- United Kingdom

- /

- Media

- /

- AIM:TMO

Not Many Are Piling Into Time Out Group plc (LON:TMO) Stock Yet As It Plummets 26%

Unfortunately for some shareholders, the Time Out Group plc (LON:TMO) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

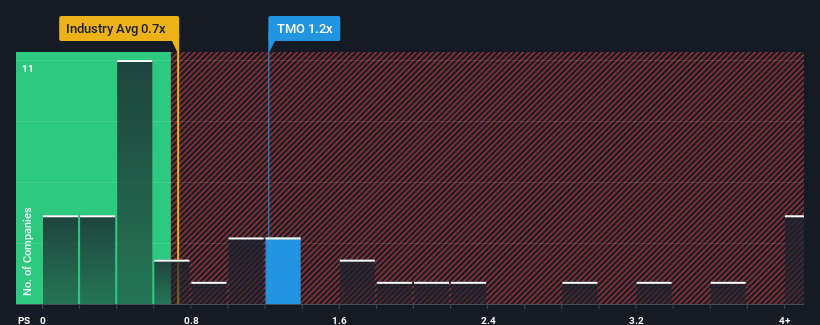

In spite of the heavy fall in price, it's still not a stretch to say that Time Out Group's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Media industry in the United Kingdom, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Time Out Group

How Time Out Group Has Been Performing

Time Out Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Time Out Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Time Out Group's Revenue Growth Trending?

In order to justify its P/S ratio, Time Out Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 1.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 108% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 17%. With the rest of the industry predicted to shrink by 1.2%, that would be a fantastic result.

In light of this, it's peculiar that Time Out Group's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Time Out Group looks to be in line with the rest of the Media industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Time Out Group currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Time Out Group with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Time Out Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TMO

Slightly overvalued with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026