- United Kingdom

- /

- Software

- /

- LSE:APTD

Gaming Realms And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over China's economic recovery. Despite these challenges, investors continue to seek opportunities that can offer growth potential and resilience. Penny stocks, often seen as smaller or newer companies, remain an intriguing area for those willing to explore beyond established names. These stocks can provide a mix of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.215 | £301.38M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.20 | £53.29M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.07 | £316.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.46 | £124.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.23 | £196.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.21 | £68.28M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.15 | £811.87M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gaming Realms (AIM:GMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gaming Realms plc develops, publishes, and licenses mobile gaming content across various regions including the United Kingdom, the United States, Isle of Man, Malta, Gibraltar, and internationally with a market cap of £162.09 million.

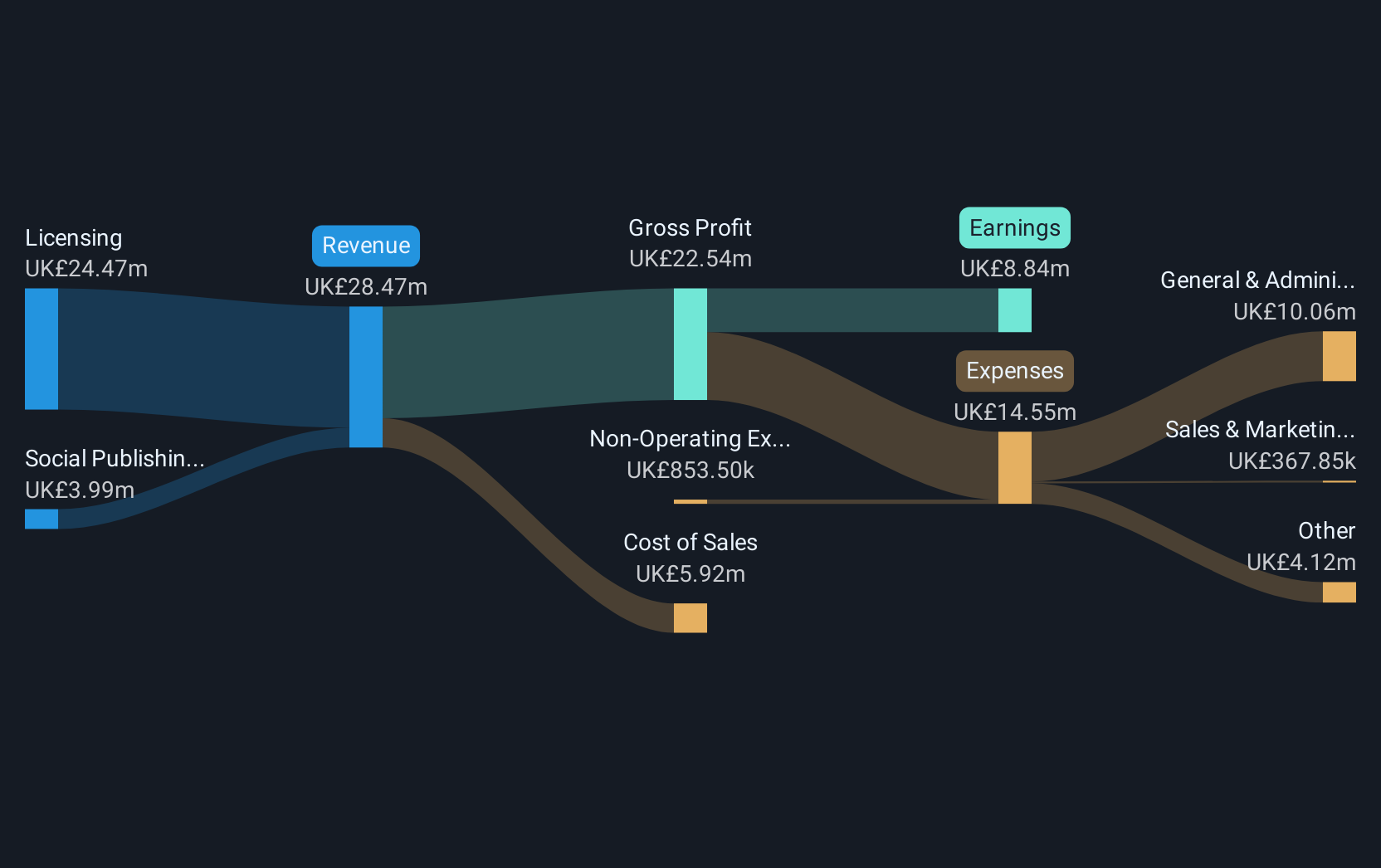

Operations: The company generates revenue primarily through Licensing (£24.47 million) and Social Publishing (£3.99 million).

Market Cap: £162.09M

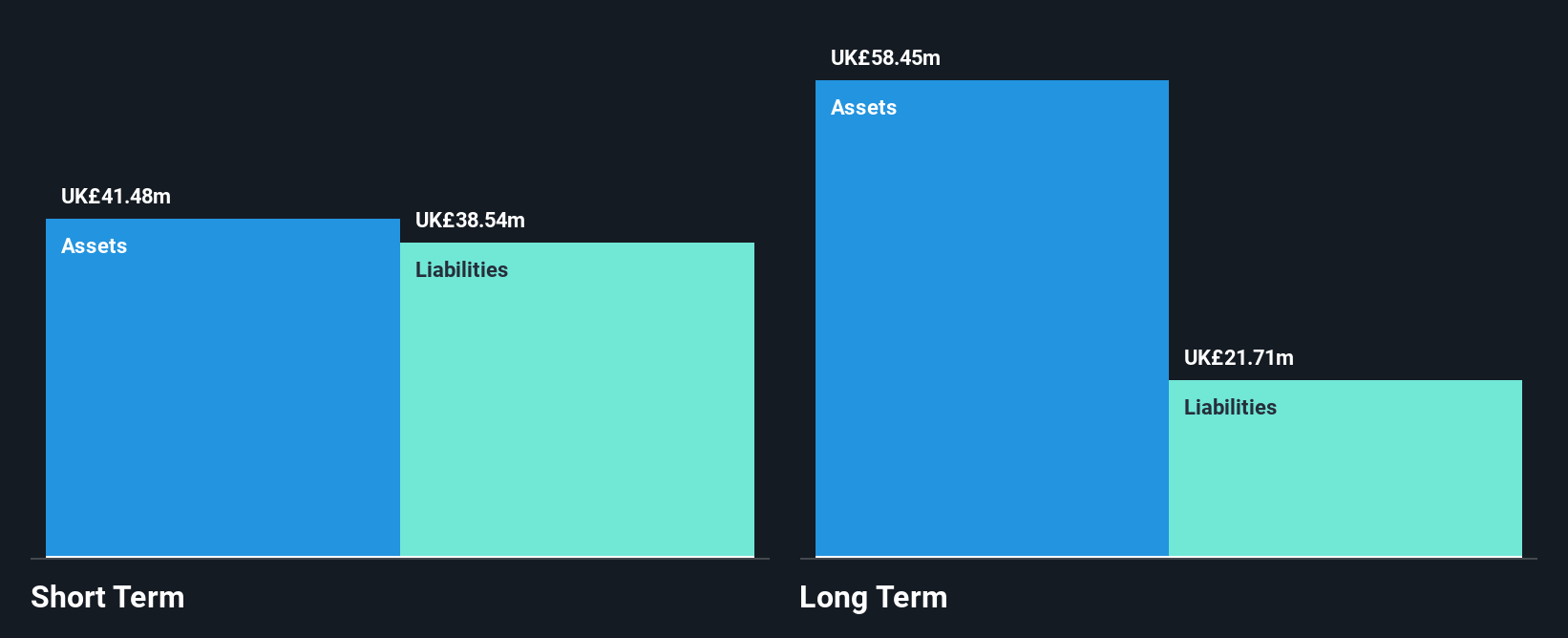

Gaming Realms plc, with a market cap of £162.09 million, has shown robust earnings growth of 49.2% over the past year and maintains high net profit margins of 31.1%. The company is debt-free, enhancing its financial stability, and its short-term assets significantly exceed both short-term and long-term liabilities. Despite a relatively new board with an average tenure of 2.7 years, Gaming Realms has not experienced shareholder dilution recently. A recent partnership with High Roller Technologies aims to expand its presence in Ontario's online casino market later in 2025, potentially boosting future revenue streams.

- Navigate through the intricacies of Gaming Realms with our comprehensive balance sheet health report here.

- Evaluate Gaming Realms' prospects by accessing our earnings growth report.

Likewise Group (AIM:LIKE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Likewise Group Plc, along with its subsidiaries, operates in the wholesale and distribution of floorcoverings, rugs, and matting products for both domestic and commercial markets in the United Kingdom and Rest of Europe, with a market cap of £66.19 million.

Operations: The company generates £149.79 million in revenue from its textile manufacturing segment.

Market Cap: £66.19M

Likewise Group Plc, with a market cap of £66.19 million, has demonstrated resilience in a challenging market environment. The company reported a 10% increase in sales revenue to June 2025, driven by expansion efforts and increased point-of-sale displays. Despite low return on equity at 2% and negative earnings growth over the past year, Likewise's operational gearing improvements suggest enhanced profitability potential. Short-term assets exceed liabilities, indicating sound liquidity management; however, interest coverage remains weak at 1.4x EBIT. While debt levels have risen slightly to a satisfactory net debt-to-equity ratio of 18%, operating cash flow covers debt well at 77.4%.

- Unlock comprehensive insights into our analysis of Likewise Group stock in this financial health report.

- Review our growth performance report to gain insights into Likewise Group's future.

Aptitude Software Group (LSE:APTD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aptitude Software Group plc, along with its subsidiaries, offers financial management software both in the United Kingdom and internationally, with a market cap of £170.88 million.

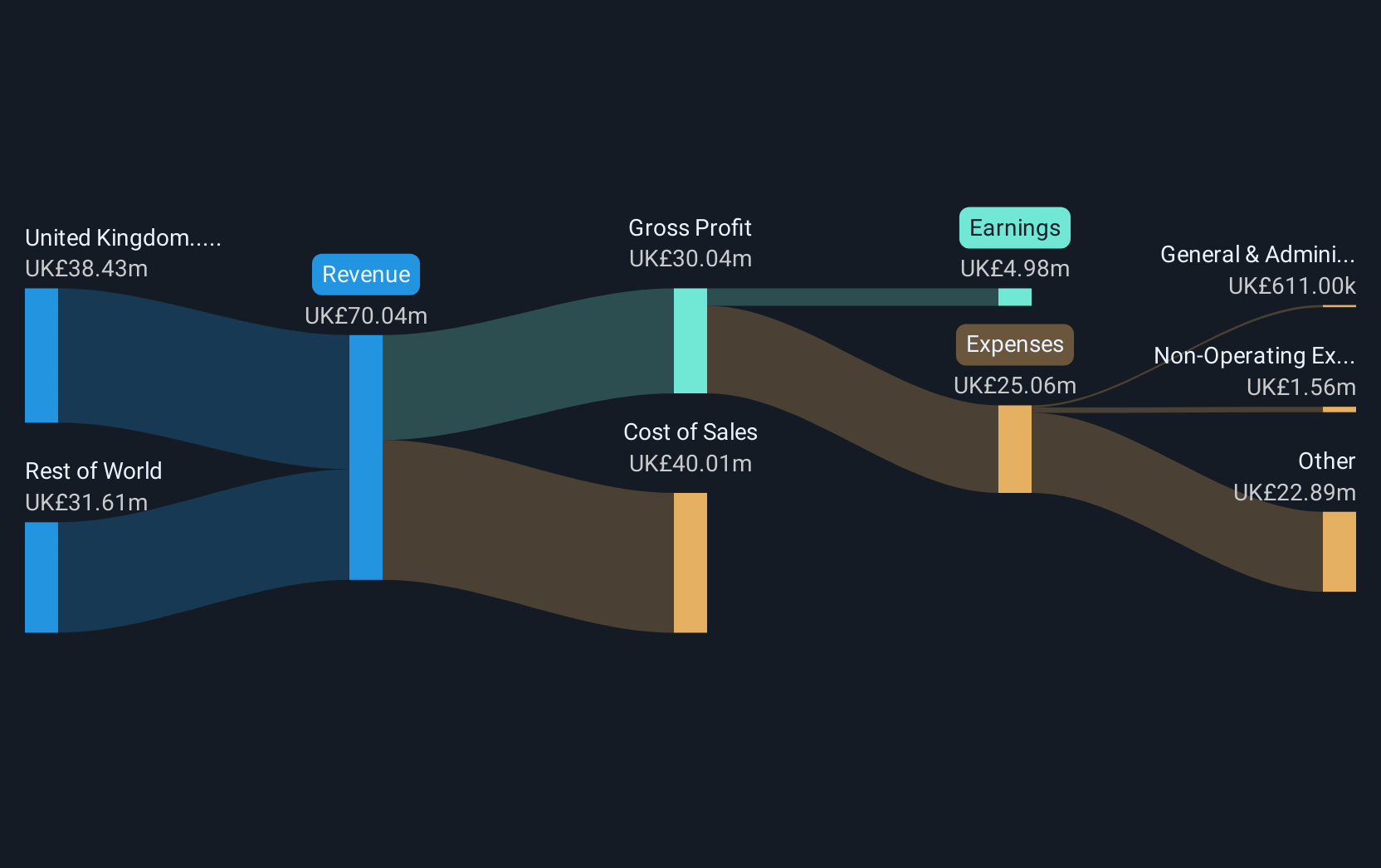

Operations: The company generates revenue of £70.04 million through its financial management software offerings in the UK and international markets.

Market Cap: £170.88M

Aptitude Software Group plc, with a market cap of £170.88 million, has shown significant earnings growth of 20.7% over the past year, surpassing its five-year average decline. The company's net profit margins improved to 7.1%, and it maintains strong liquidity with short-term assets exceeding long-term liabilities. Aptitude's debt is well covered by operating cash flow, and interest payments are substantially covered by EBIT at 79.7x coverage. Trading below estimated fair value enhances its appeal despite low return on equity of 8.6%. Recent board changes include Paula Dowdy's appointment as Non-Executive Director, bringing extensive leadership experience to the company.

- Click to explore a detailed breakdown of our findings in Aptitude Software Group's financial health report.

- Gain insights into Aptitude Software Group's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Dive into all 293 of the UK Penny Stocks we have identified here.

- Looking For Alternative Opportunities? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:APTD

Aptitude Software Group

Provides financial management software in the United Kingdom and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives