- United Kingdom

- /

- Software

- /

- LSE:SGE

Top High Growth Tech Stocks In The UK For September 2024

Reviewed by Simply Wall St

The United Kingdom market has shown positive momentum, rising 1.2% in the last 7 days and 7.1% over the past year, with earnings anticipated to grow by 14% annually over the next few years. In this favorable environment, identifying high growth tech stocks that can capitalize on these trends is crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.17 billion.

Operations: Informa generates revenue through four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates globally, providing services in events, digital solutions, and academic research across various regions including the UK, Europe, the US, and China.

Informa's recent financial performance shows a mixed picture, with revenue for H1 2024 at £1.70 billion, up from £1.52 billion the previous year. However, net income dropped to £147.3 million from £253.5 million due to a significant one-off loss of £213.5 million impacting results as of June 30, 2024. The company has repurchased 41.67 million shares for £338.9 million in H1 2024, completing a total buyback of 191.88 million shares since March 2022. Informa’s earnings are forecasted to grow by an impressive 21.46% annually over the next three years, surpassing the UK market average growth rate of 14%. This growth is supported by robust R&D investments aimed at enhancing digital business segments and ensuring sustained innovation within its portfolio—key factors driving future prospects in the tech sector despite current challenges in profitability and earnings consistency.

- Navigate through the intricacies of Informa with our comprehensive health report here.

Understand Informa's track record by examining our Past report.

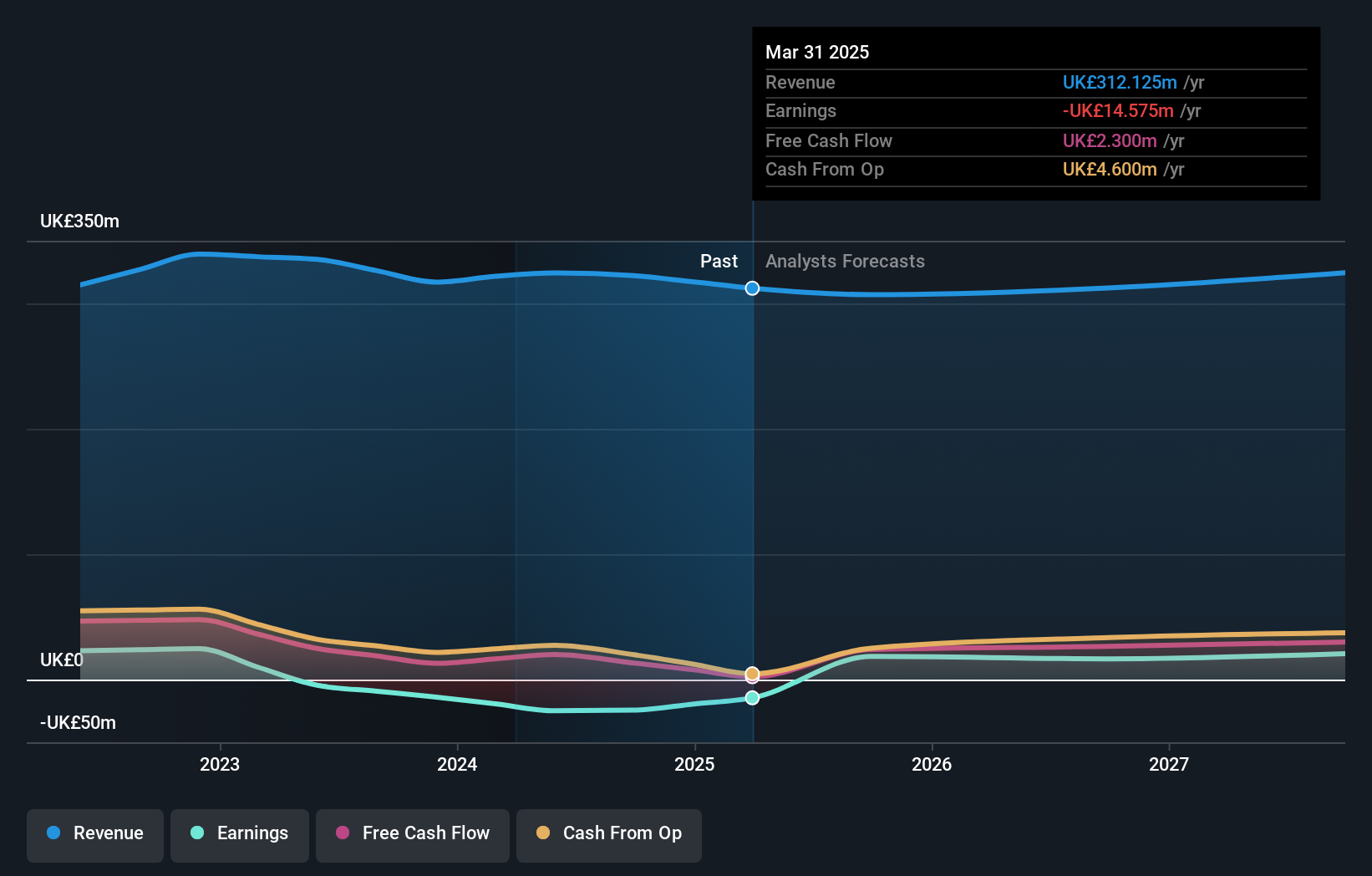

NCC Group (LSE:NCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £547.73 million.

Operations: NCC Group plc generates revenue primarily from its Cyber Security segment (£258.50 million) and Escode segment (£65.90 million). The company focuses on providing cyber and software resilience services across various regions including the UK, Asia-Pacific, North America, and Europe.

NCC Group's revenue for FY 2024 was £324.4 million, a slight decrease from £335.1 million the previous year, while net loss widened to £24.9 million from £4.6 million. Despite current challenges, the company is expected to see an 87.41% annual earnings growth over the next three years, driven by strategic investments and client projects like upgrading Ale Municipality’s water network with a SEK 450 million contract. With R&D expenses at approximately 4.5% of revenue, NCC continues to innovate in cybersecurity solutions amidst rising demand for robust digital infrastructure in the UK market.

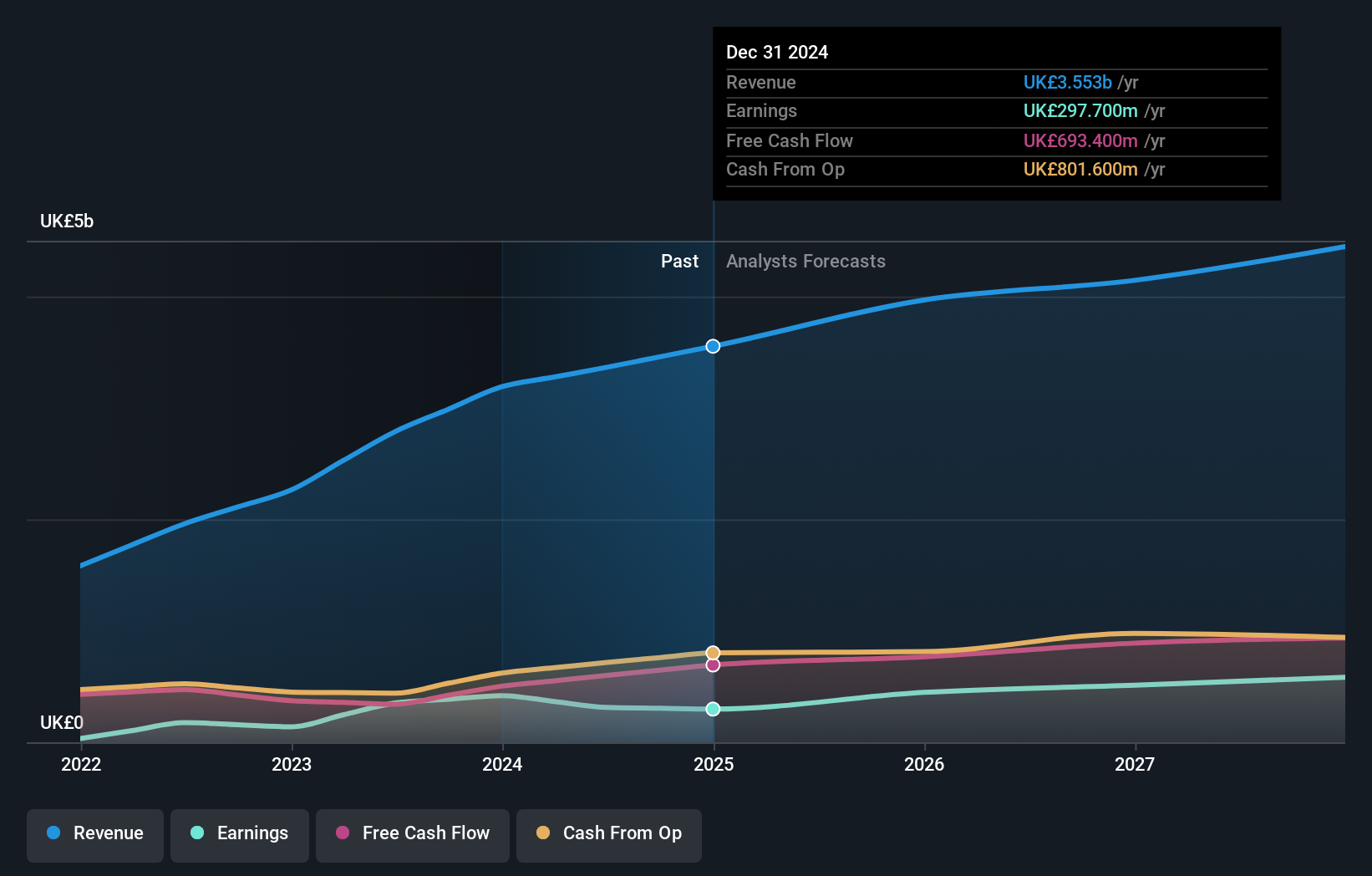

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, together with its subsidiaries, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally, with a market cap of £10.16 billion.

Operations: Sage Group generates revenue primarily from technology solutions and services focused on small and medium businesses, with significant contributions from North America (£1.01 billion) and Europe (£595 million). The company operates across various regions, including the United Kingdom & Ireland, which contributes £488 million to its revenue.

Sage Group's revenue is projected to grow at 8% annually, outpacing the broader UK market's 3.8%. The company has seen a notable earnings growth of 28.4% over the past year, surpassing the software industry's average of 19.9%. Sage’s R&D expenses are approximately £140 million, representing a significant investment in innovation and product development. A recent partnership with VoPay enhances Sage Business Cloud Payroll by integrating advanced payment technologies, addressing inefficiencies for SMBs and providing features like automated direct deposits and self-serve portals.

- Click here to discover the nuances of Sage Group with our detailed analytical health report.

Evaluate Sage Group's historical performance by accessing our past performance report.

Make It Happen

- Investigate our full lineup of 46 UK High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SGE

Sage Group

Provides technology solutions and services for small and medium businesses in North America, Europe, the United Kingdom, Ireland, Africa and Asia-Pacific.

Proven track record average dividend payer.