Informa plc (LON:INF) has announced that it will pay a dividend of £0.07 per share on the 19th of September. Although the dividend is now higher, the yield is only 2.3%, which is below the industry average.

Informa's Projected Earnings Seem Likely To Cover Future Distributions

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Based on the last payment, Informa's profits didn't cover the dividend, but the company was generating enough cash instead. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

According to analysts, EPS should be several times higher next year. Assuming the dividend continues along recent trends, we estimate that the payout ratio could reach 42%, which is in a comfortable range for us.

Check out our latest analysis for Informa

Dividend Volatility

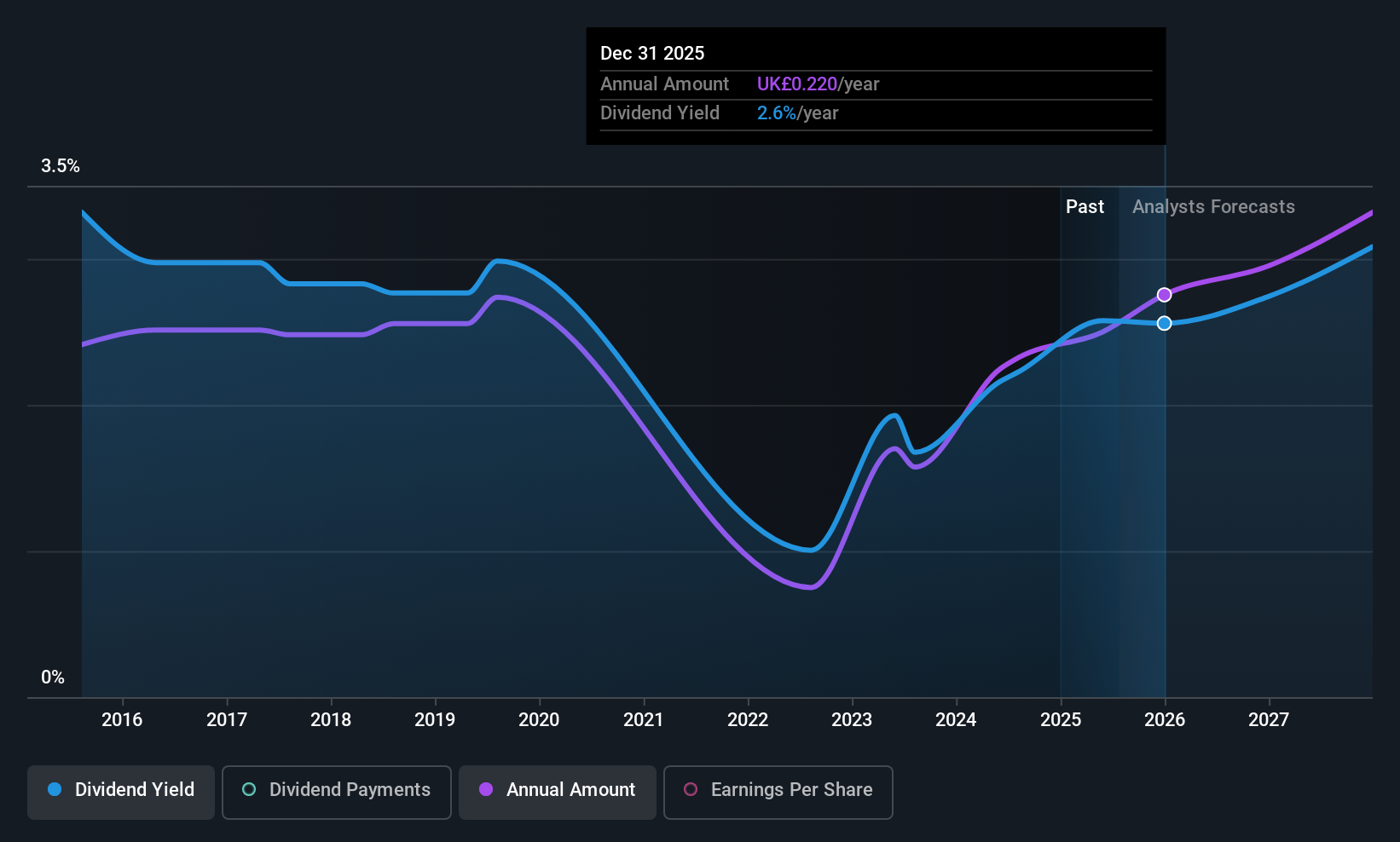

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the dividend has gone from £0.193 total annually to £0.20. Its dividends have grown at less than 1% per annum over this time frame. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Informa's Dividend Might Lack Growth

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that Informa has grown earnings per share at 67% per year over the past five years. Although earnings per share is up nicely Informa is paying out 372% of its earnings as dividends, which we feel is borderline unsustainable without extenuating circumstances.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Informa will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Informa is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 4 warning signs for Informa that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, North America, China, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026