- United Kingdom

- /

- Consumer Durables

- /

- LSE:BOOT

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The UK stock market has been under pressure recently, with the FTSE 100 index experiencing declines due to weak trade data from China, which has affected global economic sentiment. Despite these challenges, investors can still find opportunities by exploring lesser-known areas of the market. Penny stocks, though often considered a niche investment category, can present growth potential when supported by strong financial fundamentals. In this article, we will look at three such penny stocks that may offer intriguing prospects for those seeking to uncover hidden value in smaller or newer companies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.49 | £12.31M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.565 | £520.79M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.79 | £144.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.76 | £133.67M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.00 | £15.1M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.14 | £27.15M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.66 | $383.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.315 | £63.52M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.48 | £41.37M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Next 15 Group (AIM:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next 15 Group plc operates in the United Kingdom, Africa, the United States, Europe, and the Middle East providing customer insight, delivery, engagement, and business transformation services with a market cap of £306.31 million.

Operations: No specific revenue segments are reported for Next 15 Group plc.

Market Cap: £306.31M

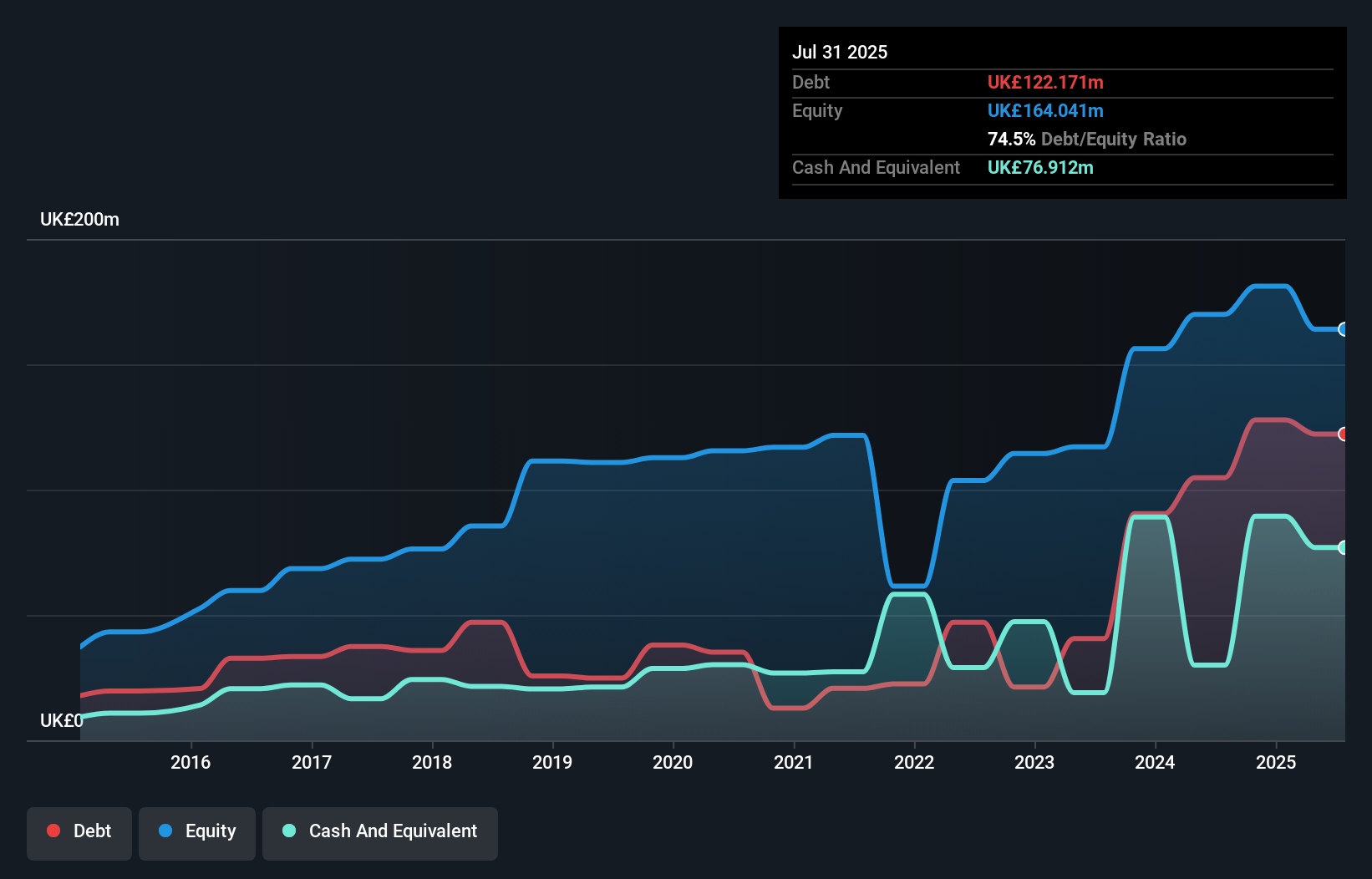

Next 15 Group plc presents a mixed picture for penny stock investors. The company's market cap of £306.31 million and satisfactory net debt to equity ratio of 27.6% suggest financial stability, but recent results show challenges with a reported net loss of £1.45 million for the half year ending July 2025, compared to a profit last year. Despite high volatility and reduced profit margins, analysts forecast significant earnings growth at 53.66% annually, indicating potential upside if operational improvements materialize. However, the inexperienced management team and board could pose risks in executing strategic initiatives effectively.

- Navigate through the intricacies of Next 15 Group with our comprehensive balance sheet health report here.

- Assess Next 15 Group's future earnings estimates with our detailed growth reports.

Bloomsbury Publishing (LSE:BMY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bloomsbury Publishing Plc is a global publisher of academic, educational, and general fiction and non-fiction books for a diverse audience including children, general readers, teachers, students, researchers, libraries, and professionals with a market cap of £404.67 million.

Operations: The company's revenue is primarily derived from its Consumer segment, which generated £228.1 million, and its Academic & Professional segment, contributing £90.9 million.

Market Cap: £404.67M

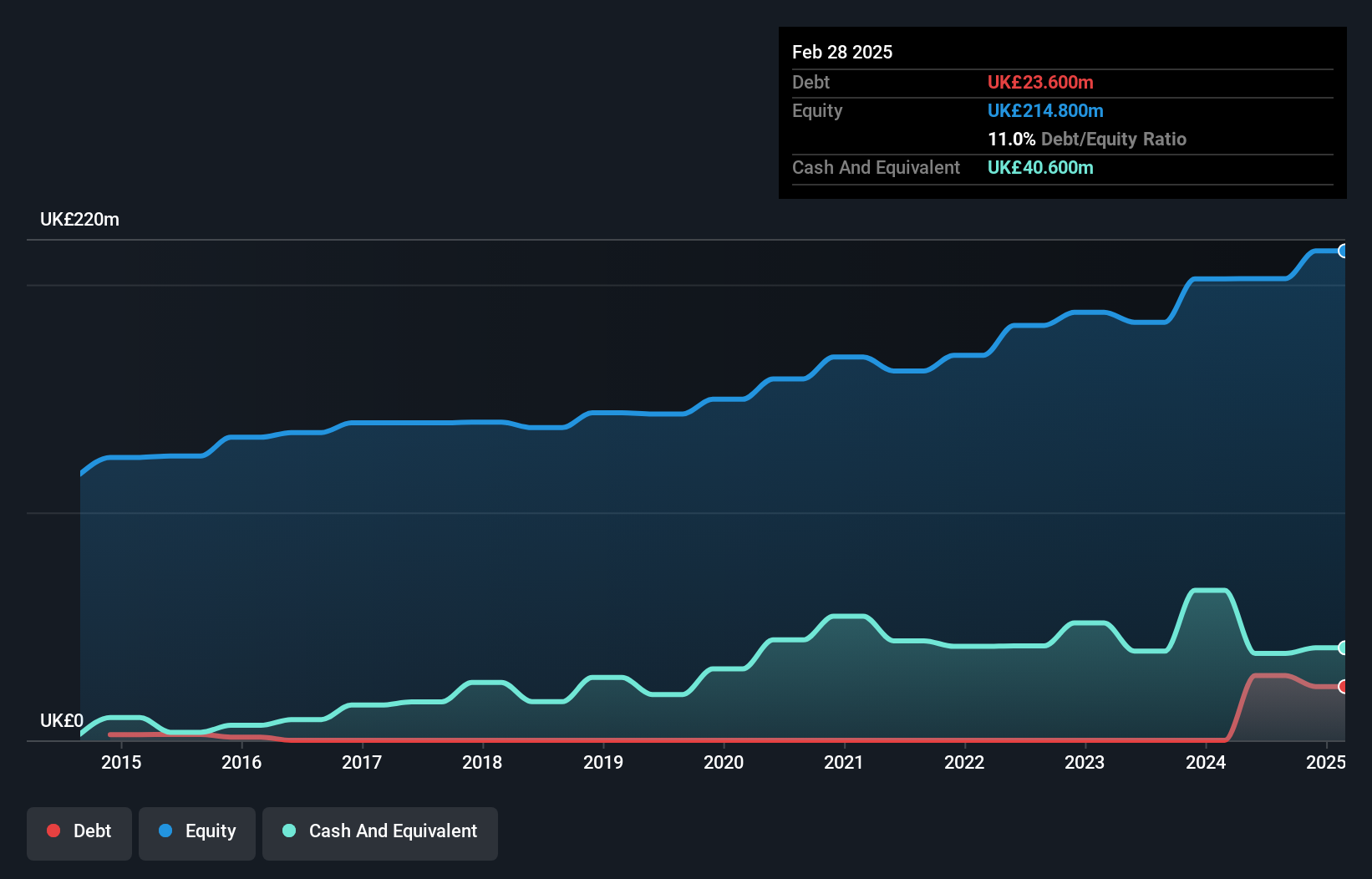

Bloomsbury Publishing Plc's recent performance highlights both strengths and challenges for penny stock investors. The company's market cap of £404.67 million indicates a solid presence, with its debt well covered by operating cash flow, suggesting financial prudence. However, the decline in sales to £159.5 million and net income to £13.8 million for the half year indicates potential headwinds. Despite this, Bloomsbury's seasoned management team and strong interest coverage ratio provide stability. The recent drop from major indices could signal caution, yet analysts see potential price appreciation of 52.4%, reflecting optimism about future prospects despite current volatility challenges.

- Click here to discover the nuances of Bloomsbury Publishing with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Bloomsbury Publishing's future.

Henry Boot (LSE:BOOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities with a market cap of £307.68 million.

Operations: The company's revenue is derived from property investment and development (£180.58 million), land promotion (£96.95 million), and construction activities (£78.70 million).

Market Cap: £307.68M

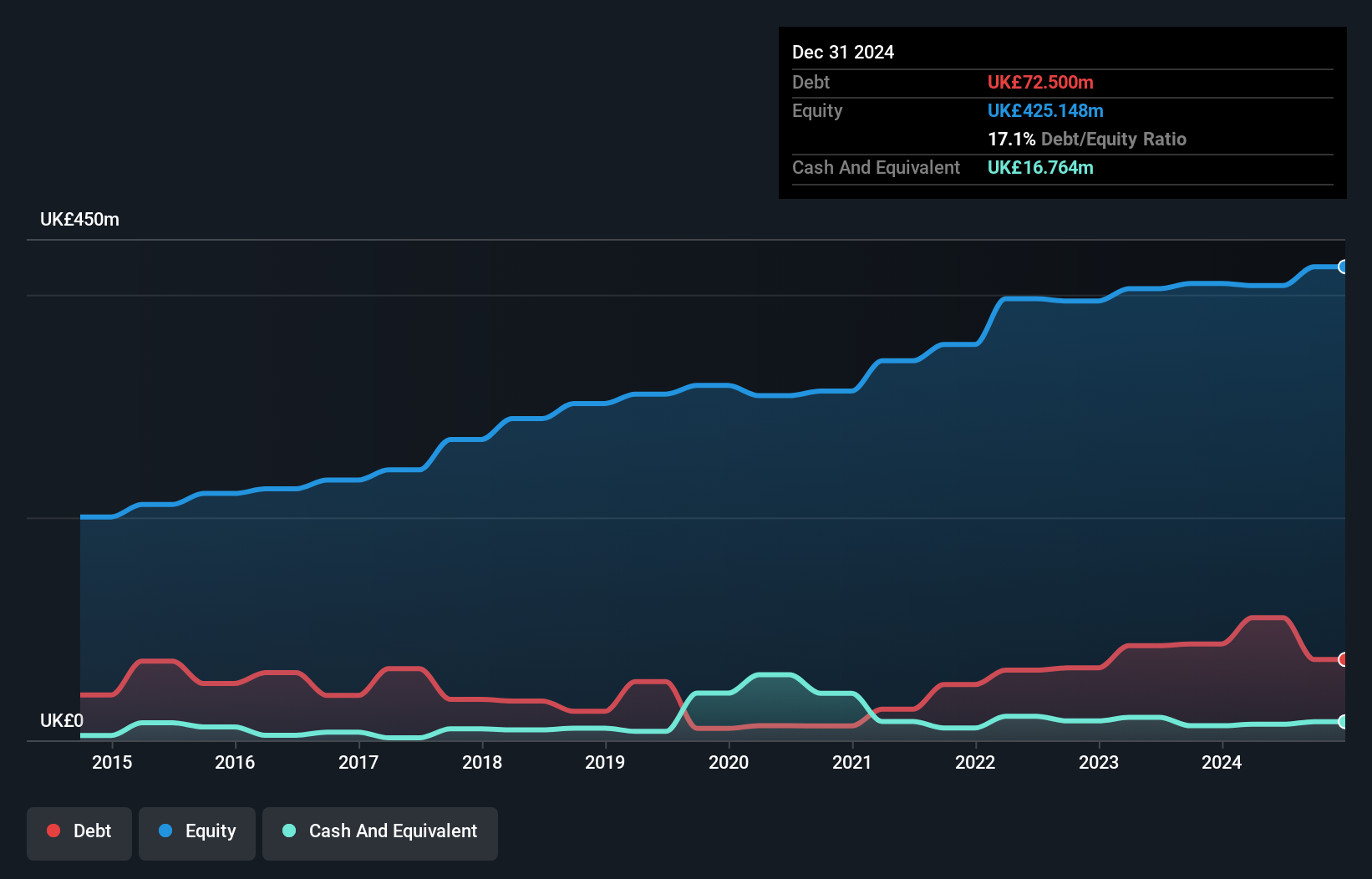

Henry Boot PLC's recent developments and financial performance offer insights for penny stock investors. The company reported a significant earnings growth of 130.1% over the past year, surpassing industry averages, though its Return on Equity remains low at 6.4%. Its seasoned management team and satisfactory net debt to equity ratio of 20% indicate solid governance and financial health. Recent projects like the Duxford AvTech campus, with a gross development value of £162 million, highlight strategic expansion efforts in sustainable technology sectors. Despite an unstable dividend track record, the company's interim dividend increase reflects confidence in future prospects amidst ongoing innovation initiatives.

- Click to explore a detailed breakdown of our findings in Henry Boot's financial health report.

- Learn about Henry Boot's future growth trajectory here.

Turning Ideas Into Actions

- Dive into all 301 of the UK Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Boot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BOOT

Henry Boot

Engages in the property investment and development, land promotion, and construction activities in the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success