- United Kingdom

- /

- Biotech

- /

- LSE:OXB

High Growth Tech Stocks To Watch In The United Kingdom September 2024

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In this environment, identifying high-growth tech stocks in the UK becomes crucial as investors look for resilient opportunities amid broader market volatility.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 20.98% | 106.13% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our UK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Nexxen International (AIM:NEXN)

Simply Wall St Growth Rating: ★★★★☆☆

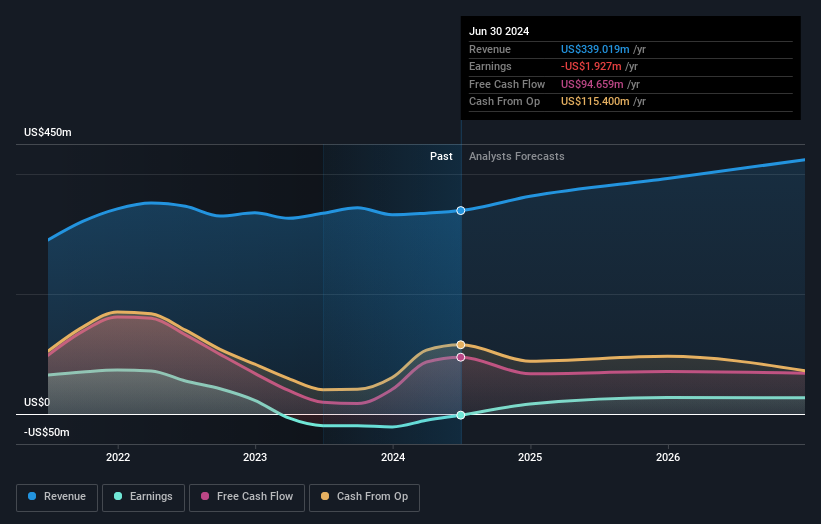

Overview: Nexxen International Ltd. offers a comprehensive software platform that facilitates connections between advertisers and publishers in Israel, with a market cap of £398.10 million.

Operations: Nexxen International Ltd. generates revenue primarily through its marketing services, amounting to $339.02 million. The company operates an end-to-end software platform designed to connect advertisers with publishers in Israel.

Nexxen International's strategic movements in the tech sector, particularly through its recent partnerships and financial performance, underscore its potential despite current unprofitability. The company's revenue is projected to grow by 8.8% annually, outpacing the UK market average of 3.7%. This growth trajectory is complemented by a significant expected increase in earnings at a rate of 71.9% per year, positioning Nexxen for profitability within three years. Recent collaborations with The Trade Desk and Vevo enhance Nexxen’s offerings in advanced advertising data segments and programmatic access to premium inventory, respectively—innovations that meet evolving digital media demands effectively. Additionally, the company’s commitment to shareholder returns was evident with a recent share repurchase totaling $3.7 million, signaling confidence in its financial strategy and future prospects.

- Unlock comprehensive insights into our analysis of Nexxen International stock in this health report.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

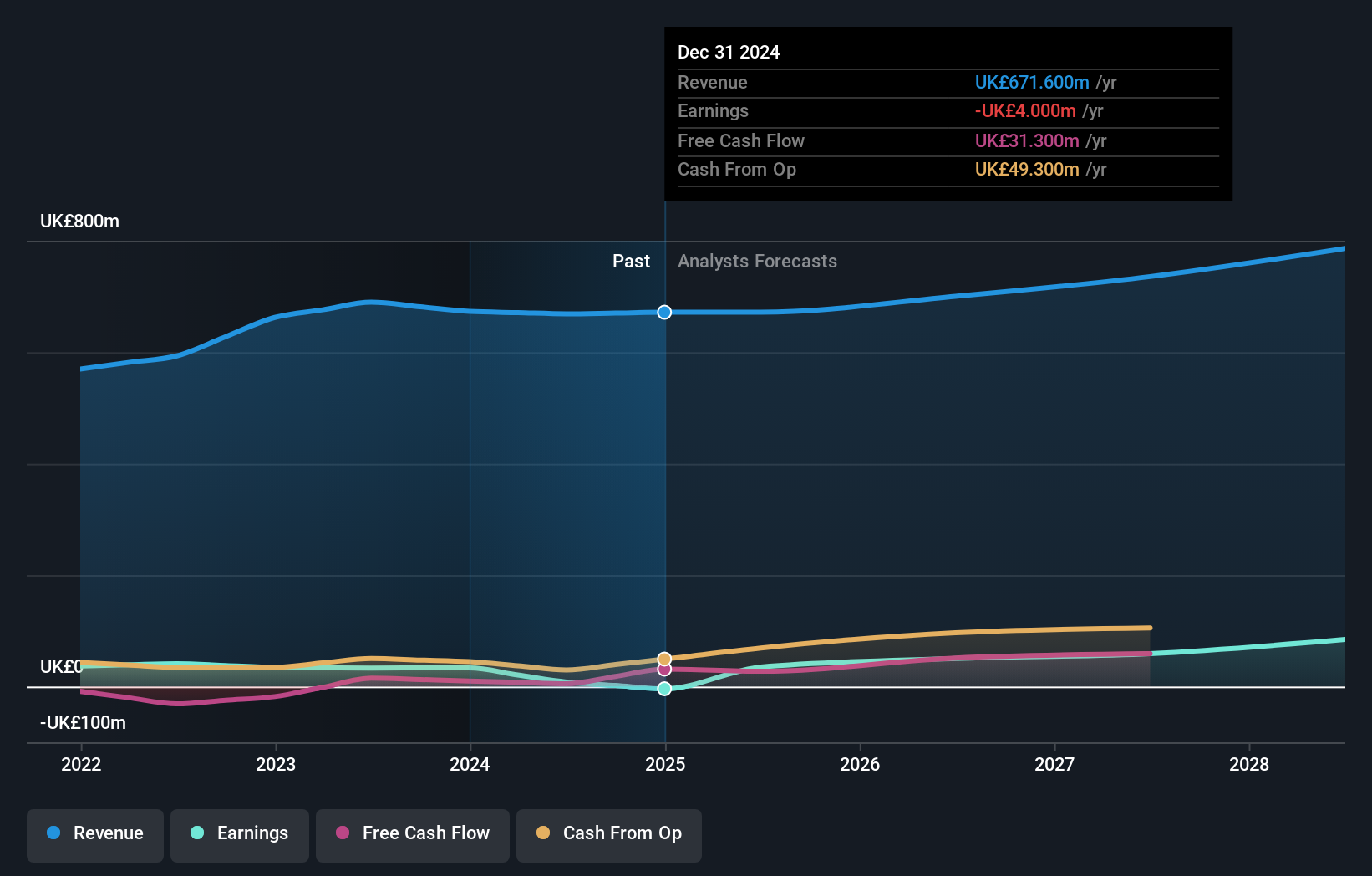

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.30 billion.

Operations: Genus plc generates revenue primarily from its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company operates in various global markets including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

Despite a challenging year marked by a significant one-off loss of £47.4 million, Genus plc is poised for recovery with projected earnings growth of 39.4% annually, outstripping the UK market forecast of 14.3%. This optimism is underscored by its revenue growth rate of 4.1%, which also surpasses the national average of 3.7%. With a recent affirmation to maintain its dividend at 21.7 pence per share and an R&D focus that promises innovation and competitiveness in biotechnology, Genus balances current adversities with robust future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Genus.

Evaluate Genus' historical performance by accessing our past performance report.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

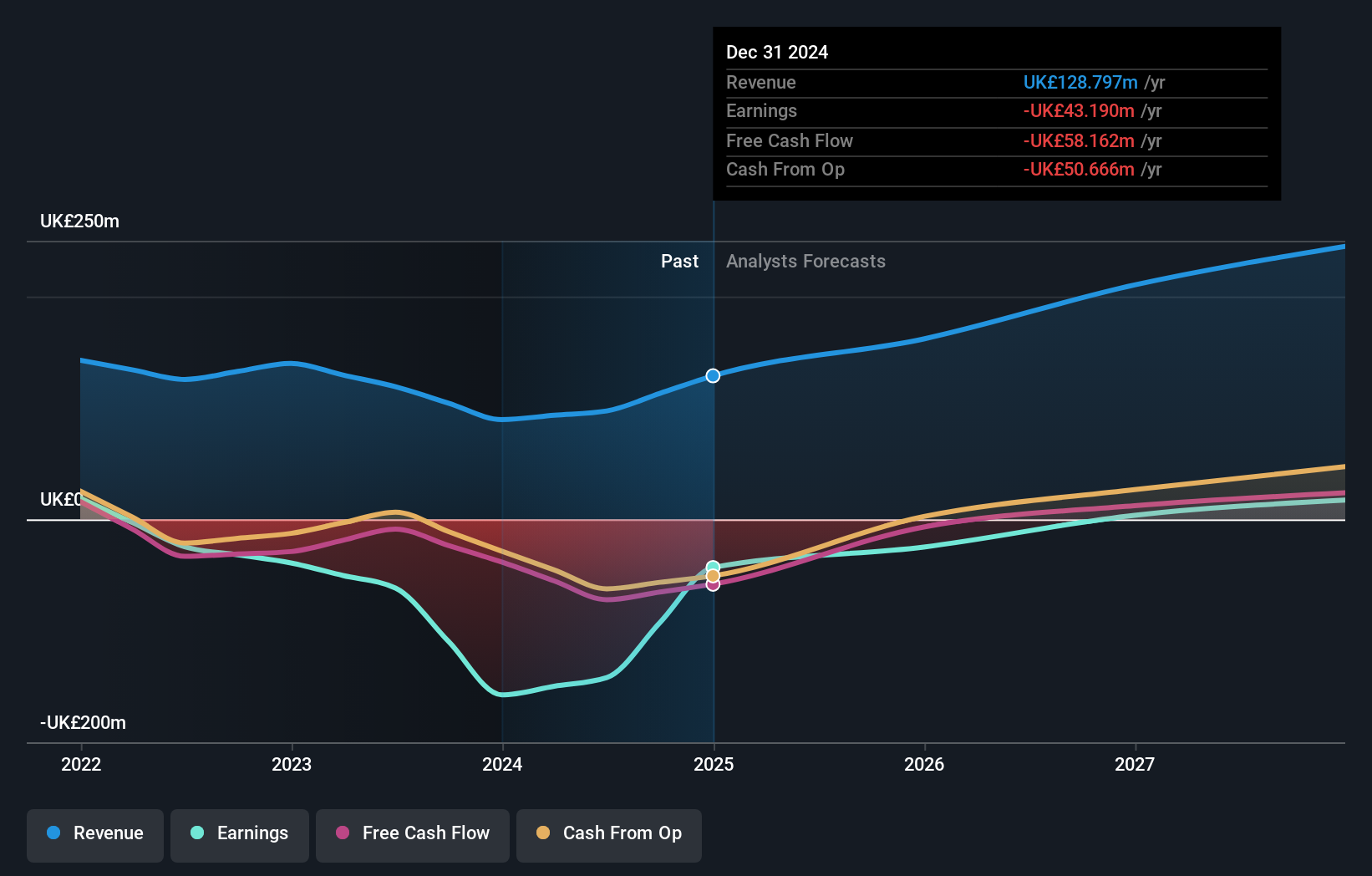

Overview: Oxford Biomedica plc, a contract development and manufacturing organization, focuses on delivering therapies to patients worldwide and has a market cap of £399.77 million.

Operations: Oxford Biomedica generates revenue primarily from its platform segment, which contributed £97.24 million. The company's operations are centered on contract development and manufacturing of therapies for global patients.

Oxford Biomedica, amidst a challenging landscape, is steering towards profitability with its revenue forecast to surge by 21% annually, outpacing the UK market average of 3.7%. This growth trajectory is underpinned by significant R&D investments, which are pivotal for sustaining its competitive edge in biotechnology. Notably, earnings are expected to skyrocket by 106.1% annually over the next three years, reflecting the company's robust strategic focus and innovation-driven approach. Recent corporate maneuvers include reaffirming financial guidance with anticipated revenues hitting up to £134 million for 2024 and welcoming Lucinda Crabtree as CFO, enhancing leadership amidst ongoing transformations in the sector.

- Get an in-depth perspective on Oxford Biomedica's performance by reading our health report here.

Explore historical data to track Oxford Biomedica's performance over time in our Past section.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 45 UK High Growth Tech and AI Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXB

Oxford Biomedica

A contract development and manufacturing organization, focuses on delivering therapies to patients worldwide.

High growth potential and good value.