- United Kingdom

- /

- Specialty Stores

- /

- AIM:VTU

December 2024's Best UK Dividend Stocks

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences volatility due to weak trade data from China and fluctuating commodity prices, investors are increasingly seeking stability in their portfolios. In such uncertain times, dividend stocks can offer a reliable source of income, making them an attractive option for those looking to navigate the current market challenges while benefiting from regular payouts.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.15% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.30% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.40% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.19% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.01% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.71% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.44% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.88% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.85% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.72% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Next 15 Group (AIM:NFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £385.89 million.

Operations: Next 15 Group plc generates its revenue through providing communications services across various regions, including the United Kingdom, Europe, Africa, the United States, and the Asia Pacific.

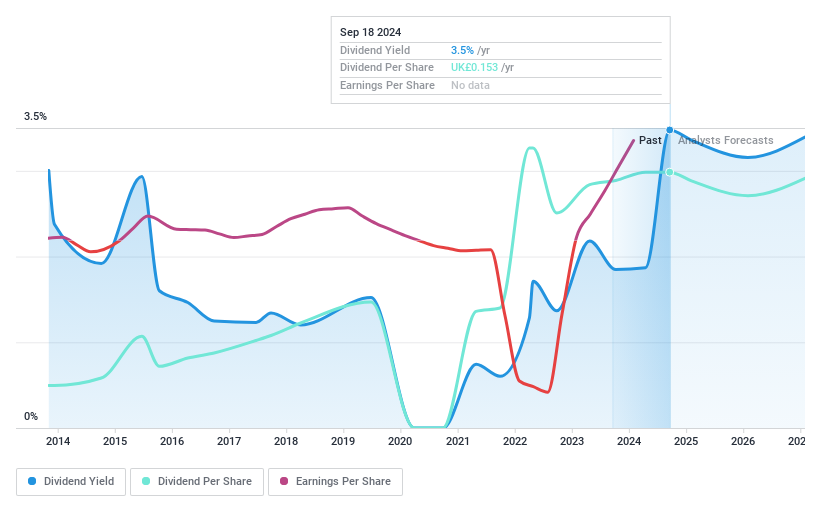

Dividend Yield: 4%

Next 15 Group's dividend payments are well covered by both earnings and cash flows, with low payout ratios of 25.2% and 23.3%, respectively. However, the company's dividends have been unreliable over the past decade, showing volatility with significant drops at times. Despite this instability, Next 15 Group offers good relative value compared to peers and trades significantly below its estimated fair value. Earnings grew substantially last year but are forecasted to decline in coming years.

- Click to explore a detailed breakdown of our findings in Next 15 Group's dividend report.

- Upon reviewing our latest valuation report, Next 15 Group's share price might be too pessimistic.

Vertu Motors (AIM:VTU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vertu Motors plc is an automotive retailer operating in the United Kingdom with a market cap of £192.94 million.

Operations: Vertu Motors plc generates revenue primarily from its Retail - Gasoline & Auto Dealers segment, amounting to £4.79 billion.

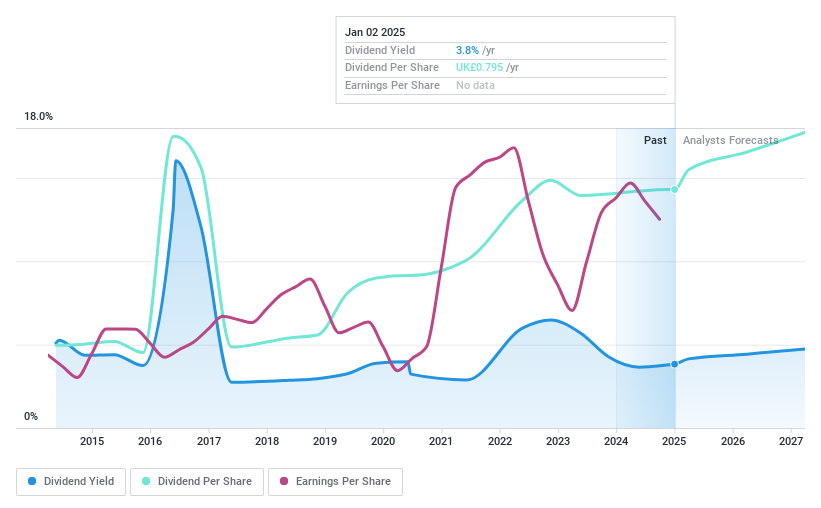

Dividend Yield: 4.1%

Vertu Motors' dividends are well covered by both earnings and cash flows, with payout ratios of 41.8% and 17.5%, respectively. However, the company's dividend history is marked by volatility over the past decade. Recent share buybacks worth £3 million aim to enhance shareholder value amidst declining net income of £15.96 million for the half-year ending August 2024, down from £22.42 million a year ago, reflecting tighter profit margins despite increased sales revenue of £2.49 billion.

- Click here and access our complete dividend analysis report to understand the dynamics of Vertu Motors.

- The valuation report we've compiled suggests that Vertu Motors' current price could be quite moderate.

Intermediate Capital Group (LSE:ICG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Intermediate Capital Group plc is a private equity firm specializing in direct and fund of fund investments, with a market cap of £5.99 billion.

Operations: Intermediate Capital Group's revenue is primarily derived from its Investment Company segment, generating £214.10 million, and its Fund Management Company segment, contributing £708.50 million.

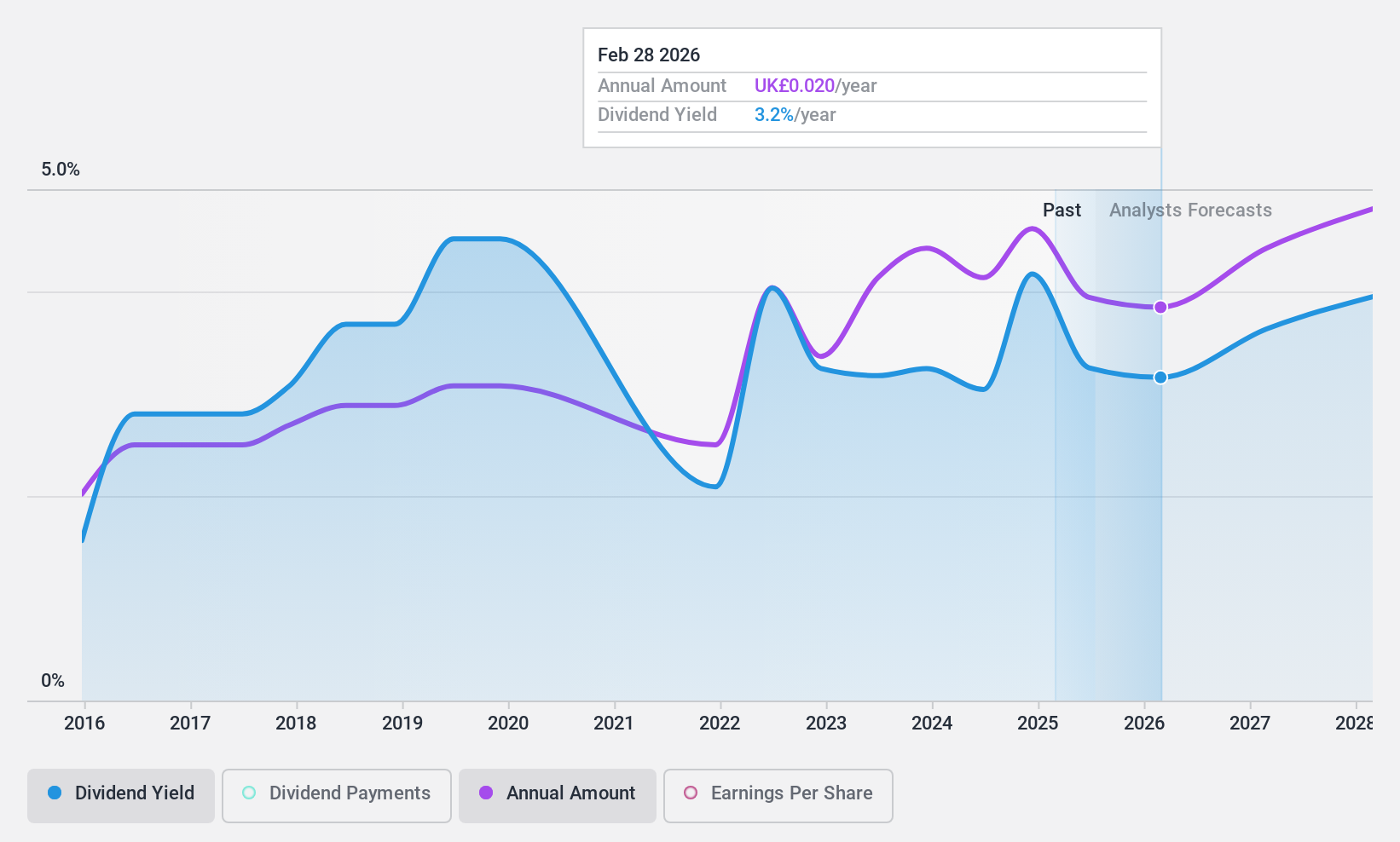

Dividend Yield: 3.9%

Intermediate Capital Group's dividend payments are covered by earnings and cash flows, with payout ratios of 57.1% and 51.2%, respectively, though its dividend history shows volatility over the past decade. The company plans to increase dividends annually by mid-single digits, recently declaring an interim dividend of £0.263 per share for January 2025. Despite a drop in half-year revenue to £405.3 million and net income to £152.5 million, strategic expansions into North America may bolster future growth prospects.

- Unlock comprehensive insights into our analysis of Intermediate Capital Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Intermediate Capital Group is trading behind its estimated value.

Taking Advantage

- Explore the 61 names from our Top UK Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VTU

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives