- United Kingdom

- /

- Software

- /

- AIM:GBG

High Growth Tech Stocks In The UK To Watch December 2024

Reviewed by Simply Wall St

The United Kingdom's market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting ongoing global economic challenges. In this environment, identifying high growth tech stocks that can navigate such volatility becomes crucial, as these companies often possess innovative solutions and robust business models that may offer resilience against broader market pressures.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| Filtronic | 21.68% | 55.69% | ★★★★★★ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Altitude Group | 24.51% | 30.10% | ★★★★★☆ |

| YouGov | 8.52% | 55.02% | ★★★★★☆ |

| Windar Photonics | 42.38% | 56.12% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our UK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

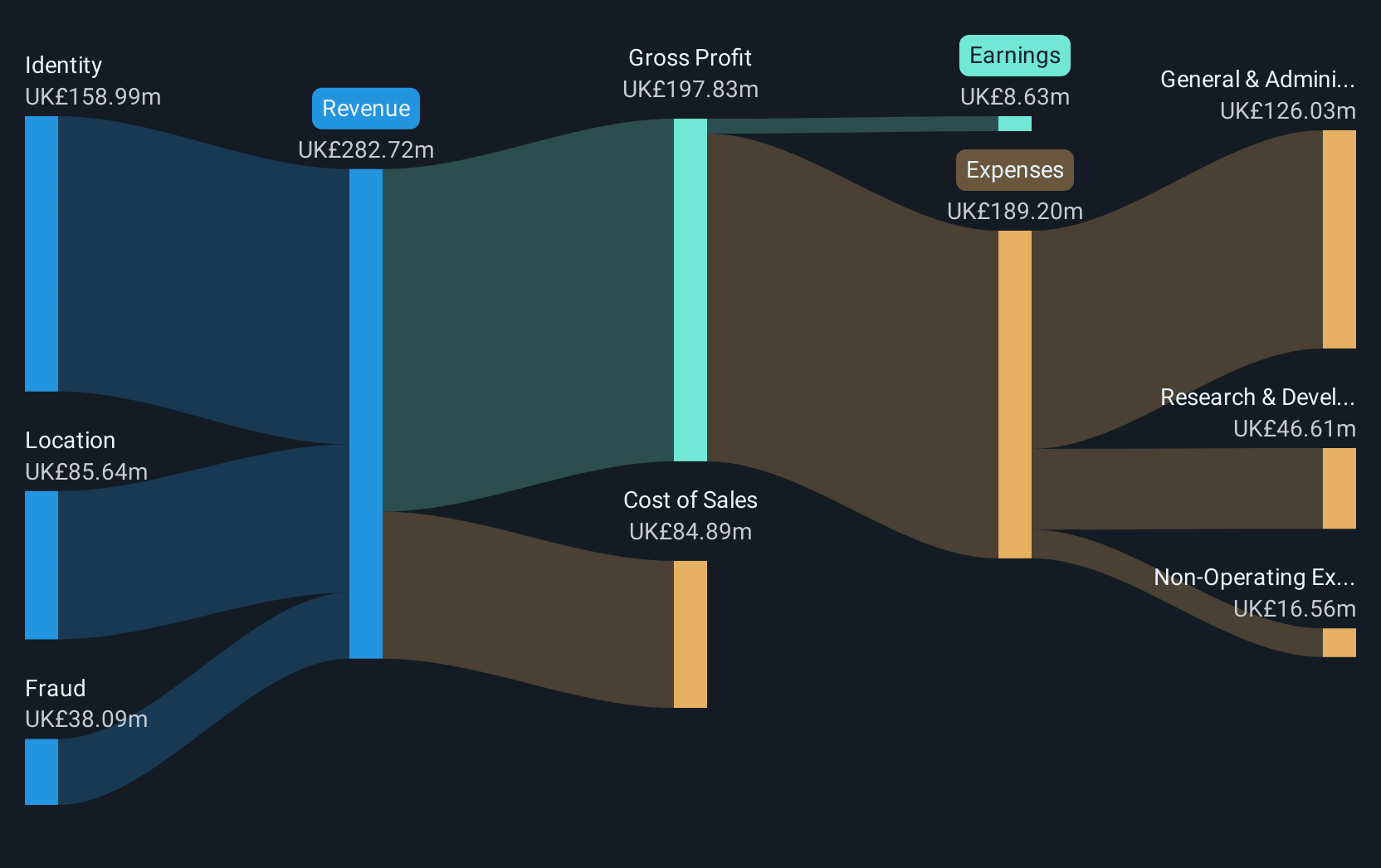

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the UK, US, Australia, and other international markets with a market cap of £867.28 million.

Operations: The company generates revenue through three primary segments: Identity (£159.78 million), Location (£83.94 million), and Fraud (£38.14 million).

GB Group's recent turnaround from a net loss to generating GBP 1.58 million in net income highlights its resilience and potential within the tech sector. This shift is underscored by a robust annual earnings growth forecast of 36.6%, significantly outpacing the UK market average of 14.8%. Moreover, with an annual revenue growth rate of 6.9%, GB Group not only exceeds the broader UK market's growth rate of 3.6% but also demonstrates a strategic recovery, particularly when considering their substantial one-off gain of £52.5M that notably skewed past financials. These figures reflect a company on an upward trajectory, albeit with challenges such as a relatively low forecasted return on equity at 3.7%. As GB Group continues to navigate its financial landscape, these metrics will be crucial in assessing its capacity to maintain profitability and expand its market share amidst evolving industry demands.

- Get an in-depth perspective on GB Group's performance by reading our health report here.

Gain insights into GB Group's historical performance by reviewing our past performance report.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

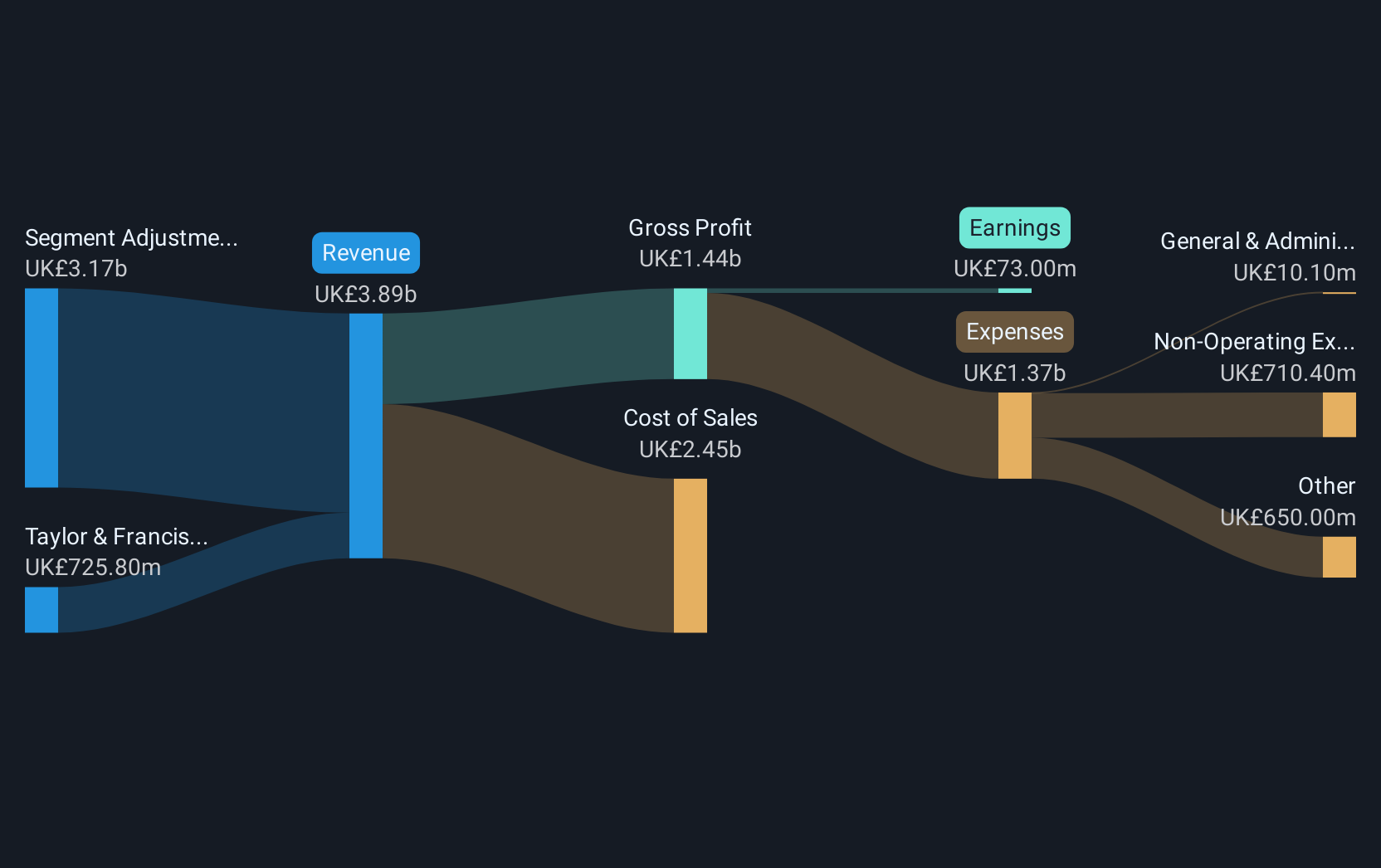

Overview: Informa plc is an international company that specializes in events, digital services, and academic research across the United Kingdom, Continental Europe, the United States, China, and globally with a market capitalization of £10.56 billion.

Operations: Informa generates revenue primarily from four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Despite facing a challenging year with a significant one-off loss of £213.5M, Informa has demonstrated resilience with an expected revenue growth of 8.2% annually, outpacing the UK market average of 3.6%. This growth is complemented by an impressive forecast for annual earnings growth at 21.5%, significantly higher than the broader market's 14.8%. Recent strategic moves, including substantial fixed-income offerings totaling over €1.7 billion and key conference presentations globally, signal Informa's proactive stance in fortifying its financial base and expanding its international presence in high-growth sectors like technology and luxury lifestyle markets through partnerships such as with Monaco for over a decade.

- Click here and access our complete health analysis report to understand the dynamics of Informa.

Review our historical performance report to gain insights into Informa's's past performance.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

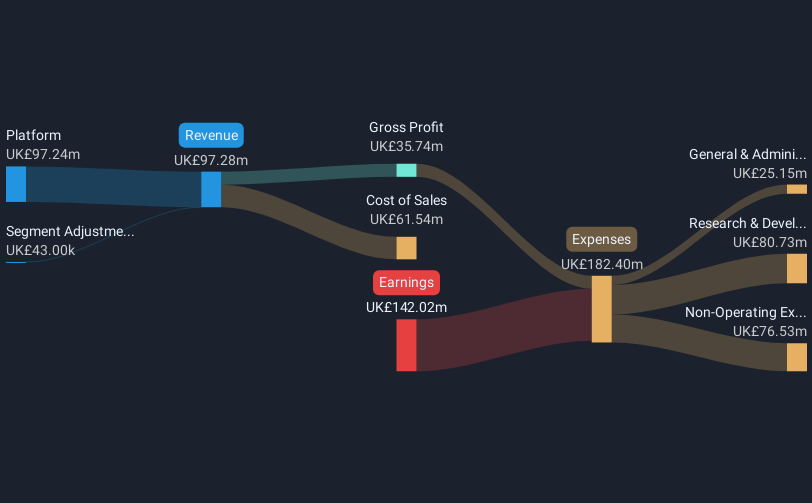

Overview: Oxford Biomedica plc is a contract development and manufacturing organization dedicated to delivering therapies globally, with a market capitalization of £450.24 million.

Operations: The company generates revenue primarily from its Platform segment, amounting to £97.24 million.

Oxford Biomedica, amid a transformative phase, is poised for significant growth with expected revenue surging at 21.2% annually, outstripping the UK's average of 3.6%. This biotech innovator is navigating from unprofitability towards a promising financial horizon, with earnings projected to escalate by an impressive 92.5% per year over the next three years. The recent strategic appointment of Colin Bond underscores a strengthened leadership aimed at enhancing governance and financial oversight as they gear up for profitability and expansion in high-stakes markets.

- Click here to discover the nuances of Oxford Biomedica with our detailed analytical health report.

Evaluate Oxford Biomedica's historical performance by accessing our past performance report.

Where To Now?

- Dive into all 50 of the UK High Growth Tech and AI Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives