Future plc (LON:FUTR) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 80% in the last year.

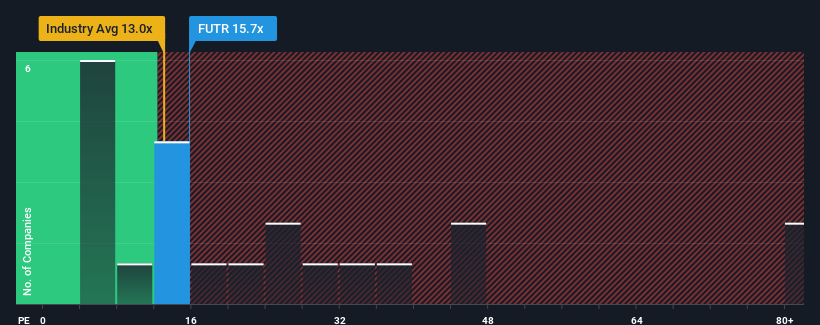

In spite of the firm bounce in price, there still wouldn't be many who think Future's price-to-earnings (or "P/E") ratio of 15.7x is worth a mention when the median P/E in the United Kingdom is similar at about 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Future could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Future

How Is Future's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Future's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 18% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the nine analysts watching the company. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Future is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Future's P/E?

Future appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Future currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Future that you should be aware of.

If you're unsure about the strength of Future's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FUTR

Future

Future plc, together with its subsidiaries, publishes and distributes content for technology, gaming, sports, fashion, beauty, homes, wealth, and knowledge sectors in the United States and the United Kingdom.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives