Should Weakness in MONY Group plc's (LON:MONY) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

With its stock down 4.5% over the past three months, it is easy to disregard MONY Group (LON:MONY). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on MONY Group's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for MONY Group is:

36% = UK£82m ÷ UK£229m (Based on the trailing twelve months to June 2025).

The 'return' is the amount earned after tax over the last twelve months. That means that for every £1 worth of shareholders' equity, the company generated £0.36 in profit.

Check out our latest analysis for MONY Group

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

MONY Group's Earnings Growth And 36% ROE

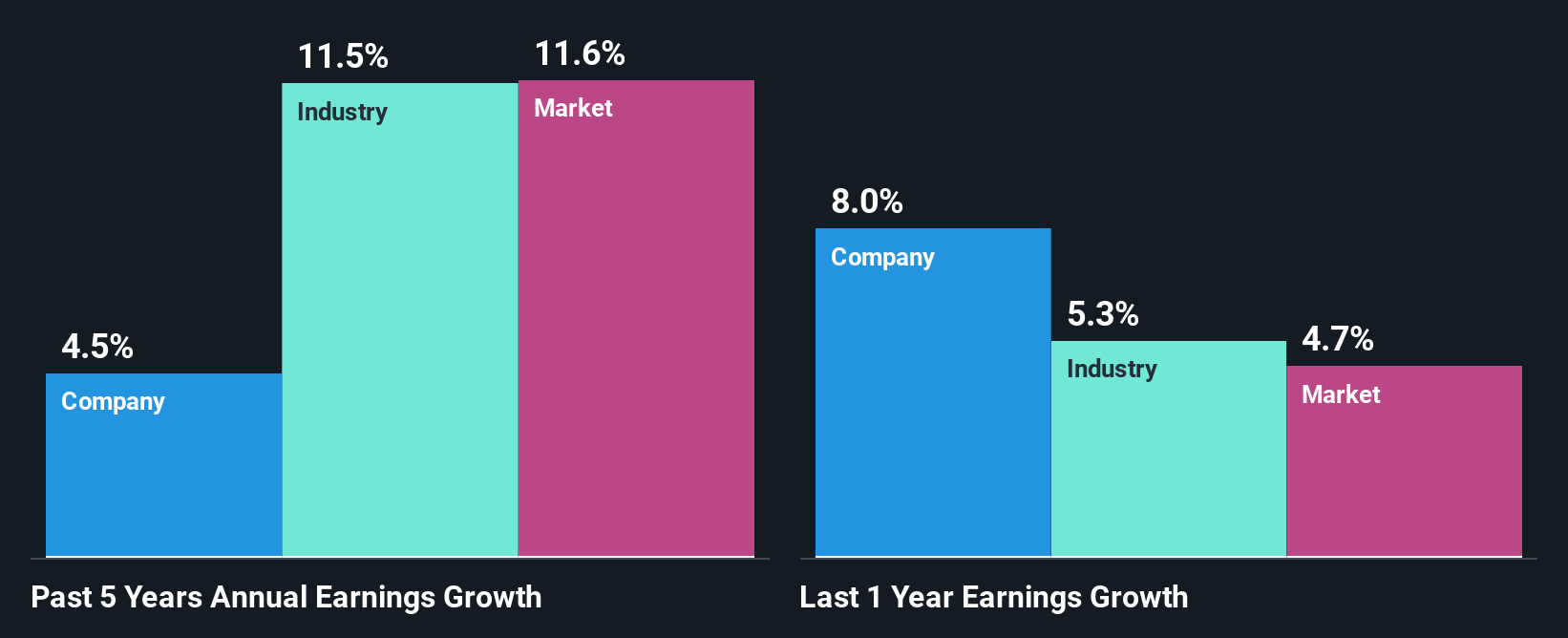

First thing first, we like that MONY Group has an impressive ROE. Further, even comparing with the industry average if 36%, the company's ROE is quite respectable. However, for some reason, the higher returns aren't reflected in MONY Group's meagre five year net income growth average of 4.5%.Despite this, MONY Group's five year net income growth was quite low averaging at only 4.5%.Yet, MONY Group has posted measly growth of 4.5% over the past five years. That's a bit unexpected from a company which has such a high rate of return. A few likely reasons why this could happen is that the company could have a high payout ratio the business has allocated capital poorly, for instance.

Next, on comparing with the industry net income growth, we found that MONY Group's reported growth was lower than the industry growth of 12% over the last few years, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for MONY? You can find out in our latest intrinsic value infographic research report.

Is MONY Group Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 86% (that is, the company retains only 14% of its income) over the past three years for MONY Group suggests that the company's earnings growth was lower as a result of paying out a majority of its earnings.

Moreover, MONY Group has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 71%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 38%.

Summary

On the whole, we do feel that MONY Group has some positive attributes. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE. Bear in mind, the company reinvests a small portion of its profits, which means that investors aren't reaping the benefits of the high rate of return. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MONY

MONY Group

Engages in the provision of price comparison and lead generation services through its websites and applications in the United Kingdom.

Outstanding track record 6 star dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success