- United Kingdom

- /

- Entertainment

- /

- AIM:GMR

3 UK Penny Stocks With At Least £100M Market Cap

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite such fluctuations, investors often seek opportunities in smaller-cap stocks that offer potential growth at lower price points. While the term "penny stocks" might seem outdated, these shares still represent a viable investment area for those looking to uncover hidden value in companies with solid fundamentals and financial strength.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.88 | £297.21M | ✅ 5 ⚠️ 1 View Analysis > |

| One Media iP Group (AIM:OMIP) | £0.0375 | £8.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.80 | £306.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.755 | £424.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.04 | £389.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.488 | £190.13M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.6M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.008 | £2.2B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.35 | £37.87M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 396 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eleco Plc is a software and services provider operating in the UK, Scandinavia, Germany, Europe, the US, and internationally with a market cap of £109.38 million.

Operations: There are no specific revenue segments reported for this company.

Market Cap: £109.38M

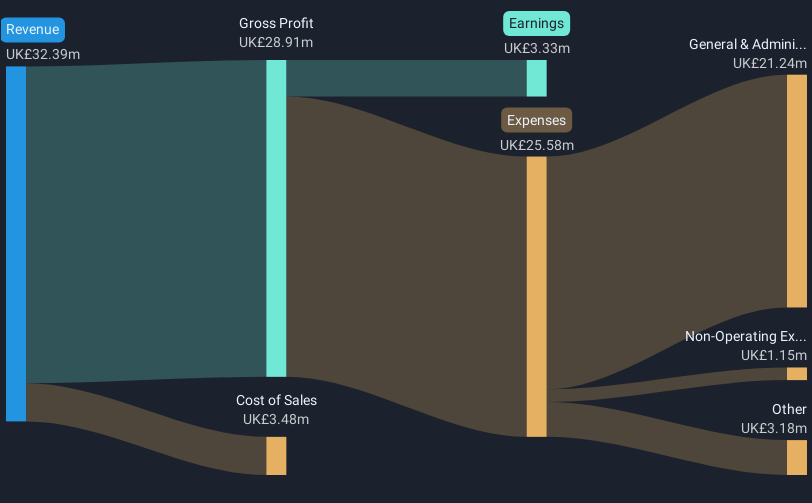

Eleco Plc's financial stability is underscored by its debt-free status and strong asset position, with short-term assets of £20.2 million exceeding both short-term and long-term liabilities. The company has demonstrated robust earnings growth, with a 25.6% increase over the past year, surpassing industry averages. Recent earnings results show sales rising to £32.39 million from £28.01 million the previous year, while net income improved to £3.33 million from £2.66 million, reflecting enhanced profitability margins. Additionally, Eleco announced a 25% increase in its annual dividend payout per share, signaling confidence in future cash flows and shareholder value enhancement.

- Dive into the specifics of Eleco here with our thorough balance sheet health report.

- Examine Eleco's earnings growth report to understand how analysts expect it to perform.

Gaming Realms (AIM:GMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gaming Realms plc develops, publishes, and licenses mobile gaming content across various international markets with a market cap of £124.19 million.

Operations: The company's revenue is derived from two main segments: Licensing, which generates £24.47 million, and Social Publishing (excluding Licensing), contributing £4.20 million.

Market Cap: £124.19M

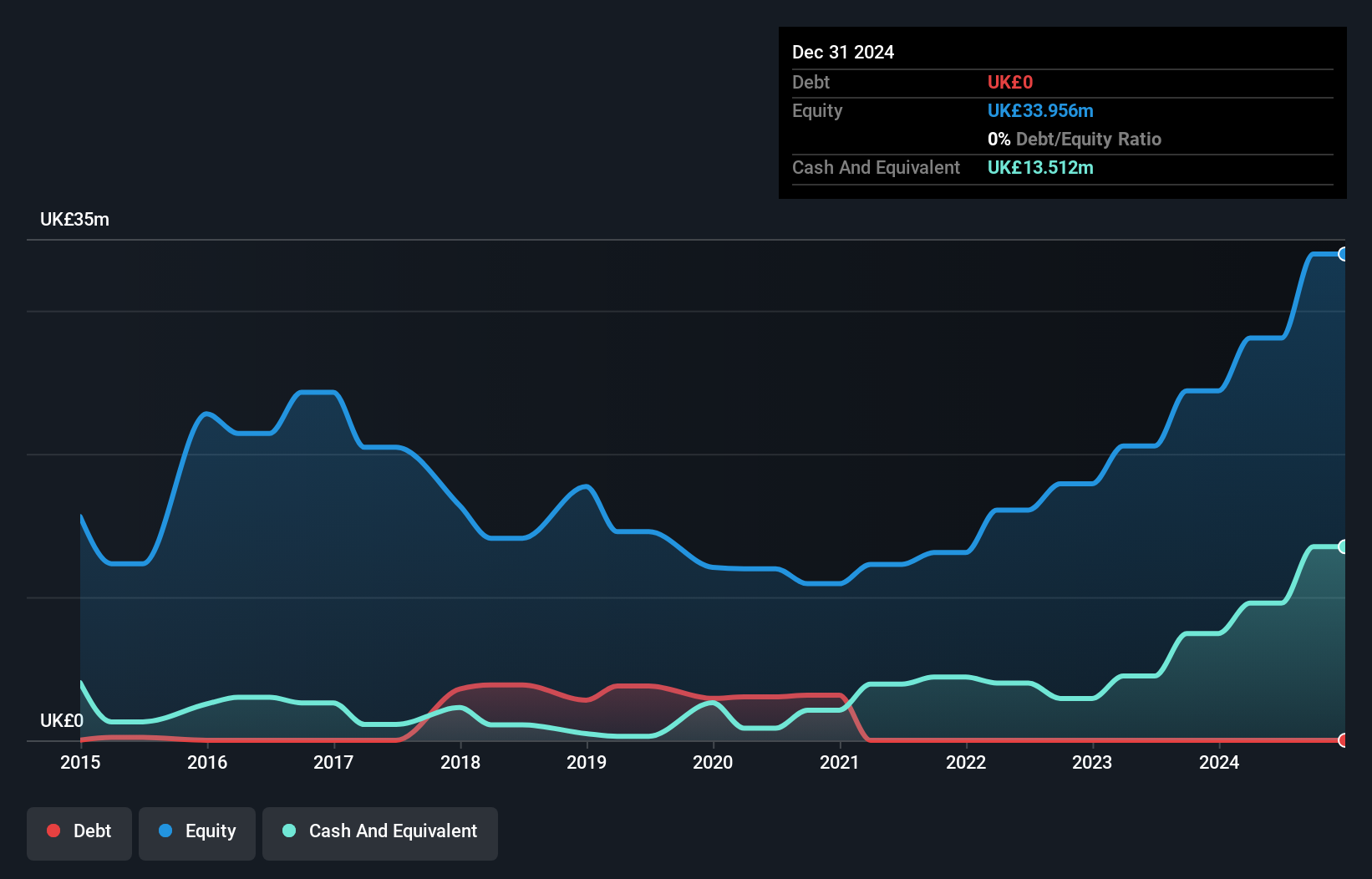

Gaming Realms plc exhibits financial strength with short-term assets of £20.3 million surpassing its liabilities, and it remains debt-free, highlighting prudent fiscal management. The company has shown substantial earnings growth over the past five years, averaging 68.7% annually, though recent growth at 49.2% aligns with industry trends. Its net profit margin improved to 31.1%, reflecting operational efficiency and profitability enhancement. Analysts anticipate a stock price increase of 38.2%. Recent initiatives include a share buyback program authorized to repurchase up to 10% of its issued capital, potentially enhancing shareholder value by reducing outstanding shares or holding them as treasury stock.

- Navigate through the intricacies of Gaming Realms with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Gaming Realms' future.

NCC Group (LSE:NCC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market capitalization of approximately £449.49 million.

Operations: NCC Group's revenue is primarily derived from its Cyber Security segment, which accounts for £256.58 million, and its Escode segment, contributing £65.55 million.

Market Cap: £449.49M

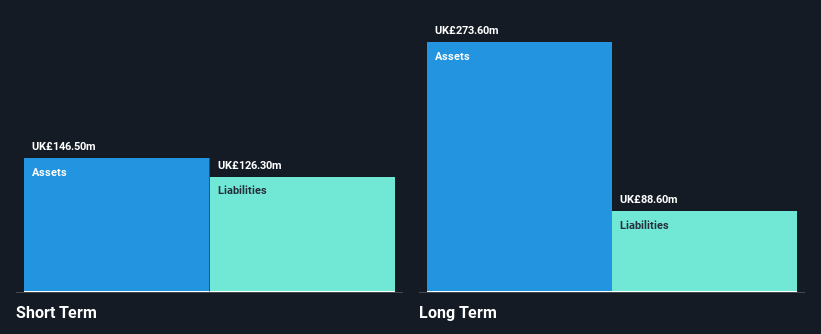

NCC Group plc, with a market cap of £449.49 million, operates primarily in the Cyber Security sector, generating significant revenue from this segment. Despite being currently unprofitable and having increased losses over the past five years, NCC's short-term assets comfortably cover both its short and long-term liabilities. The company's net debt to equity ratio is satisfactory at 22.1%, though interest coverage by EBIT is below ideal levels. Recent developments include exploring strategic alternatives for its Escode division and securing a new £120 million revolving credit facility to strengthen financial flexibility amidst ongoing business adjustments.

- Get an in-depth perspective on NCC Group's performance by reading our balance sheet health report here.

- Gain insights into NCC Group's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Discover the full array of 396 UK Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GMR

Gaming Realms

Develops, publishes, and licenses mobile gaming content in the United Kingdom, the United States, Isle of Man, Malta, Gibraltar, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives