- United Kingdom

- /

- Capital Markets

- /

- LSE:LIO

3 UK Stocks Trading At Up To 49.3% Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced setbacks due to weak trade data from China, highlighting the interconnected nature of global economies. Despite these challenges, there are still opportunities to find undervalued stocks that could offer significant potential for investors.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Liontrust Asset Management (LSE:LIO) | £6.26 | £12.34 | 49.3% |

| Gaming Realms (AIM:GMR) | £0.40 | £0.77 | 48.1% |

| Tracsis (AIM:TRCS) | £6.00 | £11.42 | 47.5% |

| GlobalData (AIM:DATA) | £2.215 | £4.12 | 46.2% |

| C&C Group (LSE:CCR) | £1.518 | £2.90 | 47.7% |

| Mercia Asset Management (AIM:MERC) | £0.345 | £0.68 | 49.1% |

| Foxtons Group (LSE:FOXT) | £0.65 | £1.22 | 46.9% |

| Tortilla Mexican Grill (AIM:MEX) | £0.525 | £1.01 | 47.9% |

| SysGroup (AIM:SYS) | £0.34 | £0.66 | 48.8% |

| Nexxen International (AIM:NEXN) | £2.745 | £5.34 | 48.6% |

Underneath we present a selection of stocks filtered out by our screen.

LBG Media (AIM:LBG)

Overview: LBG Media plc operates as an online media publisher in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £275.99 million.

Operations: LBG Media generates £67.51 million in revenue from its online media publishing industry.

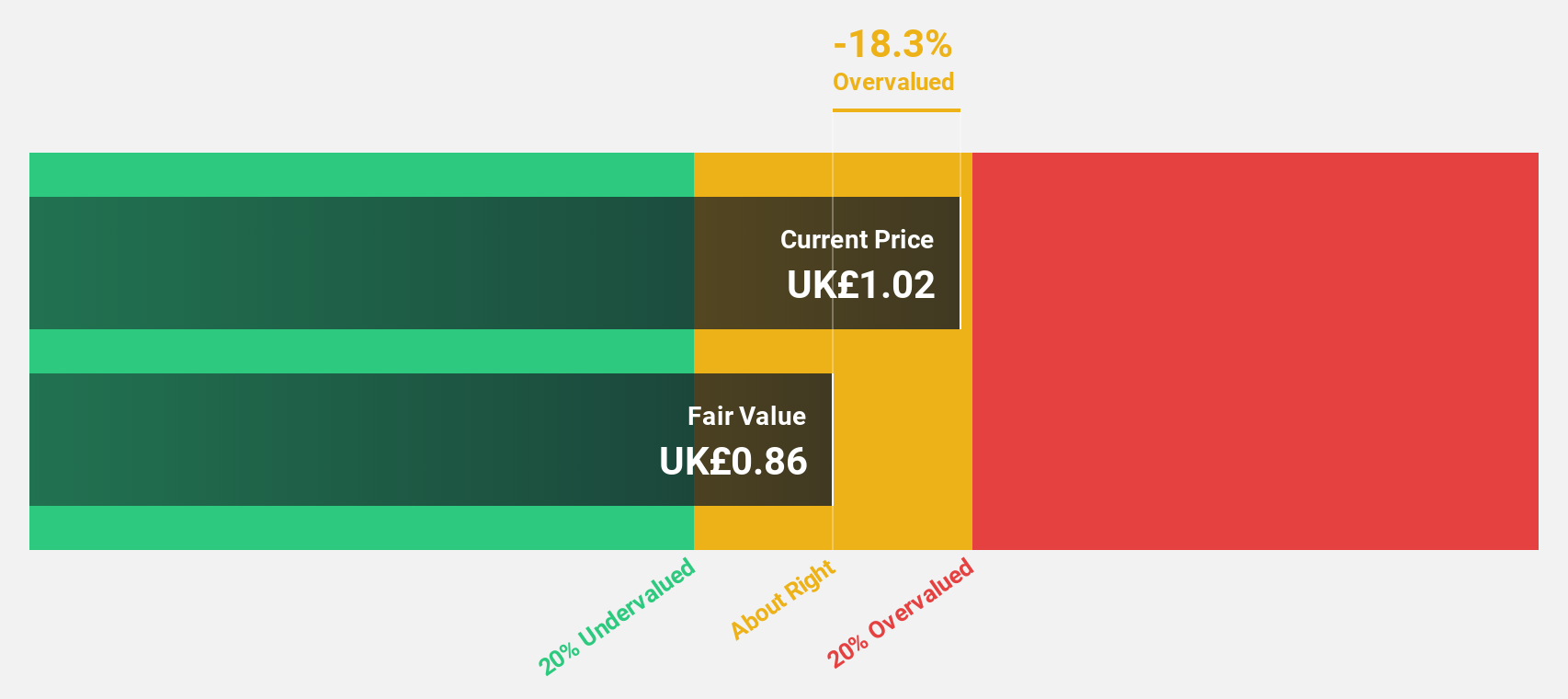

Estimated Discount To Fair Value: 21%

LBG Media is trading at £1.32, which is 21% below its estimated fair value of £1.67, indicating it may be undervalued based on cash flows. Despite recent volatility, LBG's earnings are forecast to grow significantly at 43.84% per year, outpacing the UK market's 14.1%. Revenue grew by 7.5% over the past year and is expected to continue growing faster than the UK market at 11.7% per year, though profit margins have decreased from 8.6% to 0.9%.

- Insights from our recent growth report point to a promising forecast for LBG Media's business outlook.

- Dive into the specifics of LBG Media here with our thorough financial health report.

Babcock International Group (LSE:BAB)

Overview: Babcock International Group PLC, with a market cap of £2.64 billion, specializes in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security across the UK and internationally.

Operations: The company's revenue segments are comprised of £1.10 billion from Land, £1.43 billion from Marine, £1.52 billion from Nuclear, and £341.50 million from Aviation.

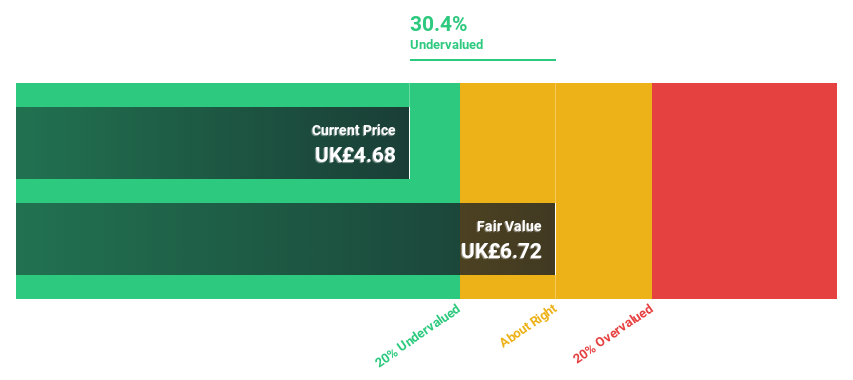

Estimated Discount To Fair Value: 22.8%

Babcock International Group is trading at £5.24, which is 22.8% below its estimated fair value of £6.78, suggesting it may be undervalued based on cash flows. The company reported a net income of £165.7 million for FY24, a significant turnaround from the previous year's net loss of £35 million. Earnings are forecast to grow at 15.44% per year, outpacing the UK market's 14.1%. Despite high debt levels, Babcock's return on equity is expected to reach 30.5% in three years.

- Our expertly prepared growth report on Babcock International Group implies its future financial outlook may be stronger than recent results.

- Take a closer look at Babcock International Group's balance sheet health here in our report.

Liontrust Asset Management (LSE:LIO)

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of £400.06 million.

Operations: Liontrust Asset Management Plc generates its revenue primarily from its Investment Management segment, which accounts for £197.89 million.

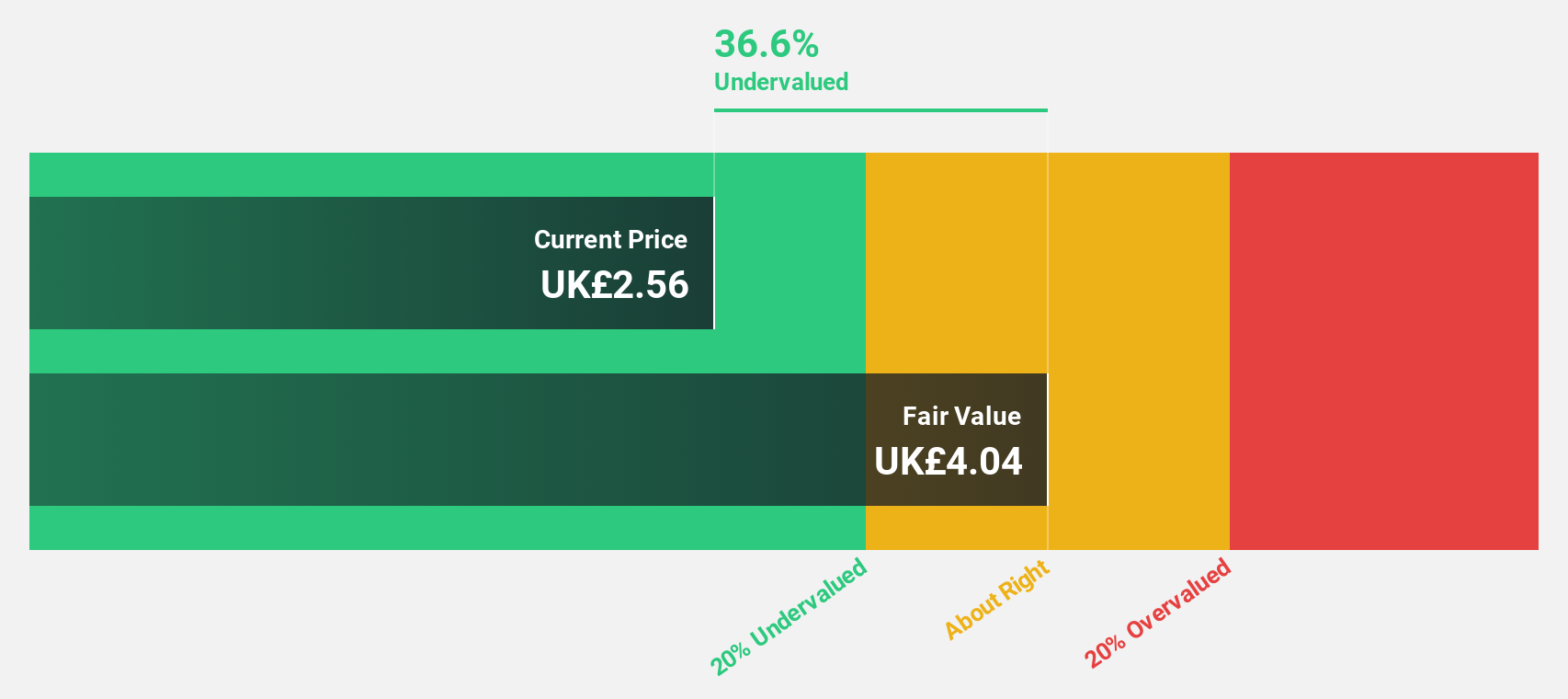

Estimated Discount To Fair Value: 49.3%

Liontrust Asset Management is trading at £6.26, significantly below its estimated fair value of £12.34, indicating potential undervaluation based on cash flows. Despite a challenging year with a net loss of £3.49 million and declining sales, the company is forecast to become profitable within three years and achieve high return on equity (29.8%). Recent board changes and strategic hires aim to improve sentiment after substantial investor outflows totaling £1.2 billion in early 2024.

- Upon reviewing our latest growth report, Liontrust Asset Management's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Liontrust Asset Management's balance sheet health report.

Seize The Opportunity

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 51 more companies for you to explore.Click here to unveil our expertly curated list of 54 Undervalued UK Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LIO

Liontrust Asset Management

Liontrust Asset Management Plc is a publicly owned investment manager.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives