- United Kingdom

- /

- Biotech

- /

- LSE:GNS

High Growth Tech Stocks In The United Kingdom To Watch

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently closed lower, impacted by weak trade data from China and a broader global economic slowdown. In this challenging market environment, identifying high growth tech stocks in the UK that can weather such economic headwinds becomes crucial for investors seeking resilient opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.21% | 29.27% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Genus | 4.12% | 39.40% | ★★★★☆☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.27 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, which contribute £314.90 million and £352.50 million, respectively. The company operates in multiple regions including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

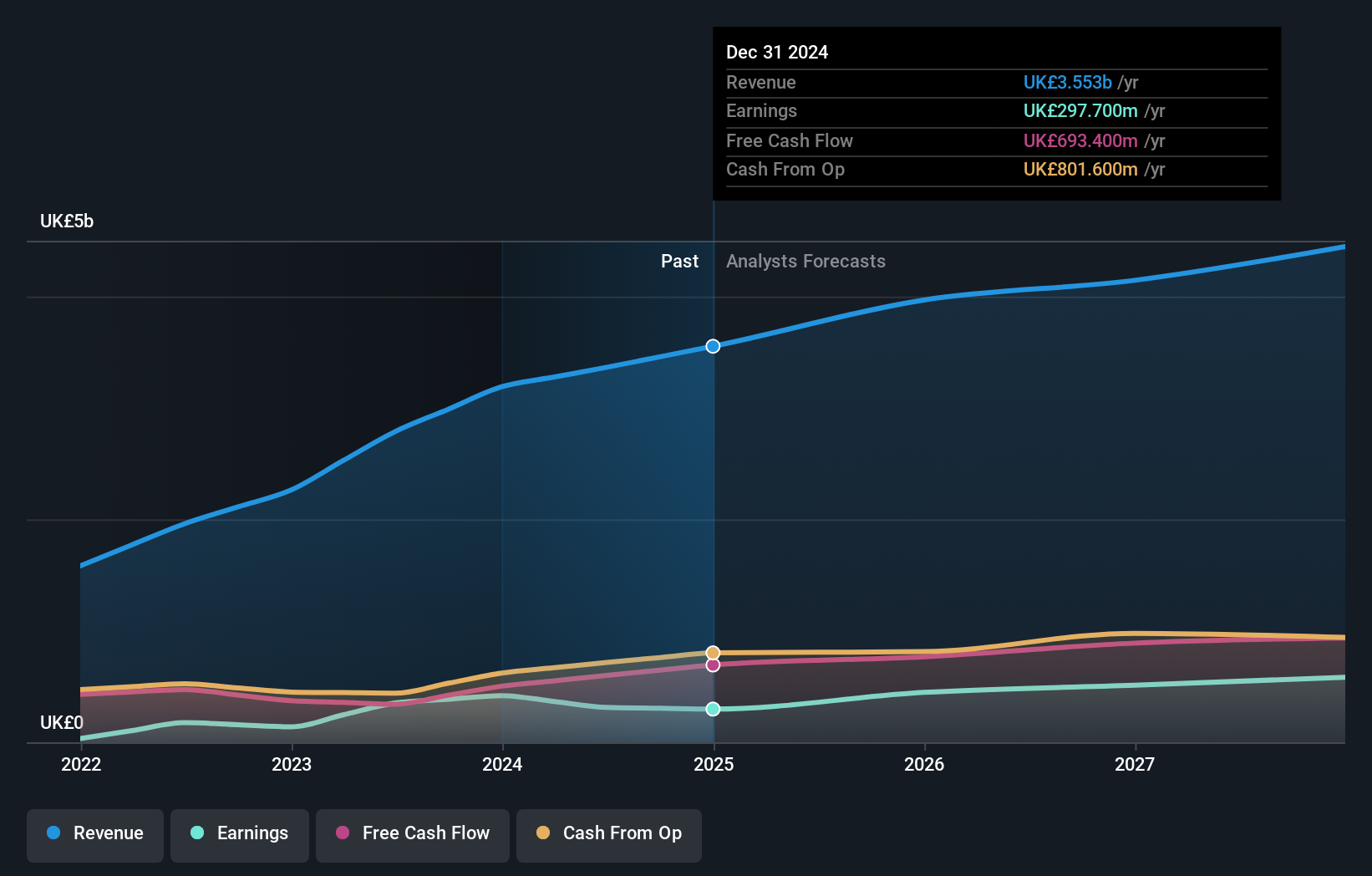

Genus plc, a standout in the biotech sector, reported annual sales of £668.8 million for 2024, slightly down from £689.7 million the previous year. Despite a significant one-off loss of £47.8 million impacting net income to £7.9 million from £33.3 million last year, Genus's earnings are expected to grow at an impressive 39.4% annually over the next three years, outpacing both its industry and market averages. Notably, R&D expenses have been pivotal; with consistent investments driving innovation and future growth prospects in animal genetics and biotechnology segments.

- Navigate through the intricacies of Genus with our comprehensive health report here.

Understand Genus' track record by examining our Past report.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.12 billion.

Operations: Informa generates revenue primarily through its four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company's diverse portfolio spans international events, digital services, and academic research across multiple regions including the UK, Europe, the US, and China.

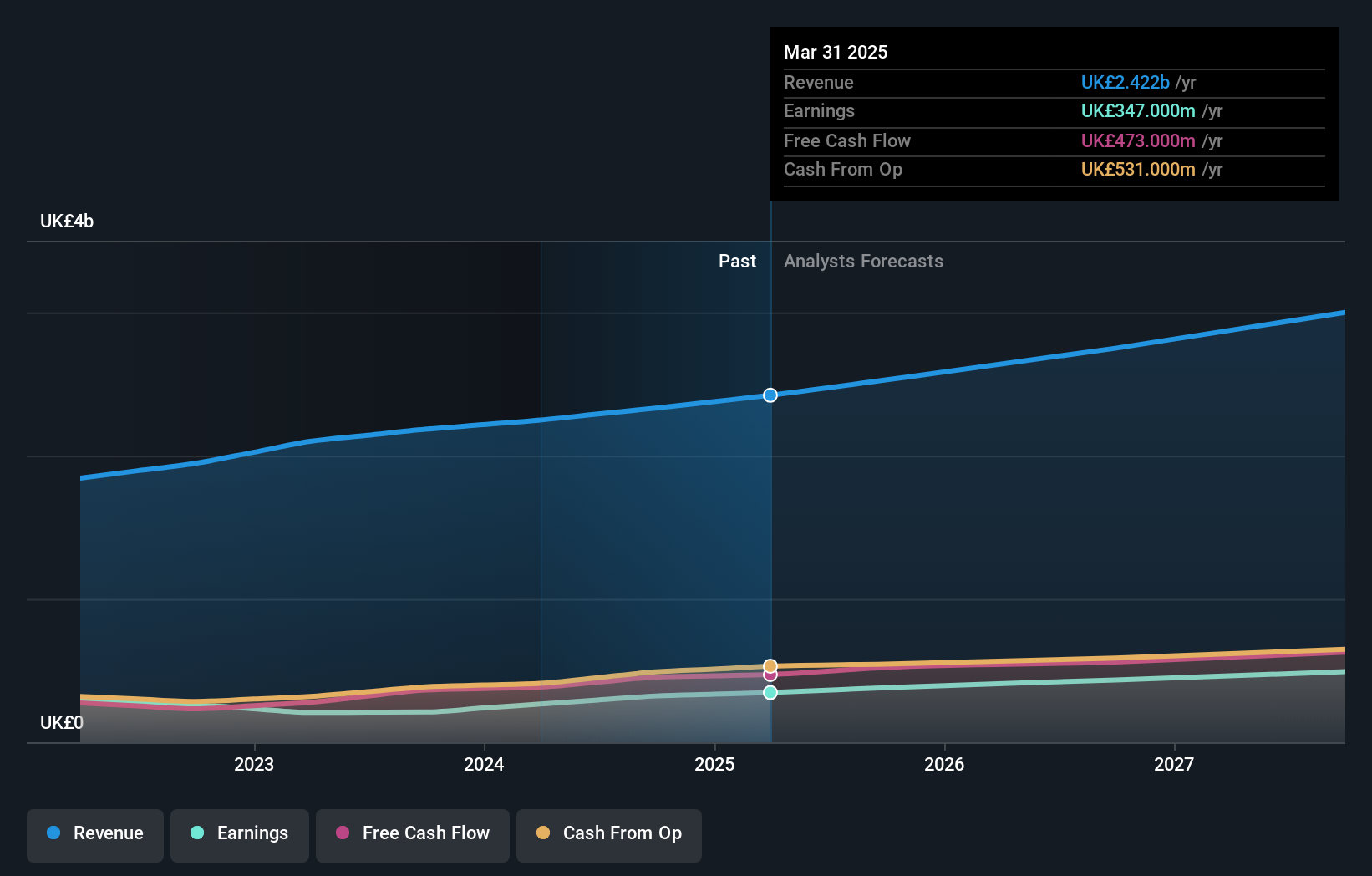

Informa's revenue is forecasted to grow at 6.7% annually, outpacing the UK market's 3.7% growth rate, while its earnings are projected to rise by 21.5% per year. The company has repurchased 41.67 million shares for £338.9 million in the first half of 2024, reflecting a strategic move to enhance shareholder value amidst significant one-off losses impacting recent financials (£213.5M). Notably, Informa’s commitment to innovation is evident with substantial R&D investments driving future prospects in its digital business segments and conference operations across various industries like mining and biopharmaceuticals.

- Click to explore a detailed breakdown of our findings in Informa's health report.

Gain insights into Informa's historical performance by reviewing our past performance report.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, together with its subsidiaries, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally, with a market cap of £9.95 billion.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company focuses on offering technology solutions and services tailored to small and medium businesses across these regions.

Sage Group's strategic focus on Sage Business Cloud has driven a 9% increase in Q3 2024 revenue to £585 million, with total nine-month revenue reaching £1.74 billion. The company's earnings are projected to grow by 15.1% annually, outpacing the UK market's 14.4%. Significant R&D investments, amounting to around 8% of revenue, underscore its commitment to innovation and enhancing product offerings like the recent integration with VoPay for streamlined payroll solutions.

- Dive into the specifics of Sage Group here with our thorough health report.

Explore historical data to track Sage Group's performance over time in our Past section.

Where To Now?

- Navigate through the entire inventory of 47 UK High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential second-rate dividend payer.