The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices declining due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, investors often find potential in penny stocks—smaller or newer companies that can offer unique opportunities. While the term "penny stocks" might seem outdated, they remain a relevant investment area for those seeking value in companies with strong financial health and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.49 | £12.31M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.565 | £520.79M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.79 | £144.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.76 | £133.67M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.00 | £15.1M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.14 | £27.15M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.66 | $383.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.315 | £63.52M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.48 | £41.37M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AO World plc operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany, with a market capitalization of approximately £585.38 million.

Operations: The company generates revenue of £1.21 billion from its online retailing of domestic appliances and ancillary services.

Market Cap: £585.38M

AO World plc, an online retailer in the UK and Germany, reported half-year sales of £585.6 million, up from £512.1 million a year ago, with net income rising to £12.6 million. Despite lower profit margins at 0.9% compared to last year's 2.5%, the company has reduced its debt significantly over five years and maintains strong short-term asset coverage for liabilities. Earnings growth has been negative recently; however, AO's debt is well-covered by operating cash flow and interest payments are adequately managed by EBIT at 21.5x coverage, indicating financial resilience amid market volatility.

- Click here to discover the nuances of AO World with our detailed analytical financial health report.

- Understand AO World's earnings outlook by examining our growth report.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.11 billion.

Operations: The company's revenue is derived from four main segments: Auto (€31.39 million), Real Estate (€22.25 million), Jobs & Services (€15.96 million), and Generalist (€13.22 million).

Market Cap: £1.11B

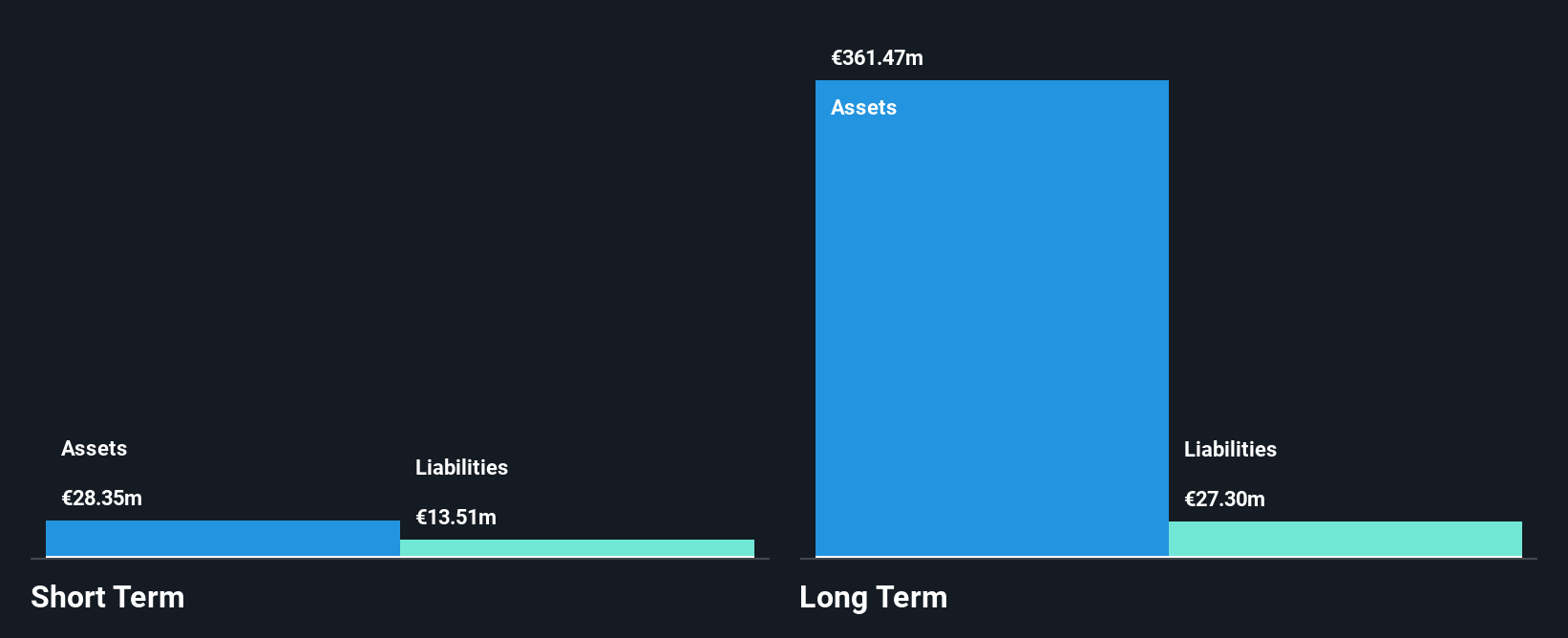

Baltic Classifieds Group, with a market cap of £1.11 billion, shows promising financial health despite recent guidance adjustments indicating slower revenue and profit growth. The company's short-term assets comfortably cover both its short and long-term liabilities, while operating cash flow effectively manages its debt. Earnings have grown significantly over the past five years at an average rate of 61.1% per year, though recent growth has slowed to 39.7%. The management team is seasoned with an average tenure of 8.8 years, providing stability amid market fluctuations. Additionally, Baltic's interest payments are well-covered by EBIT at 23.2x coverage.

- Dive into the specifics of Baltic Classifieds Group here with our thorough balance sheet health report.

- Explore Baltic Classifieds Group's analyst forecasts in our growth report.

easyJet (LSE:EZJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: easyJet plc is a low-cost airline carrier operating in Europe with a market cap of £3.63 billion.

Operations: The company generates revenue primarily through its airline operations (£8.67 billion) and holiday packages (£1.92 billion).

Market Cap: £3.63B

easyJet plc, with a market cap of £3.63 billion, has demonstrated robust financial health despite an unstable dividend track record. The airline's revenue increased to £10.11 billion for the year ending September 2025, with net income rising to £494 million. Its short-term assets (£4.6 billion) exceed both short and long-term liabilities, and its debt is well-managed by operating cash flow and reduced significantly over five years from 143.8% to 53.8%. Although earnings growth slowed recently compared to its impressive five-year average of 71.9%, easyJet continues trading at favorable valuations relative to peers in the industry.

- Take a closer look at easyJet's potential here in our financial health report.

- Learn about easyJet's future growth trajectory here.

Where To Now?

- Reveal the 301 hidden gems among our UK Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baltic Classifieds Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BCG

Baltic Classifieds Group

Operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success