- United Kingdom

- /

- Media

- /

- LSE:INF

High Growth Tech Stocks to Watch in July 2025

Reviewed by Simply Wall St

As the UK market grapples with global economic headwinds, reflected in the recent downturn of the FTSE 100 and FTSE 250 indices due to weak trade data from China, investors are keenly observing how these macroeconomic factors might influence high-growth tech stocks. In this challenging environment, a good stock is often characterized by its ability to innovate and adapt swiftly to changing conditions, offering potential resilience amidst broader market volatility.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Audioboom Group | 8.49% | 59.18% | ★★★★★☆ |

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| Pinewood Technologies Group | 25.20% | 40.70% | ★★★★★☆ |

| ActiveOps | 14.40% | 43.34% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Oxford Biomedica | 18.08% | 69.07% | ★★★★★☆ |

| Trustpilot Group | 15.30% | 39.03% | ★★★★★☆ |

| Windar Photonics | 36.00% | 48.66% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 53.95% | 53.30% | ★★★★★☆ |

| SRT Marine Systems | 45.43% | 91.35% | ★★★★★★ |

Click here to see the full list of 43 stocks from our UK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

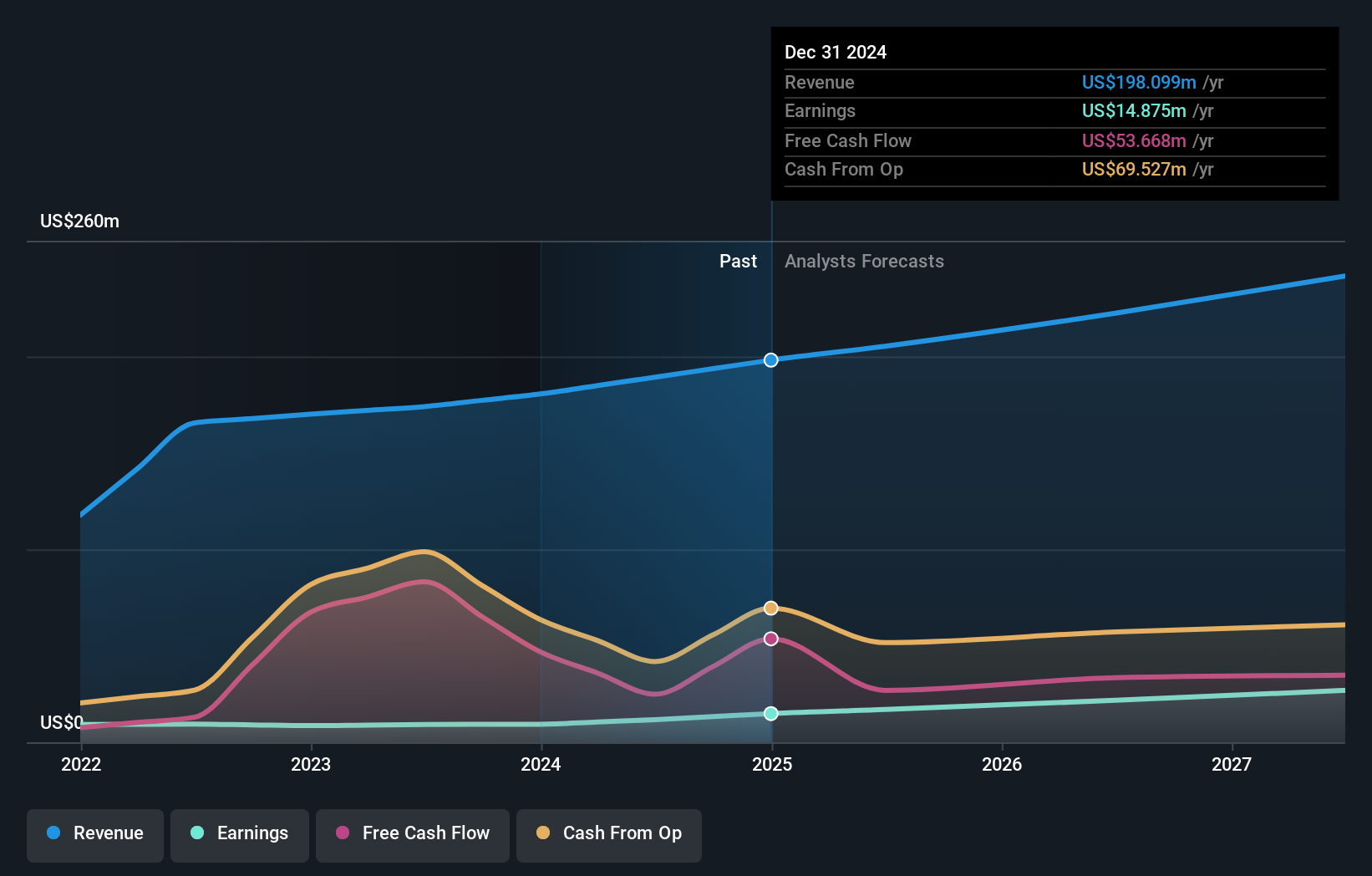

Overview: Craneware plc, along with its subsidiaries, specializes in developing, licensing, and supporting healthcare software solutions in the United States, with a market capitalization of £787.93 million.

Operations: The company generates revenue primarily from its healthcare software segment, amounting to $198.10 million.

Craneware, a UK-based healthcare software provider, has demonstrated robust financial performance with earnings growth of 58.9% over the past year, significantly outpacing the industry's -6.9%. This growth is supported by an aggressive R&D investment strategy that not only fuels innovation but also aligns with evolving market demands in healthcare technology. Despite recent M&A turbulence, where Bain Capital withdrew a £940 million acquisition proposal citing valuation discrepancies, Craneware's strategic focus remains on enhancing product offerings and securing competitive advantage in a challenging market. The firm's commitment to R&D and its ability to exceed industry growth rates underscore its potential resilience and adaptability in the dynamic tech landscape.

- Dive into the specifics of Craneware here with our thorough health report.

Understand Craneware's track record by examining our Past report.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Growth Rating: ★★★★☆☆

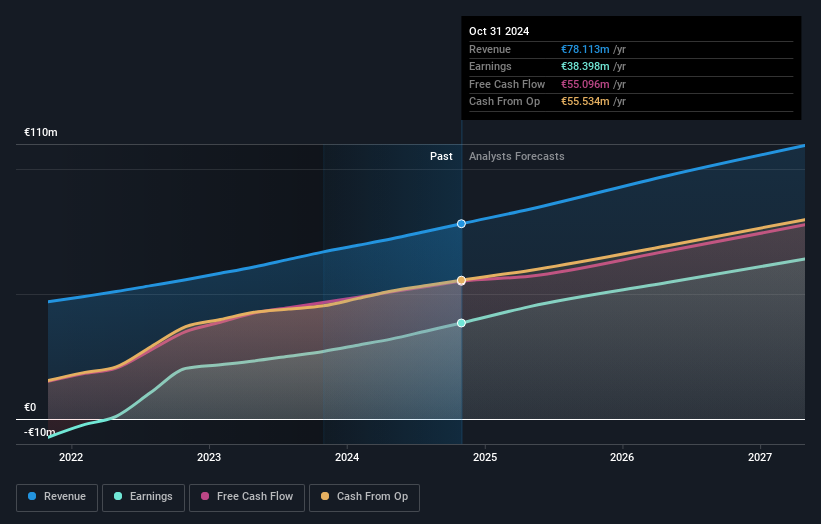

Overview: Baltic Classifieds Group PLC operates online classifieds portals across the automotive, real estate, jobs and services, and general merchandise sectors in Estonia, Latvia, and Lithuania with a market capitalization of approximately £1.78 billion.

Operations: The company generates revenue through its online classifieds portals, with significant contributions from the automotive (€31.39 million) and real estate (€22.25 million) sectors.

Baltic Classifieds Group PLC, a player in the Interactive Media and Services sector, has shown commendable financial agility with a 39.7% surge in earnings over the past year, notably outperforming its industry's growth of 3.4%. This growth is underpinned by an aggressive R&D investment strategy that aligns with market demands, contributing to high-quality earnings. The company also initiated a share repurchase program on July 3, 2025, reflecting confidence in its financial health and commitment to shareholder value. With revenue expected to grow annually at 13.1%, outpacing the UK's average of 3.5%, and forecasted annual profit growth of 16.6%, Baltic Classifieds is positioning itself strongly within its competitive landscape while adapting swiftly to evolving market dynamics.

- Click to explore a detailed breakdown of our findings in Baltic Classifieds Group's health report.

Gain insights into Baltic Classifieds Group's past trends and performance with our Past report.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

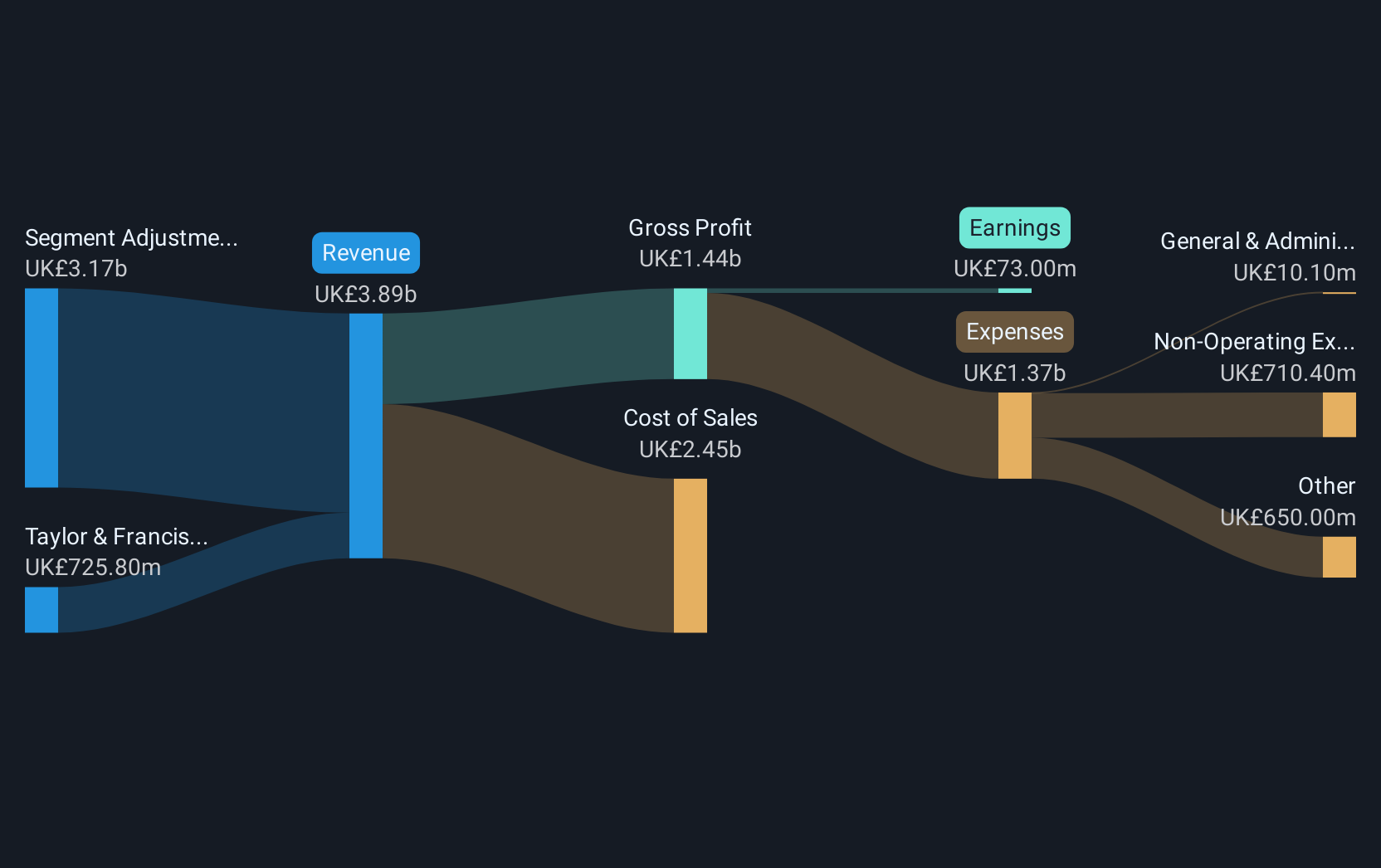

Overview: Informa plc is an international company specializing in events, digital services, and academic research with operations across the United Kingdom, Continental Europe, North America, China, and other global regions, and it has a market cap of £10.93 billion.

Operations: Informa generates revenue primarily through its Informa Markets segment (£1.72 billion), followed by Informa Connect (£631 million), Taylor & Francis (£698.20 million), and Informa Tech (£423.90 million). The company focuses on providing international events, digital services, and academic research across various regions globally.

Despite a challenging year with earnings contracting by 28.9%, Informa's strategic additions to its Luxury and Lifestyle portfolio, such as Art Monte-Carlo, underline its adaptive market approach. This move, leveraging long-term partnerships in Monaco, enhances its presence in high-value sectors and is complemented by an expected revenue growth of 7.2% annually—outstripping the UK market average of 3.5%. Furthermore, the company's commitment to shareholder returns is evident from a dividend increase to 13.6 pence per share and reaffirmed earnings guidance projecting a robust growth trajectory for 2025.

- Click here and access our complete health analysis report to understand the dynamics of Informa.

Assess Informa's past performance with our detailed historical performance reports.

Key Takeaways

- Investigate our full lineup of 43 UK High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, North America, China, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives