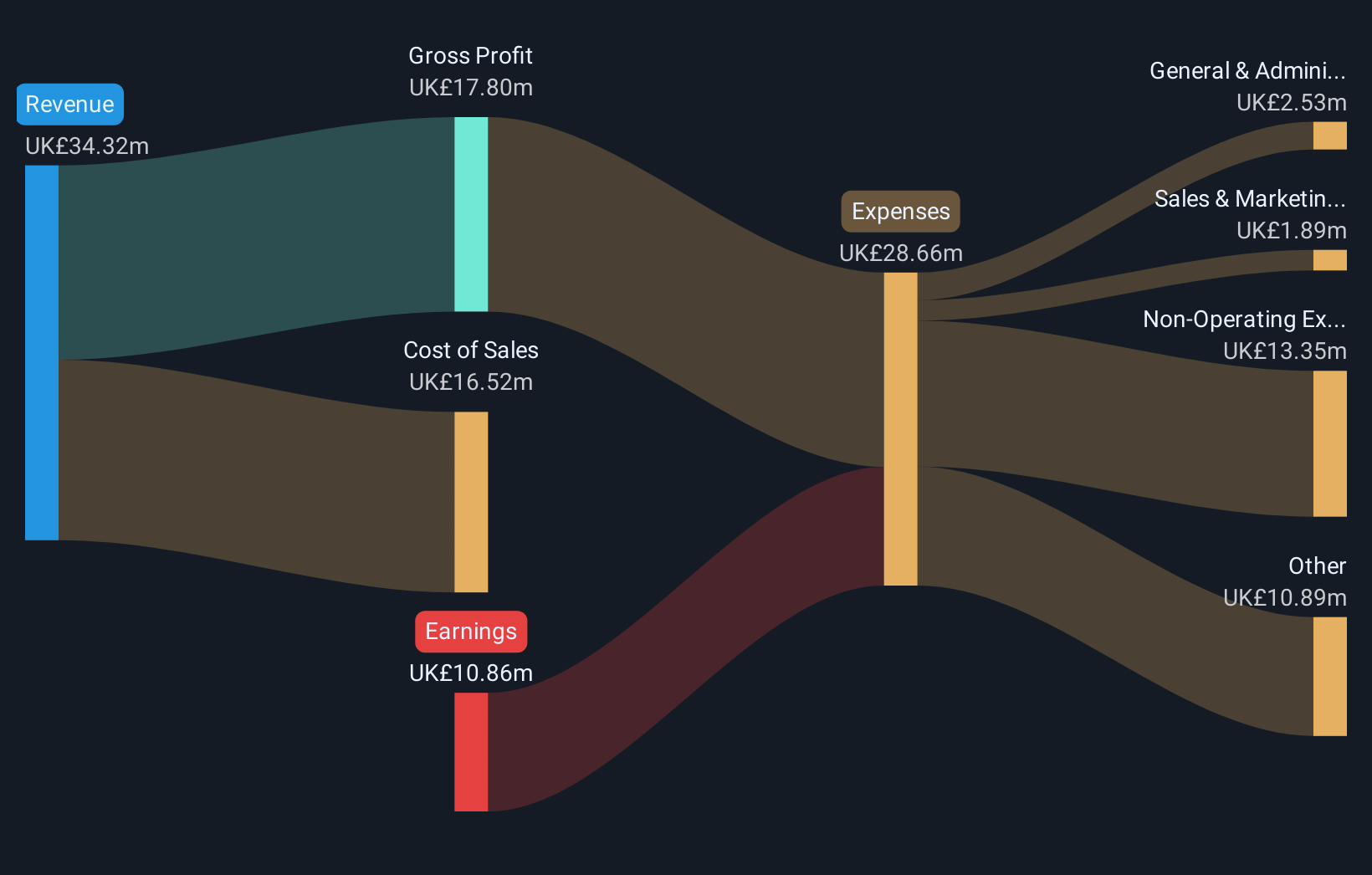

Operations: The company's revenue is derived from two primary segments: Xeim, contributing £27.29 million, and The Lawyer, generating £8.66 million.

Market Cap: £36.64M

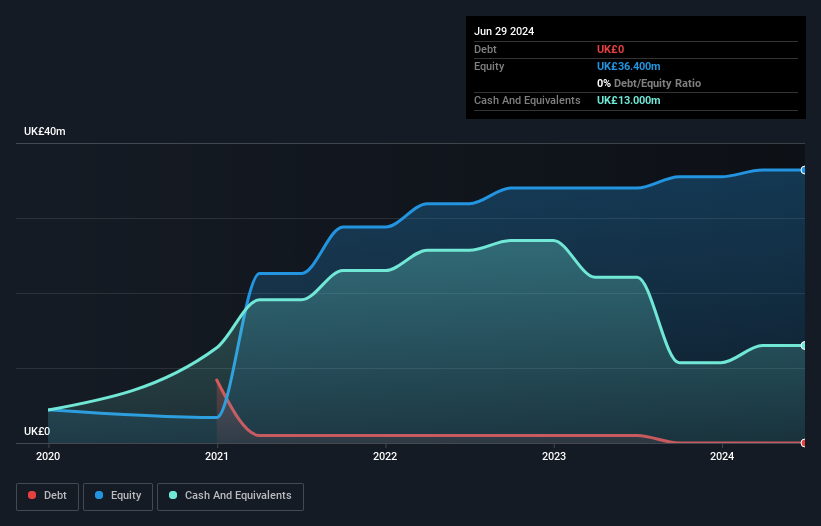

Centaur Media, with a market cap of £36.64 million, has experienced significant changes in its board, appointing Martin Rowland as Chair. Despite being debt-free and having high-quality earnings, the company faces challenges with shareholder dilution and short-term liabilities exceeding assets (£14M vs £17.3M). Recent guidance indicates expected 2024 revenue of at least £34 million, below analyst consensus. Although Centaur's net profit margin improved to 12.9% from 9.9%, earnings growth of 29.5% last year lagged behind industry averages and is projected to decline by an average of 17.5% annually over the next three years.

- Click here to discover the nuances of Centaur Media with our detailed analytical financial health report.

- Gain insights into Centaur Media's outlook and expected performance with our report on the company's earnings estimates.

National World (LSE:NWOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: National World Plc operates in the news publishing industry in the United Kingdom with a market cap of £40.15 million.

Operations: The company generates revenue from identifying and acquiring investment projects, amounting to £95.6 million.

Market Cap: £40.15M

National World Plc, with a market cap of £40.15 million, is involved in the bidding process for the Telegraph newspaper business. The company is debt-free and its short-term assets (£29.2M) comfortably exceed both long-term (£500K) and short-term liabilities (£22.9M). Despite stable weekly volatility, National World has faced negative earnings growth over the past year and a decline in net profit margins to 2.5% from 4.2%. While its board is experienced, the management team lacks tenure with an average of 1.9 years, indicating recent changes that may impact strategic direction.

- Unlock comprehensive insights into our analysis of National World stock in this financial health report.

- Review our growth performance report to gain insights into National World's future.

Key Takeaways

- Navigate through the entire inventory of 470 UK Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National World might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NWOR

National World

Provides news and information services through a portfolio of multimedia publications and websites in the United Kingdom.

Flawless balance sheet moderate.

Market Insights

Community Narratives