- United Kingdom

- /

- Insurance

- /

- LSE:CRE

Discover 3 UK Penny Stocks Under £400M Market Cap

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, impacting companies tied to commodity imports. Amidst these broader market challenges, investors often seek opportunities in smaller or newer companies that can offer growth potential despite their size. Penny stocks, though an older term, remain a relevant investment area for those interested in exploring firms with solid financial foundations and the potential for long-term gains.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.49 | £12.31M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.525 | £516.29M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.775 | £143.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.96 | £14.49M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.655 | $380.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.80 | £72.81M | ✅ 4 ⚠️ 3 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.26 | £60.86M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.075 | £171.57M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

everplay group (AIM:EVPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Everplay Group PLC, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the United Kingdom, with a market cap of £499.97 million.

Operations: The company's revenue is generated from its segment focused on developing and publishing games and apps, amounting to £158.33 million.

Market Cap: £499.97M

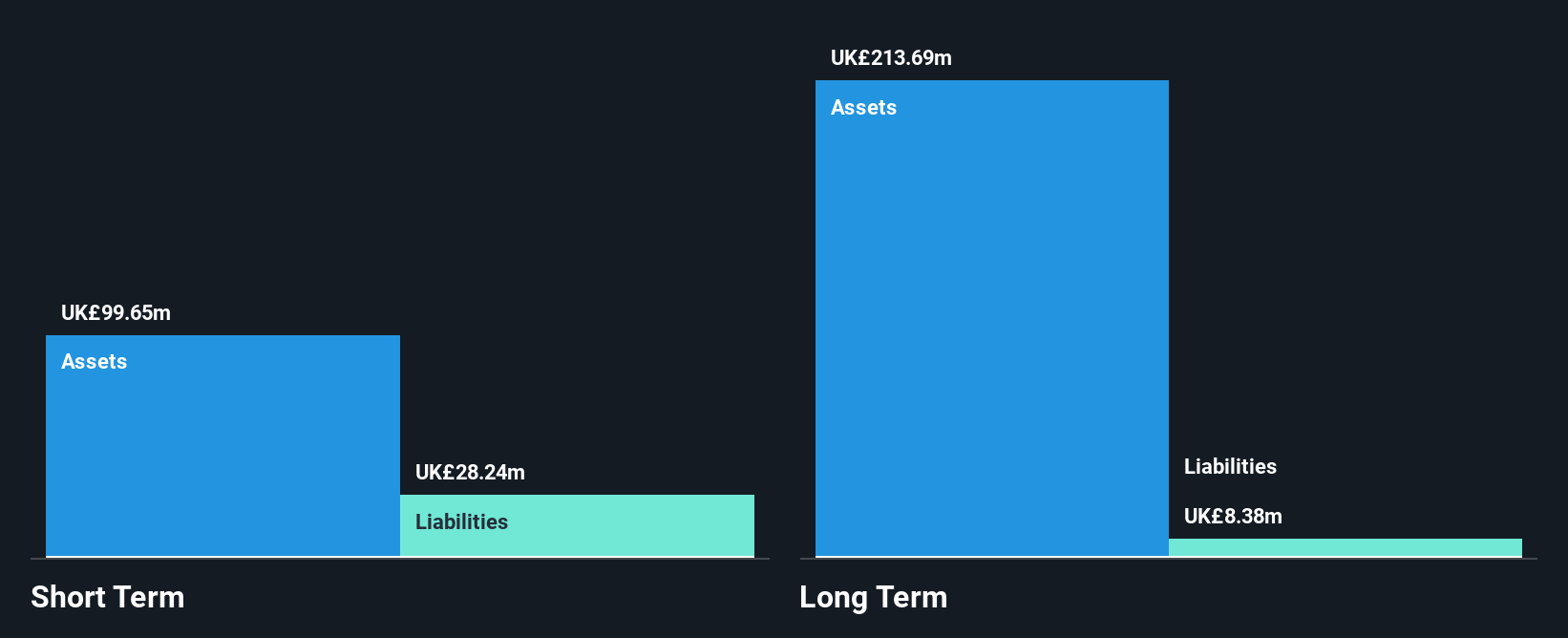

Everplay Group PLC, with a market cap of £499.97 million, has recently appointed Mikkel Weider as CEO starting January 2026, bringing significant industry experience. The company reported sales of £72.36 million for the half-year ending June 2025, down from the previous year but saw an increase in net income to £10.63 million. Everplay is debt-free and its short-term assets exceed liabilities significantly, indicating financial stability despite a large one-off loss impacting recent results. The board's average tenure is low at 2.3 years, suggesting recent changes in leadership structure as it seeks strategic acquisitions to drive growth.

- Dive into the specifics of everplay group here with our thorough balance sheet health report.

- Examine everplay group's earnings growth report to understand how analysts expect it to perform.

Conduit Holdings (LSE:CRE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Conduit Holdings Limited, with a market cap of £526.93 million, operates through its subsidiary to offer reinsurance products and services globally.

Operations: The company generates revenue through three primary segments: Casualty ($184.7 million), Property ($343.4 million), and Specialty ($166.6 million).

Market Cap: £526.93M

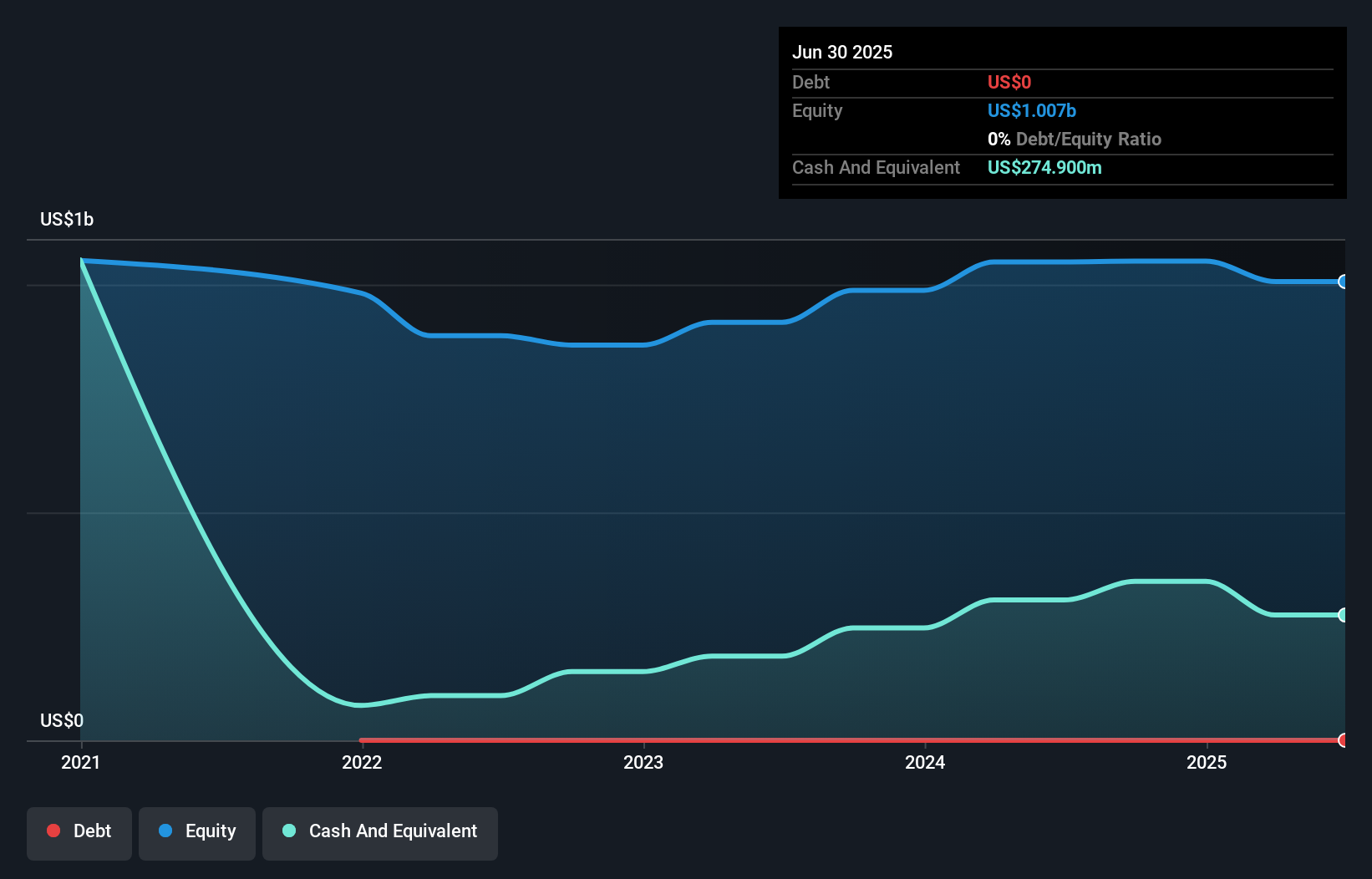

Conduit Holdings Limited, with a market cap of £526.93 million, operates without debt, which eliminates concerns over interest coverage. However, its short-term assets of US$376.5 million fall short of covering liabilities totaling US$1.1 billion, raising liquidity concerns despite having no long-term debt issues. Recent leadership changes include the appointment of Nicholas Shott and Stephen Postlewhite to strengthen governance and underwriting strategy respectively. The company's return on equity is low at 1.4%, and profit margins have declined significantly from 30.2% last year to 1.7%. Despite these challenges, earnings are forecasted to grow annually by 27%.

- Click to explore a detailed breakdown of our findings in Conduit Holdings' financial health report.

- Explore Conduit Holdings' analyst forecasts in our growth report.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, with a market cap of £559.92 million, operates globally by manufacturing components, technology systems, and precision parts.

Operations: The company generates revenue from various segments, including North America (excl. Subsea Technologies) at $384.7 million, Asia Pacific at $316.6 million, Hunting Titan at $212.9 million, Subsea Technologies at $127.4 million, and Europe, Middle East and Africa (EMEA) at $80.4 million.

Market Cap: £559.92M

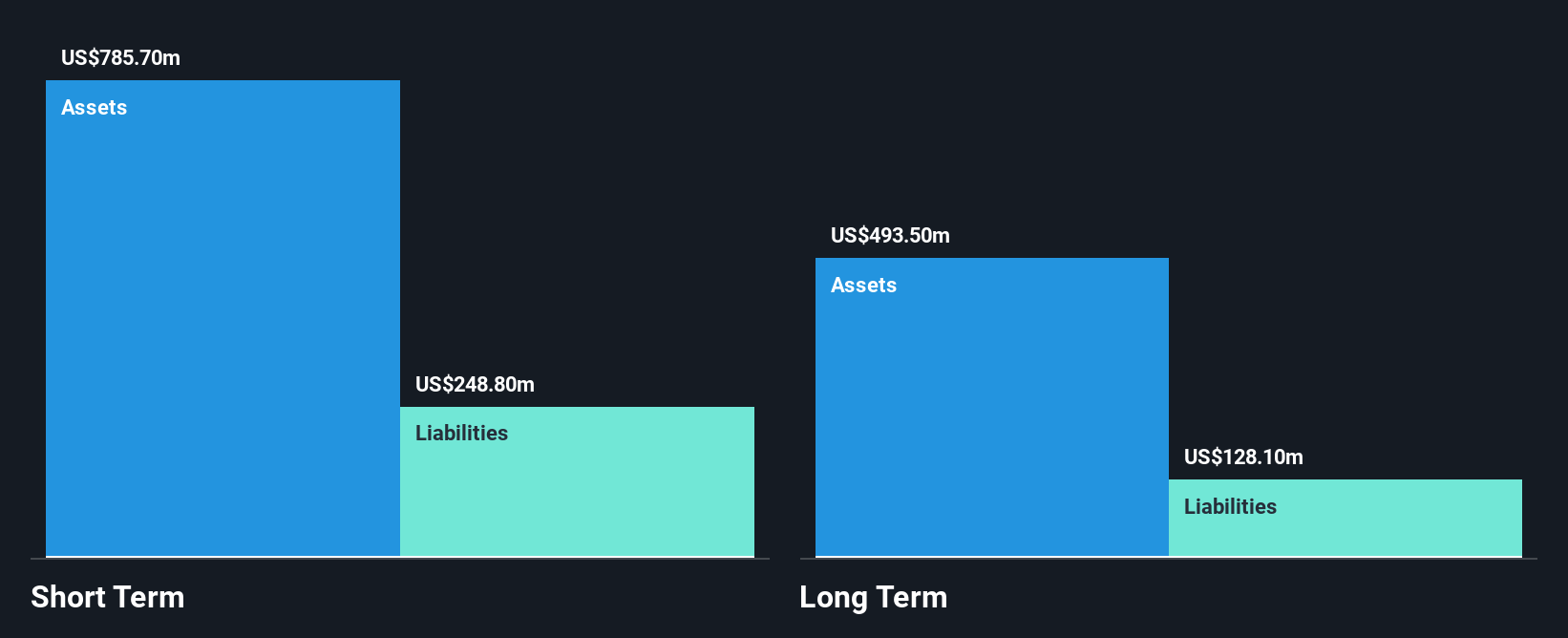

Hunting PLC, with a market cap of £559.92 million, is navigating financial challenges as it remains unprofitable. Despite this, the company has reduced its losses significantly over the past five years and maintains a strong cash position with short-term assets exceeding both short-term and long-term liabilities. The management team is experienced, averaging 10.4 years in tenure, which supports strategic initiatives like acquisitions funded by $336.5 million in liquidity. Although its debt to equity ratio has risen over five years, Hunting's positive free cash flow provides a runway for over three years while pursuing growth through share repurchases and dividends increases.

- Unlock comprehensive insights into our analysis of Hunting stock in this financial health report.

- Assess Hunting's future earnings estimates with our detailed growth reports.

Where To Now?

- Click this link to deep-dive into the 301 companies within our UK Penny Stocks screener.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRE

Conduit Holdings

Through its subsidiary, provides reinsurance products and services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success