- United Kingdom

- /

- Software

- /

- AIM:IDOX

IDOX Leads These 3 High Growth Tech Stocks in the UK

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty, the United Kingdom's market has been experiencing some turbulence, with the FTSE 100 recently closing lower due to weak trade data from China and concerns over domestic demand in the world's second-largest economy. In this challenging environment, identifying high-growth tech stocks can be crucial for investors seeking opportunities that are resilient to broader market fluctuations, as these companies often demonstrate innovative capabilities and potential for significant expansion despite external pressures.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Facilities by ADF | 26.24% | 161.47% | ★★★★★☆ |

| Pinewood Technologies Group | 27.24% | 25.48% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Altitude Group | 24.51% | 30.10% | ★★★★★☆ |

| YouGov | 7.55% | 56.01% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Audioboom Group | 32.11% | 175.02% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 40 stocks from our UK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

IDOX (AIM:IDOX)

Simply Wall St Growth Rating: ★★★★☆☆

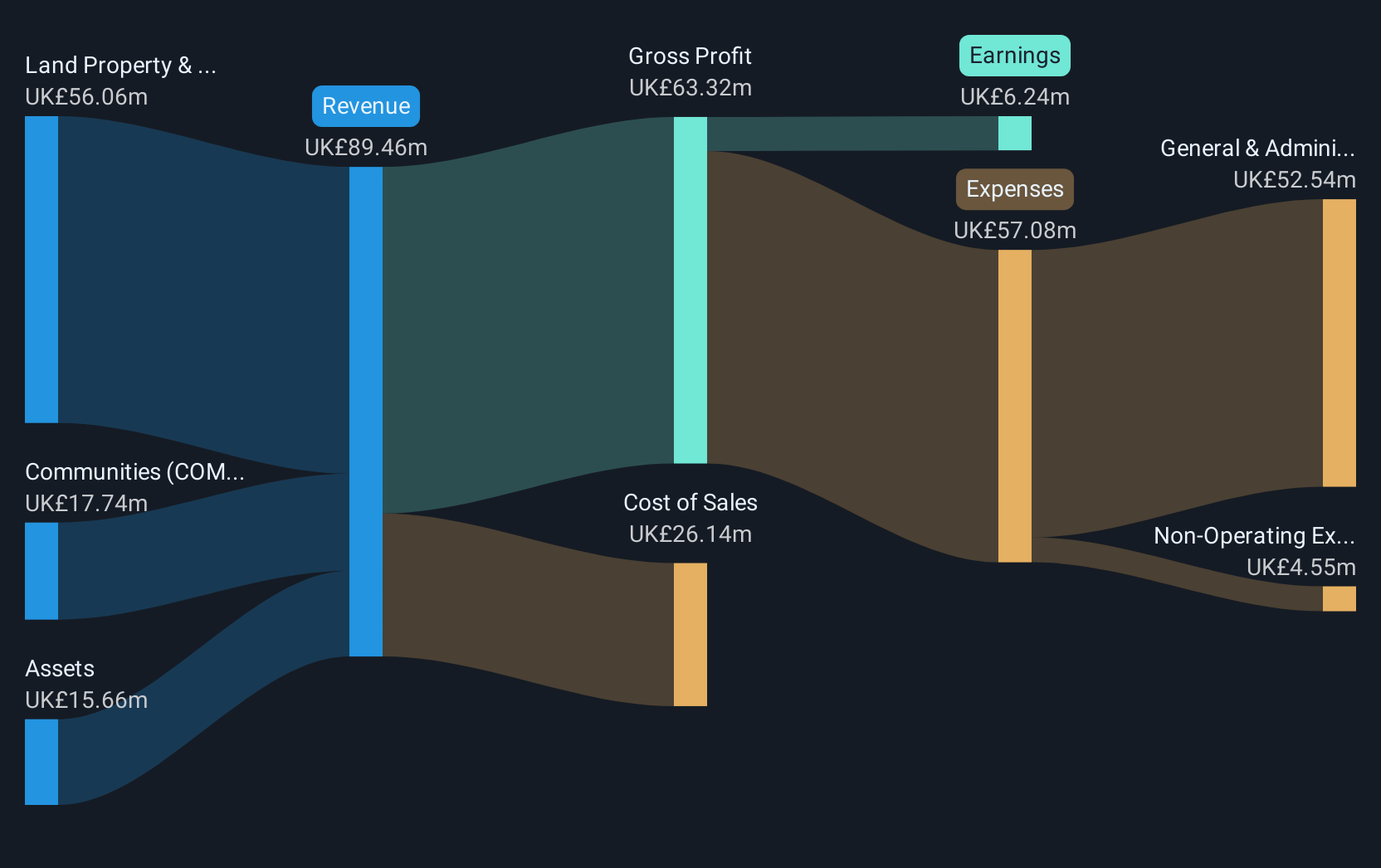

Overview: IDOX plc, with a market cap of £259 million, offers software and services designed to support the management needs of local governments and various organizations across the UK, US, Europe, and other international markets.

Operations: The company generates revenue primarily from three segments: Land Property & Public Protection (£55.26 million), Communities (£17.44 million), and Assets (£14.89 million).

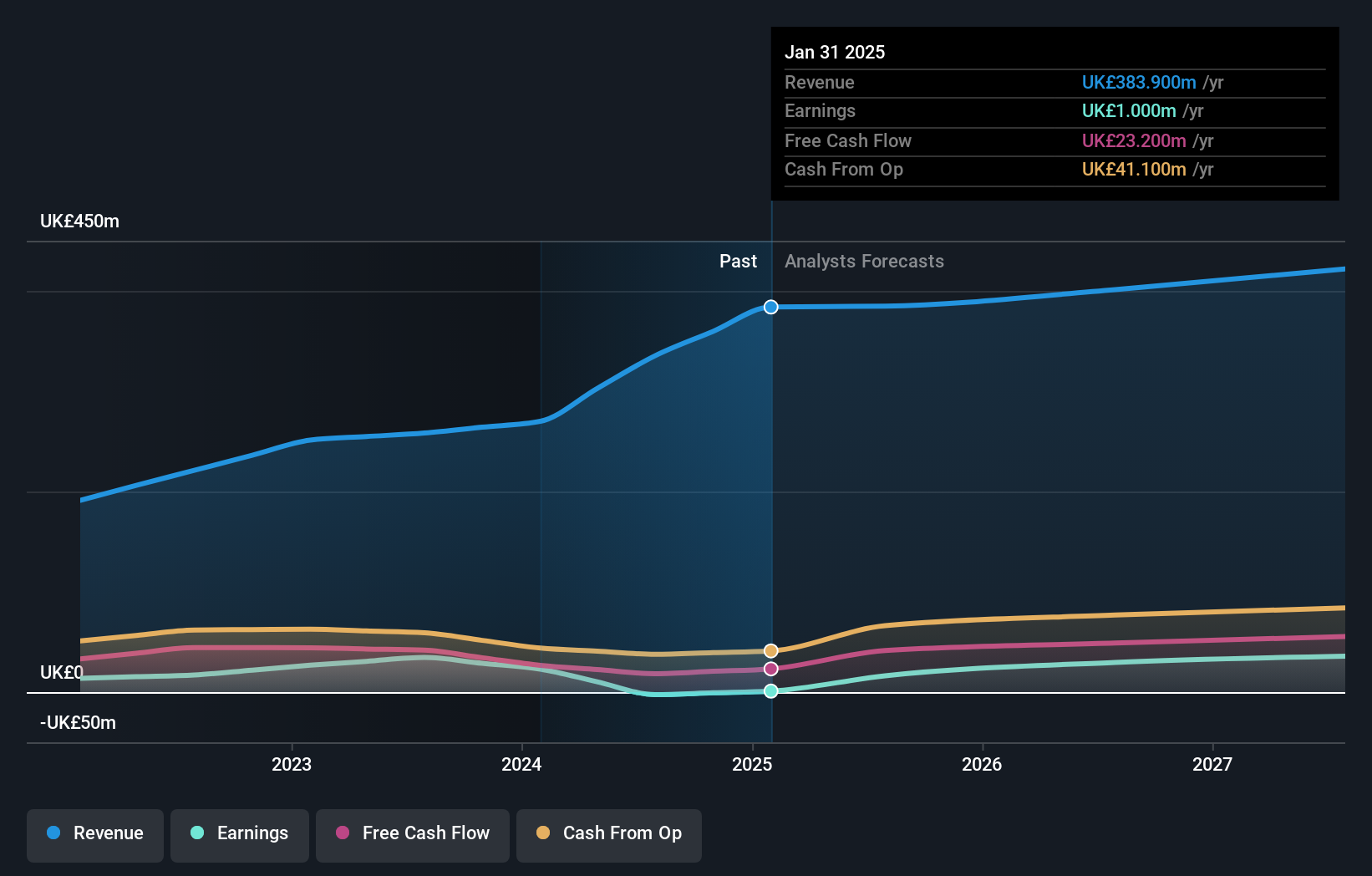

IDOX, a player in the UK tech landscape, recently underscored its commitment to growth with several strategic moves. The company's revenue is projected to increase by 5.6% annually, outpacing the UK market average of 3.8%. Notably, IDOX's earnings are expected to surge by 24.1% per year, reflecting robust financial health and operational efficiency. Recent contracts like the £2.4 million deal with North Yorkshire Council for digital modernisation highlight IDOX’s pivotal role in transforming local government operations through technology solutions. These developments not only bolster IDOX’s market position but also align with broader trends towards digital governance and enhanced service delivery frameworks within the public sector.

- Click here to discover the nuances of IDOX with our detailed analytical health report.

Evaluate IDOX's historical performance by accessing our past performance report.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc is a company that offers online market research services across various regions including the United Kingdom, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific with a market capitalization of £366.81 million.

Operations: YouGov generates revenue primarily through its Research segment (£177.70 million), Data Products (£83.80 million), and Consumer Panel Services (CPS) (£74.20 million).

YouGov, amidst a transformative phase, anticipates modest revenue growth of 7.6% annually, outstripping the UK's average of 3.8%. The recent executive reshuffles, including Stephan Shakespeare's interim CEO appointment, underscore a strategic pivot aimed at revitalizing its operations. With R&D expenses marked at £5 million last year—equivalent to approximately 9% of their total revenue—the firm is heavily investing in AI and data products to foster medium-term growth despite current market adversities and a challenging sales environment. This investment in innovation could well position YouGov as a resilient contender in the evolving tech landscape.

- Navigate through the intricacies of YouGov with our comprehensive health report here.

Gain insights into YouGov's past trends and performance with our Past report.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals across automotive, real estate, jobs and services, and general merchandise sectors in Estonia, Latvia, and Lithuania with a market cap of £1.47 billion.

Operations: The company generates revenue through its online classifieds portals in four main segments: automotive (€29.89 million), real estate (€20.27 million), jobs and services (€15.03 million), and general merchandise (€12.92 million).

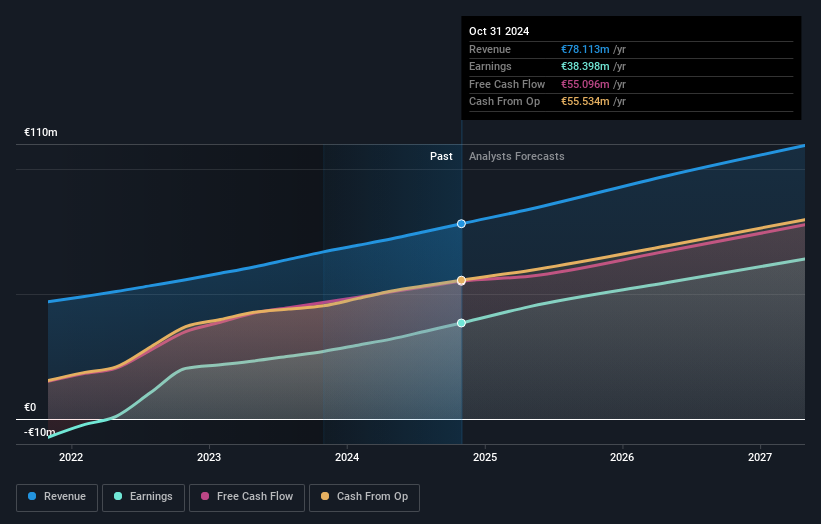

Baltic Classifieds Group (BCG) is distinguishing itself in the UK's tech sector, with a notable annual revenue growth of 13.8% and earnings expansion at 20.9%. This performance surpasses the national tech market growth rates significantly, demonstrating BCG's robust position within its industry. The company has also been proactive in governance and oversight enhancements, evident from recent appointments to its Remuneration and Audit Committees which aim to refine executive compensation practices and financial audits. These strategic moves could enhance BCG’s operational excellence and stakeholder confidence, fostering sustained growth amidst competitive market dynamics.

Next Steps

- Take a closer look at our UK High Growth Tech and AI Stocks list of 40 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IDOX

IDOX

Through its subsidiaries, provides software and services for the management of local government and other organizations in the United Kingdom, the United States, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives