- United Kingdom

- /

- Media

- /

- AIM:SAA

Exploring Three Undervalued Small Caps With Insider Action In The United Kingdom

Reviewed by Simply Wall St

Amidst a backdrop where the FTSE 100 is poised to break a three-month winning streak and broader market indices show mixed signals, investors are navigating through an environment filled with both caution and opportunity. In such a landscape, identifying undervalued small-cap stocks with insider buying can be particularly compelling, as these actions may signal unrecognized value or upcoming positive developments within these companies.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 7.5x | 0.5x | 43.15% | ★★★★★☆ |

| John Wood Group | NA | 0.3x | 49.07% | ★★★★★☆ |

| THG | NA | 0.4x | 33.18% | ★★★★★☆ |

| Bytes Technology Group | 28.7x | 6.5x | 12.37% | ★★★★☆☆ |

| CVS Group | 20.5x | 1.1x | 41.88% | ★★★★☆☆ |

| M&C Saatchi | NA | 0.5x | 49.15% | ★★★★☆☆ |

| Savills | 36.4x | 0.7x | 25.21% | ★★★☆☆☆ |

| Robert Walters | 20.6x | 0.3x | 35.50% | ★★★☆☆☆ |

| J D Wetherspoon | 21.4x | 0.4x | -63.93% | ★★★☆☆☆ |

| Hochschild Mining | NA | 1.6x | 38.95% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

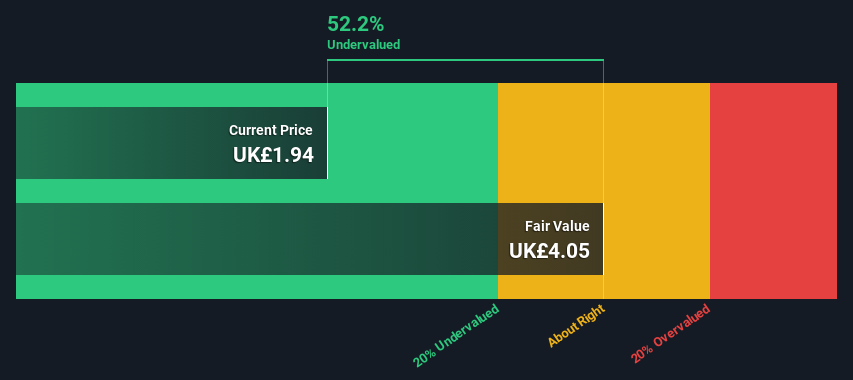

M&C Saatchi (AIM:SAA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: M&C Saatchi is a global advertising and marketing services company with a market capitalization of approximately £76 million.

Operations: The company has experienced fluctuations in gross profit margin over the observed periods, ranging from a high of 73.22% to a low of -30.69%. In recent entries, the gross profit margin was recorded at 15.87%, reflecting variability in its cost management and revenue generation efficiency.

PE: -70.0x

With a strategic shift in executive roles and a recent dividend increase, M&C Saatchi demonstrates operational dynamism amid challenging financials, reporting a net loss despite robust sales of £453.91 million last year. Insider confidence is evident as they recently purchased shares, signaling belief in the company's recovery and growth prospects. This activity, coupled with forecasted earnings growth of 43.75% annually, positions M&C Saatchi as an intriguing entity within the undervalued UK market sector.

- Navigate through the intricacies of M&C Saatchi with our comprehensive valuation report here.

Assess M&C Saatchi's past performance with our detailed historical performance reports.

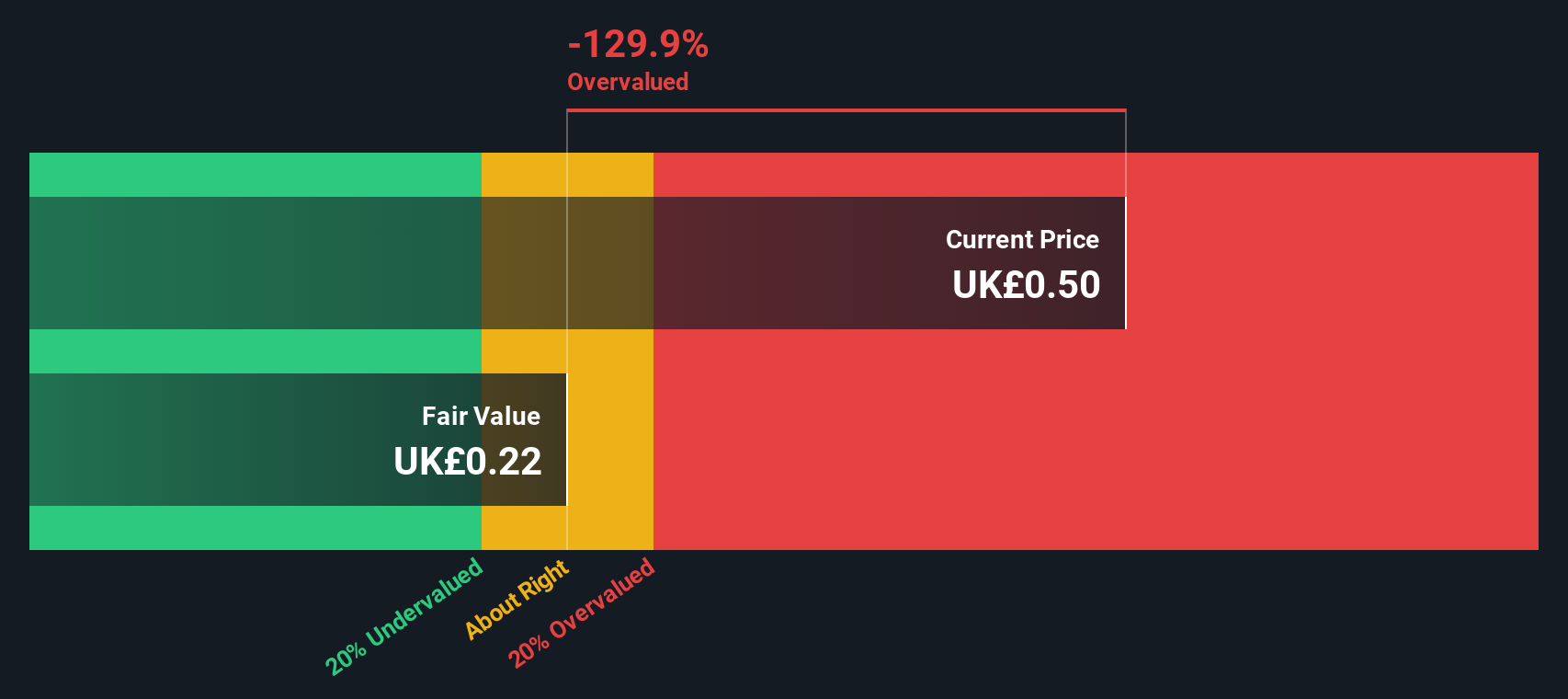

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Assura is a UK-based healthcare real estate investment trust (REIT) specializing in the development, investment, and management of primary care facilities across the United Kingdom.

Operations: The entity generates revenue primarily through its core operations, with a recent figure reported at £157.8 million. It has demonstrated a consistent gross profit margin averaging approximately 92% over the last few reporting periods, reflecting efficient cost management relative to its revenue generation.

PE: -41.5x

Assura, a UK-based healthcare property investor, reported a significant reduction in net loss to GBP 28.8 million for the year ended March 2024, down from GBP 119.2 million previously. This improvement accompanies their strategic GBP 250 million joint venture aimed at enhancing NHS infrastructure, signaling robust growth prospects and financial health. Recently, insiders demonstrated confidence in Assura's trajectory through share purchases, underscoring their belief in the company’s potential despite its reliance on higher-risk funding sources like external borrowing.

- Take a closer look at Assura's potential here in our valuation report.

Gain insights into Assura's past trends and performance with our Past report.

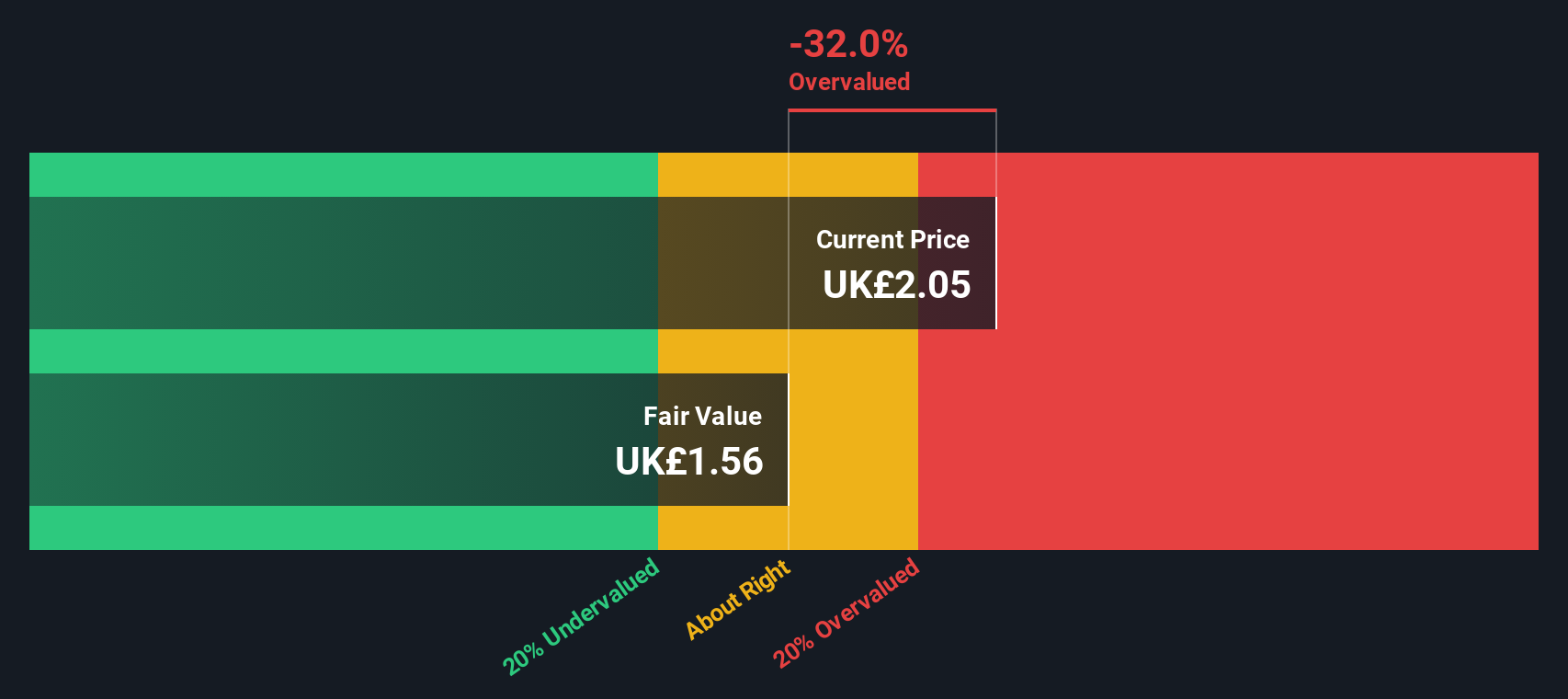

SSP Group (LSE:SSPG)

Simply Wall St Value Rating: ★★★★★☆

Overview: SSP Group operates primarily in the food and beverage sector, focusing on travel locations such as airports and railway stations, with a market capitalization of approximately £2.10 billion.

Operations: The entity generates a significant portion of its revenue from the food and beverage sector, primarily located in travel environments such as airports and railway stations, with recent figures showing £3.21 billion. Over time, the gross profit margin has shown an upward trend, increasing from 19.57% to approximately 28.84%, indicating an improvement in cost management relative to sales.

PE: 158.6x

Despite a challenging financial landscape with a slight net loss increase, SSP Group recently declared an interim dividend, signaling potential stability. Sales have notably risen to £1,517.2 million from £1,318.4 million year-over-year. Insider confidence is evident as they recently purchased shares, underscoring their belief in the company's prospects amidst forecasts of a significant 50.77% annual earnings growth and concerns over interest coverage by earnings. This blend of insider activity and dividend adjustments paints a complex yet intriguing picture for SSP Group in the undervalued sector.

- Delve into the full analysis valuation report here for a deeper understanding of SSP Group.

Examine SSP Group's past performance report to understand how it has performed in the past.

Where To Now?

- Access the full spectrum of 36 Undervalued Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SAA

M&C Saatchi

Provides advertising and marketing communications services in the United Kingdom, Europe, the Middle East, the Asia Pacific, and the Americas.

Flawless balance sheet and good value.

Market Insights

Community Narratives