- United Kingdom

- /

- Food

- /

- LSE:BAKK

Discover January 2025's Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite such headwinds, penny stocks—often smaller or newer companies—continue to attract attention for their potential to offer both affordability and growth opportunities. In this context, we'll examine several penny stocks that stand out for their financial strength and long-term potential on the UK exchange.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.21M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.81 | £417.98M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.44 | £82.58M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £367.99M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.05 | £87.29M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £181.48M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, specializes in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market capitalization of £783.67 million.

Operations: Bakkavor Group does not report specific revenue segments.

Market Cap: £783.67M

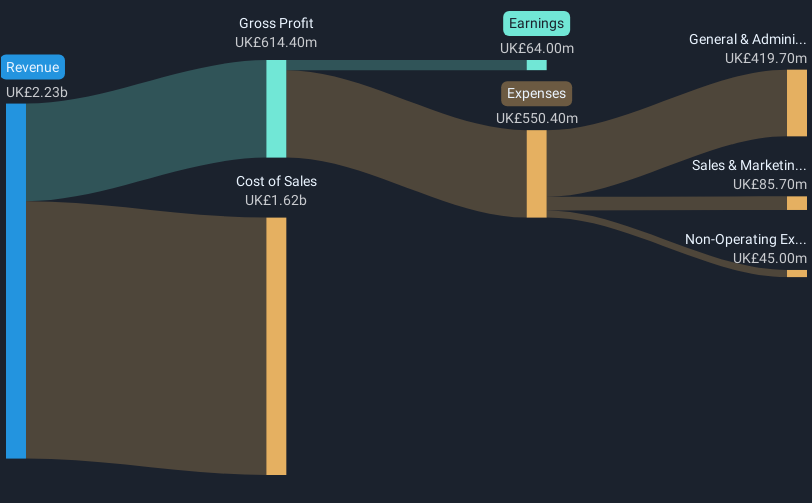

Bakkavor Group has demonstrated significant earnings growth, with a 428.7% increase over the past year, surpassing the food industry's average. Despite its low return on equity of 10.3%, Bakkavor's debt management is solid, with a net debt to equity ratio of 32.6% and interest payments well covered by EBIT at 4.2 times coverage. However, short-term assets do not cover either short or long-term liabilities, indicating potential liquidity challenges. The stock is trading below analyst price targets and offers good relative value compared to peers but has an unstable dividend track record that may concern income-focused investors.

- Jump into the full analysis health report here for a deeper understanding of Bakkavor Group.

- Gain insights into Bakkavor Group's future direction by reviewing our growth report.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.58 billion.

Operations: The company generates revenue from various segments including Auto (€29.89 million), Real Estate (€20.27 million), Jobs & Services (€15.03 million), and Generalist (€12.92 million).

Market Cap: £1.58B

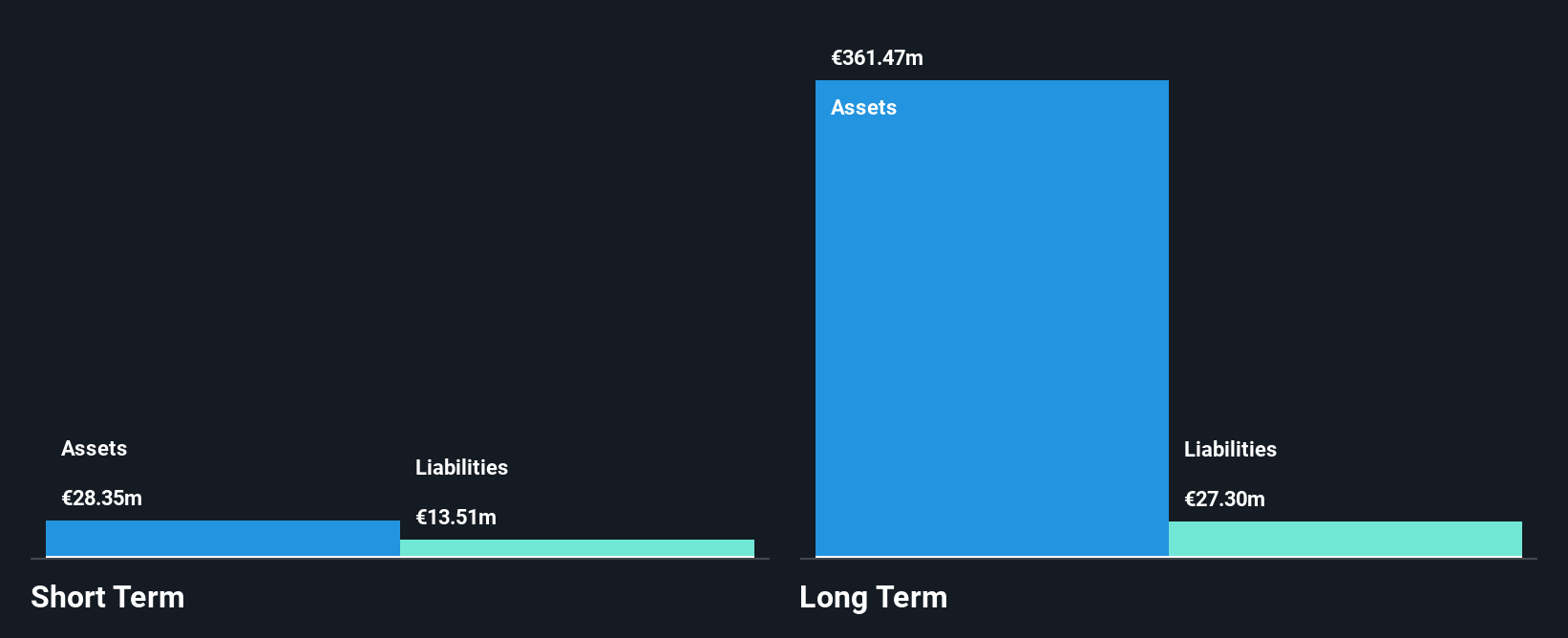

Baltic Classifieds Group has shown robust financial performance, with earnings growing 42.1% over the past year, outpacing its industry peers. The company's net profit margin improved to 49.2%, indicating high-quality earnings despite a low return on equity of 11.6%. Its debt is well-managed, with interest payments covered 15.5 times by EBIT and a satisfactory net debt to equity ratio of 6.9%. Recent executive changes and ongoing M&A considerations suggest strategic positioning for future growth, although short-term assets fall short of covering long-term liabilities, which could pose a risk if not addressed effectively.

- Click here and access our complete financial health analysis report to understand the dynamics of Baltic Classifieds Group.

- Assess Baltic Classifieds Group's future earnings estimates with our detailed growth reports.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally, with a market cap of £485.28 million.

Operations: The company generates revenue of £230.40 million from its recreational activities segment.

Market Cap: £485.28M

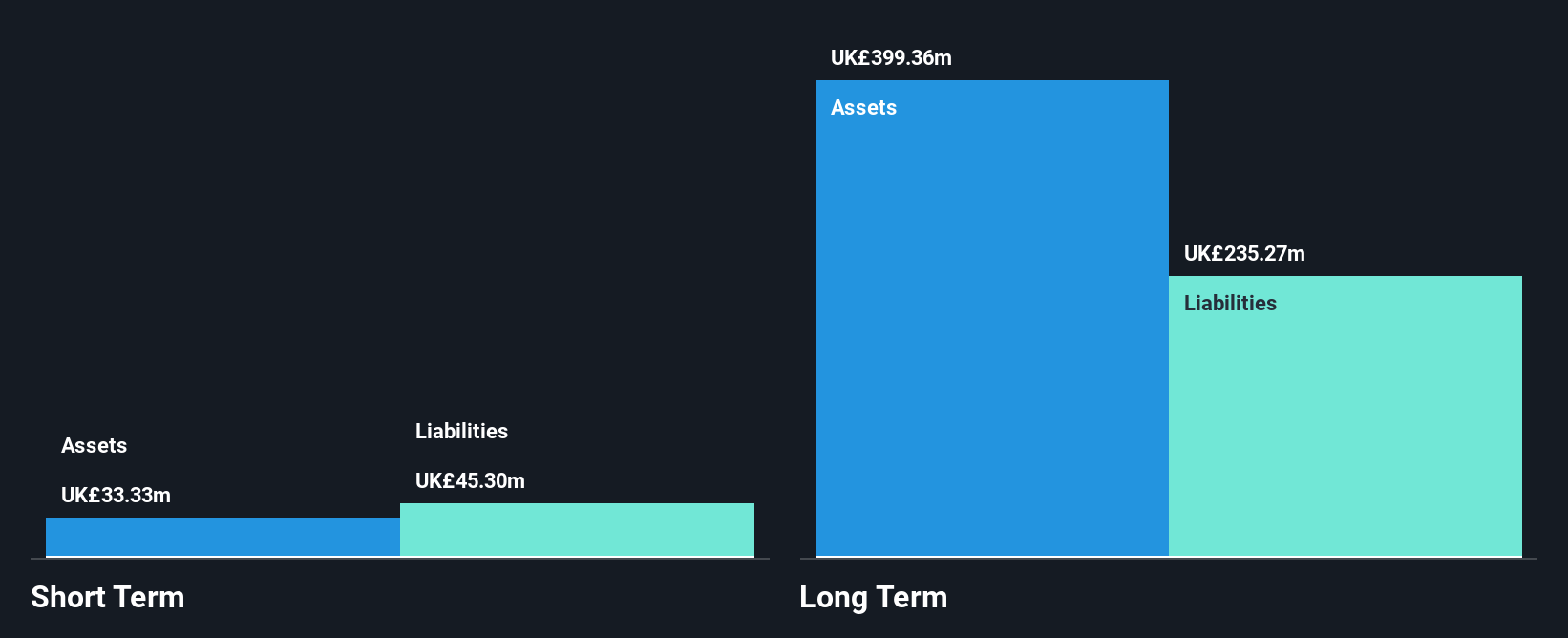

Hollywood Bowl Group plc demonstrates a mixed financial profile. The company is debt-free, which alleviates concerns about interest coverage and debt management. Despite this, short-term assets of £42.3 million do not cover its long-term liabilities of £221 million, posing potential liquidity challenges. Earnings have grown significantly by 27% annually over the past five years; however, recent earnings growth was negative at -12.4%. Analysts expect a positive outlook with forecasted earnings growth of 11.47% per year and a potential stock price increase by 41.1%. Its Price-To-Earnings ratio of 16.5x suggests good relative value compared to industry peers.

- Click here to discover the nuances of Hollywood Bowl Group with our detailed analytical financial health report.

- Gain insights into Hollywood Bowl Group's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Unlock more gems! Our UK Penny Stocks screener has unearthed 442 more companies for you to explore.Click here to unveil our expertly curated list of 445 UK Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Bakkavor Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bakkavor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAKK

Bakkavor Group

Engages in the preparation and marketing of fresh prepared foods in the United Kingdom, the United States, and China.

Adequate balance sheet second-rate dividend payer.