Should You Be Adding Auto Trader Group (LON:AUTO) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Auto Trader Group (LON:AUTO). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Quickly Is Auto Trader Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Auto Trader Group has grown EPS by 8.3% per year. That's a good rate of growth, if it can be sustained.

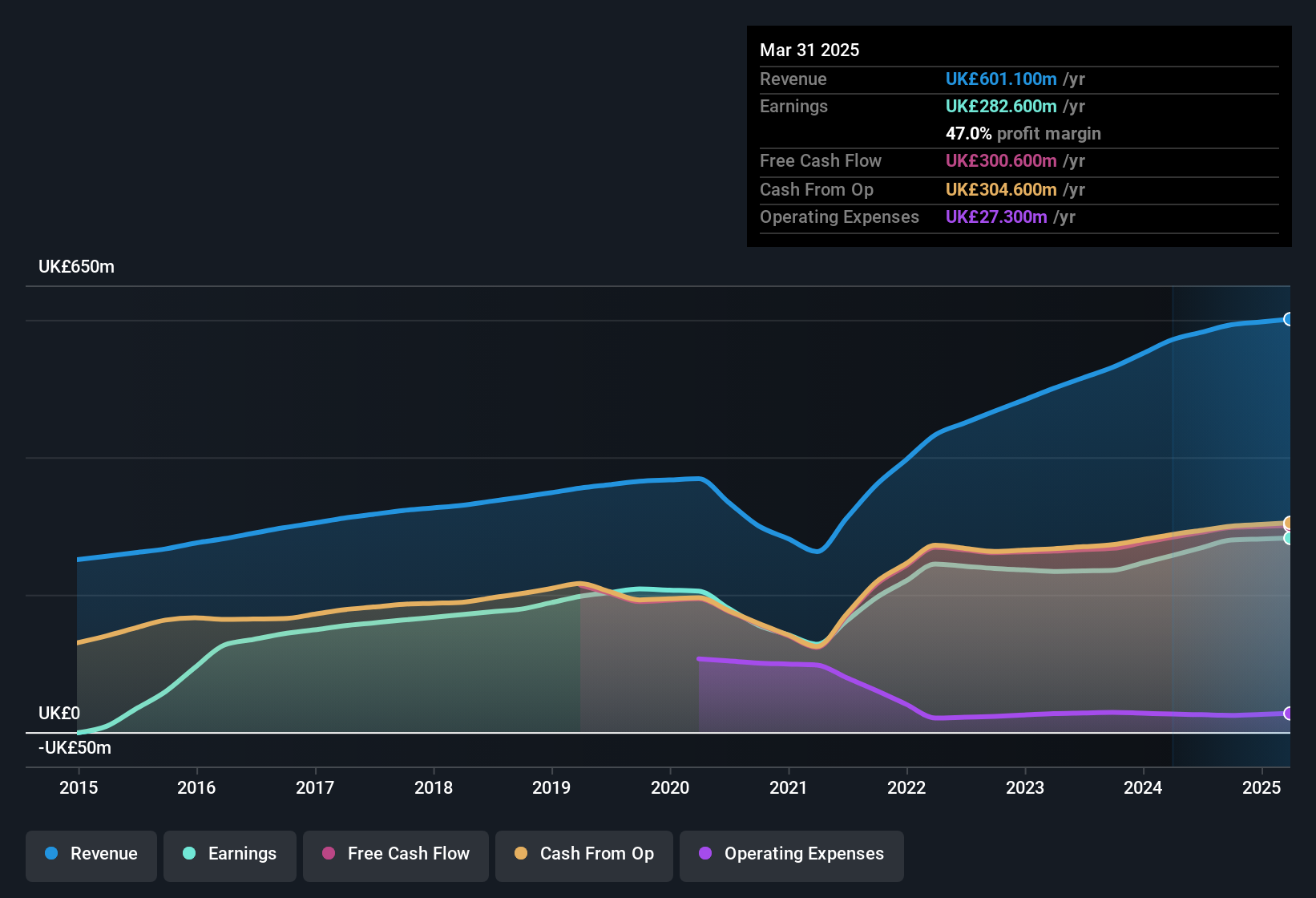

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Auto Trader Group maintained stable EBIT margins over the last year, all while growing revenue 5.3% to UK£601m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Check out our latest analysis for Auto Trader Group

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Auto Trader Group's future EPS 100% free.

Are Auto Trader Group Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a UK£6.7b company like Auto Trader Group. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they hold UK£29m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Auto Trader Group with market caps between UK£3.0b and UK£9.0b is about UK£3.1m.

Auto Trader Group's CEO took home a total compensation package worth UK£2.3m in the year leading up to March 2025. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Auto Trader Group To Your Watchlist?

One important encouraging feature of Auto Trader Group is that it is growing profits. Earnings growth might be the main attraction for Auto Trader Group, but the fun does not stop there. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Auto Trader Group. You might benefit from giving it a glance today.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in GB with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AUTO

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)