- United Kingdom

- /

- Specialty Stores

- /

- AIM:VIC

3 UK Stocks Estimated To Be Trading At Up To 29.7% Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market, particularly the FTSE 100, has recently experienced downward pressure due to weak trade data from China, highlighting global economic interdependencies. In such a climate, identifying stocks that are trading below their intrinsic value can offer investors potential opportunities for growth and resilience amid broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hercules Site Services (AIM:HERC) | £0.475 | £0.91 | 47.9% |

| Fevertree Drinks (AIM:FEVR) | £6.61 | £13.12 | 49.6% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| GlobalData (AIM:DATA) | £1.835 | £3.57 | 48.7% |

| Zotefoams (LSE:ZTF) | £2.97 | £5.69 | 47.8% |

| Informa (LSE:INF) | £8.372 | £16.33 | 48.7% |

| Duke Capital (AIM:DUKE) | £0.304 | £0.58 | 47.6% |

| Deliveroo (LSE:ROO) | £1.332 | £2.63 | 49.3% |

| Victrex (LSE:VCT) | £10.54 | £19.58 | 46.2% |

| Watches of Switzerland Group (LSE:WOSG) | £5.15 | £9.20 | 44% |

We're going to check out a few of the best picks from our screener tool.

LBG Media (AIM:LBG)

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £264.49 million.

Operations: The company generates its revenue primarily from the online media publishing industry, amounting to £82.54 million.

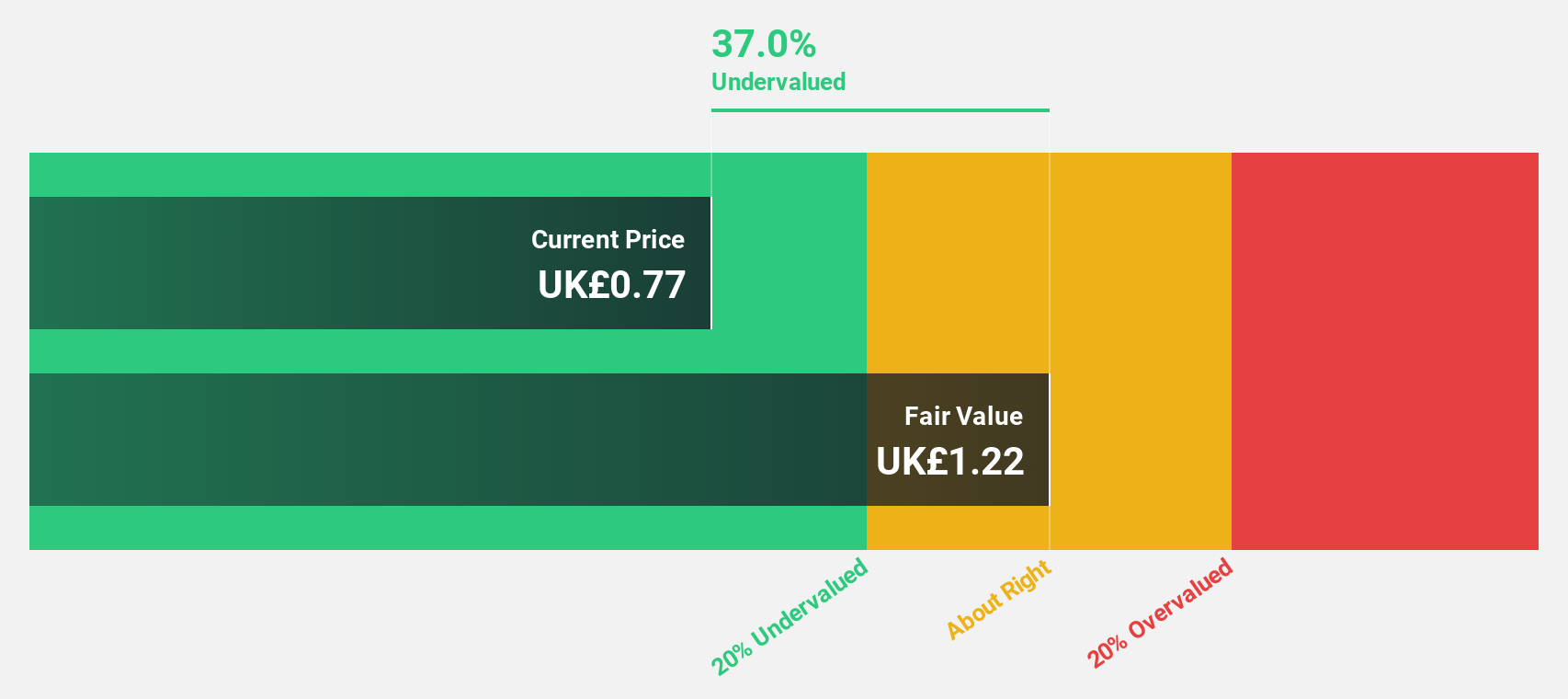

Estimated Discount To Fair Value: 29.7%

LBG Media is trading at £1.27, significantly below its estimated fair value of £1.8, indicating it may be undervalued based on cash flows. Analysts predict a 26.3% rise in stock price, with earnings expected to grow at 24.5% annually, outpacing the UK market's projected growth of 14.5%. Despite slower revenue growth compared to high benchmarks, LBG's earnings have shown substantial improvement with a recent annual increase of 33%.

- Our comprehensive growth report raises the possibility that LBG Media is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of LBG Media stock in this financial health report.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories in the United Kingdom, with a market cap of £323.08 million.

Operations: The company's revenue primarily comes from its online retail segment, generating £295.70 million.

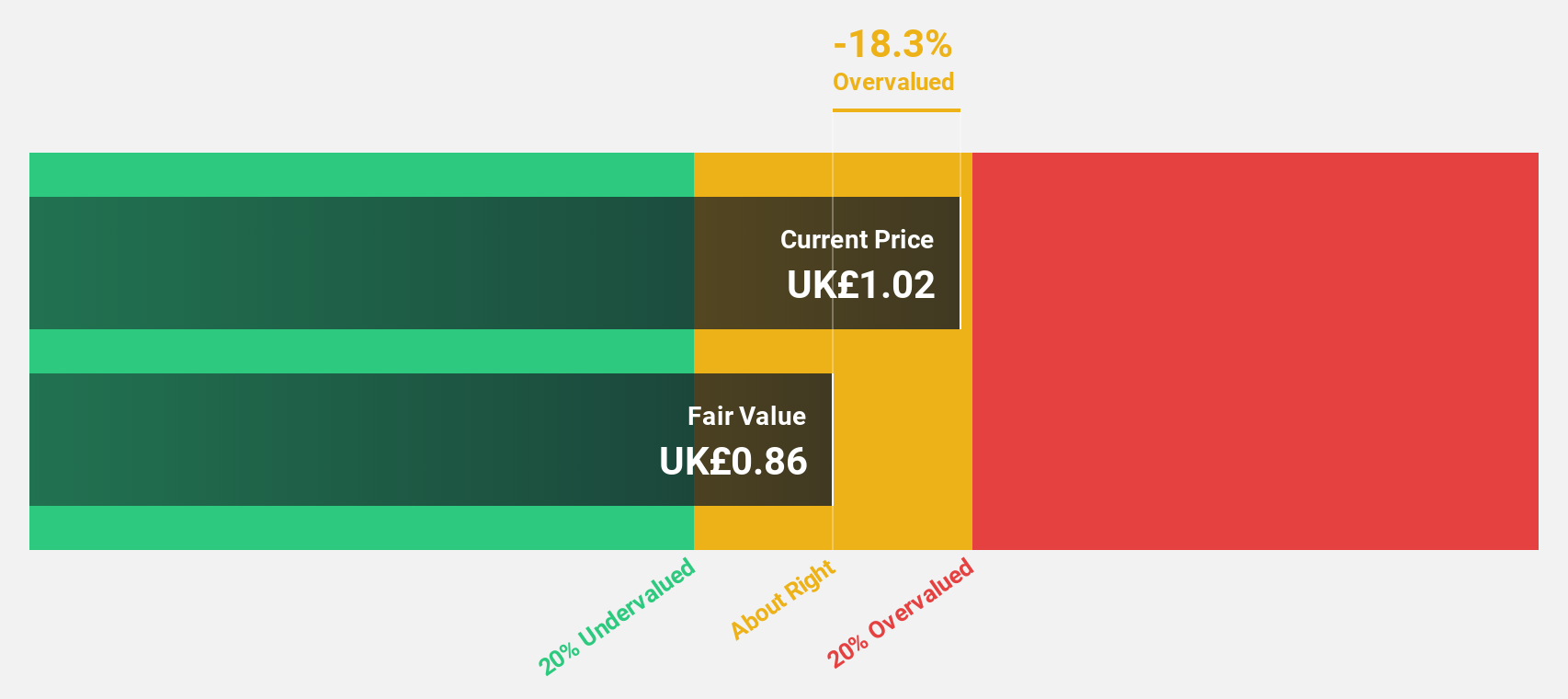

Estimated Discount To Fair Value: 25.7%

Victorian Plumbing Group is trading at £0.99, below its fair value estimate of £1.33, highlighting potential undervaluation based on cash flows. Analysts expect a 22.3% price rise and project earnings growth of 39.5% annually, surpassing UK market averages. Despite lower profit margins than last year, revenue grew to £295.7 million from £285.1 million, with dividends increasing by 15%, reflecting a strategic focus on balance sheet strength and cash preservation for future investments.

- The growth report we've compiled suggests that Victorian Plumbing Group's future prospects could be on the up.

- Get an in-depth perspective on Victorian Plumbing Group's balance sheet by reading our health report here.

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc, along with its subsidiaries, supplies respiratory and head protection products to military and first responder markets in Europe and the United States, with a market cap of approximately £447.33 million.

Operations: The company's revenue is primarily derived from its Team Wendy segment, which contributes $129.40 million, and its Avon Protection segment, accounting for $145.60 million.

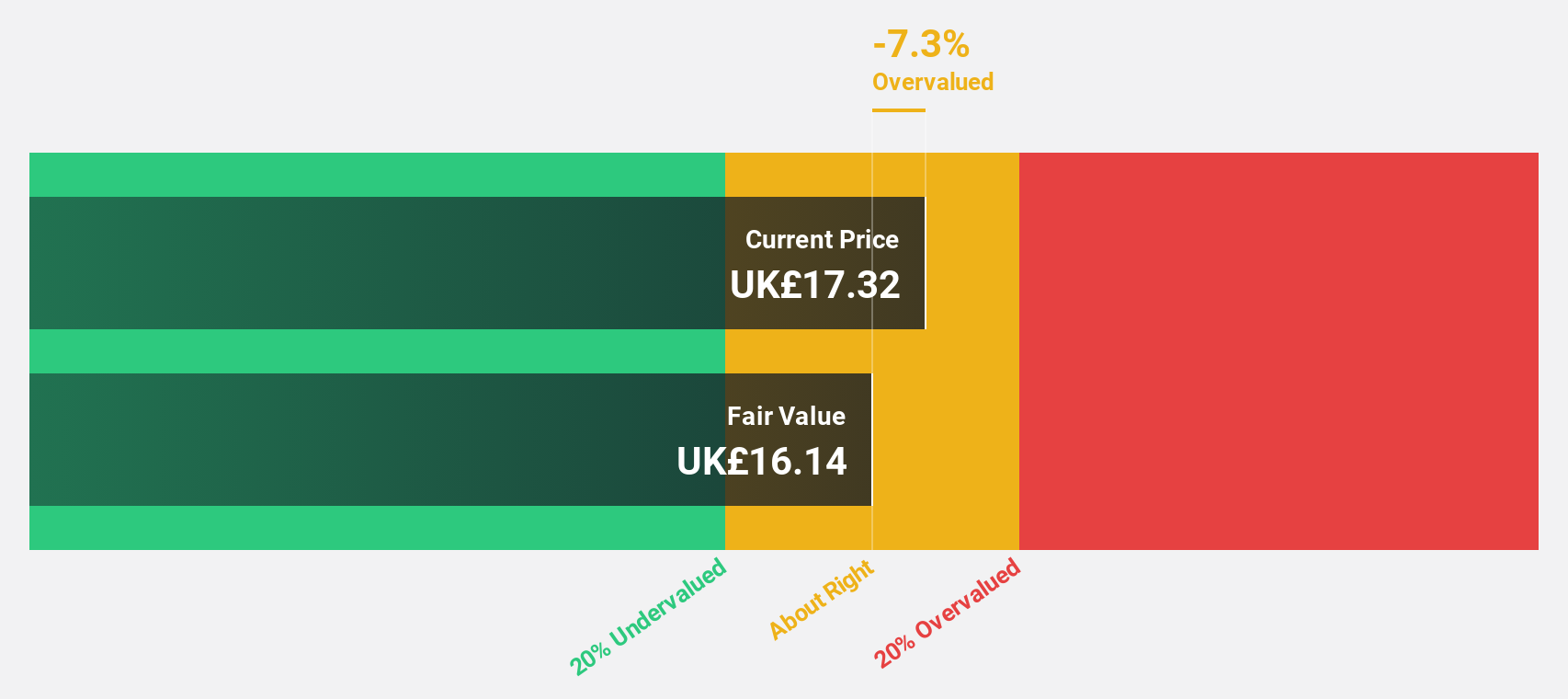

Estimated Discount To Fair Value: 26.1%

Avon Technologies, trading at £15.06, is significantly undervalued with a fair value estimate of £20.39. The company has returned to profitability with net income of US$3 million and is forecasted to grow earnings by 62% annually, outpacing the UK market's growth rate. Recent developments include an $18 million order from the Defense Logistics Agency and a proposed dividend increase, underscoring its improving financial health despite low future return on equity expectations.

- Our earnings growth report unveils the potential for significant increases in Avon Technologies' future results.

- Navigate through the intricacies of Avon Technologies with our comprehensive financial health report here.

Key Takeaways

- Click here to access our complete index of 54 Undervalued UK Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VIC

Victorian Plumbing Group

Operates as an online retailer of bathroom products and accessories for B2C and trade customers in the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives