- United Kingdom

- /

- Metals and Mining

- /

- AIM:KOD

Discover UK Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting global economic pressures. Despite these broader market concerns, certain investment opportunities continue to stand out. Penny stocks, often representing smaller or newer companies, can offer a blend of affordability and potential growth when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £154.59M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £804.39M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.19 | £101.67M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.27 | £424.68M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.455 | $264.5M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.14 | £86.34M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Audioboom Group (AIM:BOOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Audioboom Group plc is a podcast company that operates a spoken-word audio platform for hosting, distributing, and monetizing content primarily in the United Kingdom and the United States, with a market cap of £57.32 million.

Operations: The company generates $67.34 million in revenue from its Internet Software & Services segment.

Market Cap: £57.32M

Audioboom Group, with a market cap of £57.32 million, operates in the podcast industry and is generating US$67.34 million in revenue. The company has provided optimistic revenue guidance for 2024 and 2025, expecting to reach at least US$73 million this year with significantly higher adjusted EBITDA profit than initially forecasted. Despite being unprofitable with a negative return on equity and increased losses over the past five years, Audioboom benefits from a seasoned management team and board, no debt liabilities, stable weekly volatility compared to peers, and sufficient cash runway exceeding one year based on current free cash flow.

- Unlock comprehensive insights into our analysis of Audioboom Group stock in this financial health report.

- Explore Audioboom Group's analyst forecasts in our growth report.

Chapel Down Group (AIM:CDGP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Chapel Down Group Plc, with a market cap of £63.46 million, operates through its subsidiaries in the production and sale of alcoholic beverages both in the United Kingdom and internationally.

Operations: The company generates £16.28 million in revenue from its production and sale of alcoholic beverages segment.

Market Cap: £63.46M

Chapel Down Group, with a market cap of £63.46 million, is navigating challenges as it remains unprofitable despite revenue of £16.28 million from its alcoholic beverages segment. The company has experienced shareholder dilution and increased debt levels over the past five years but maintains satisfactory net debt to equity ratio and strong interest coverage by EBIT. Recent executive changes include appointing James Pennefather as CEO, bringing extensive industry experience. Chapel Down's strategic review concluded no superior transactions were available, affirming its standalone path while leveraging its significant distribution network and vineyard assets in the growing English wine market.

- Dive into the specifics of Chapel Down Group here with our thorough balance sheet health report.

- Examine Chapel Down Group's earnings growth report to understand how analysts expect it to perform.

Kodal Minerals (AIM:KOD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kodal Minerals PLC, with a market cap of £69.85 million, is involved in the exploration and evaluation of mineral resources in the United Kingdom and West Africa.

Operations: Kodal Minerals PLC currently does not report any revenue segments.

Market Cap: £69.85M

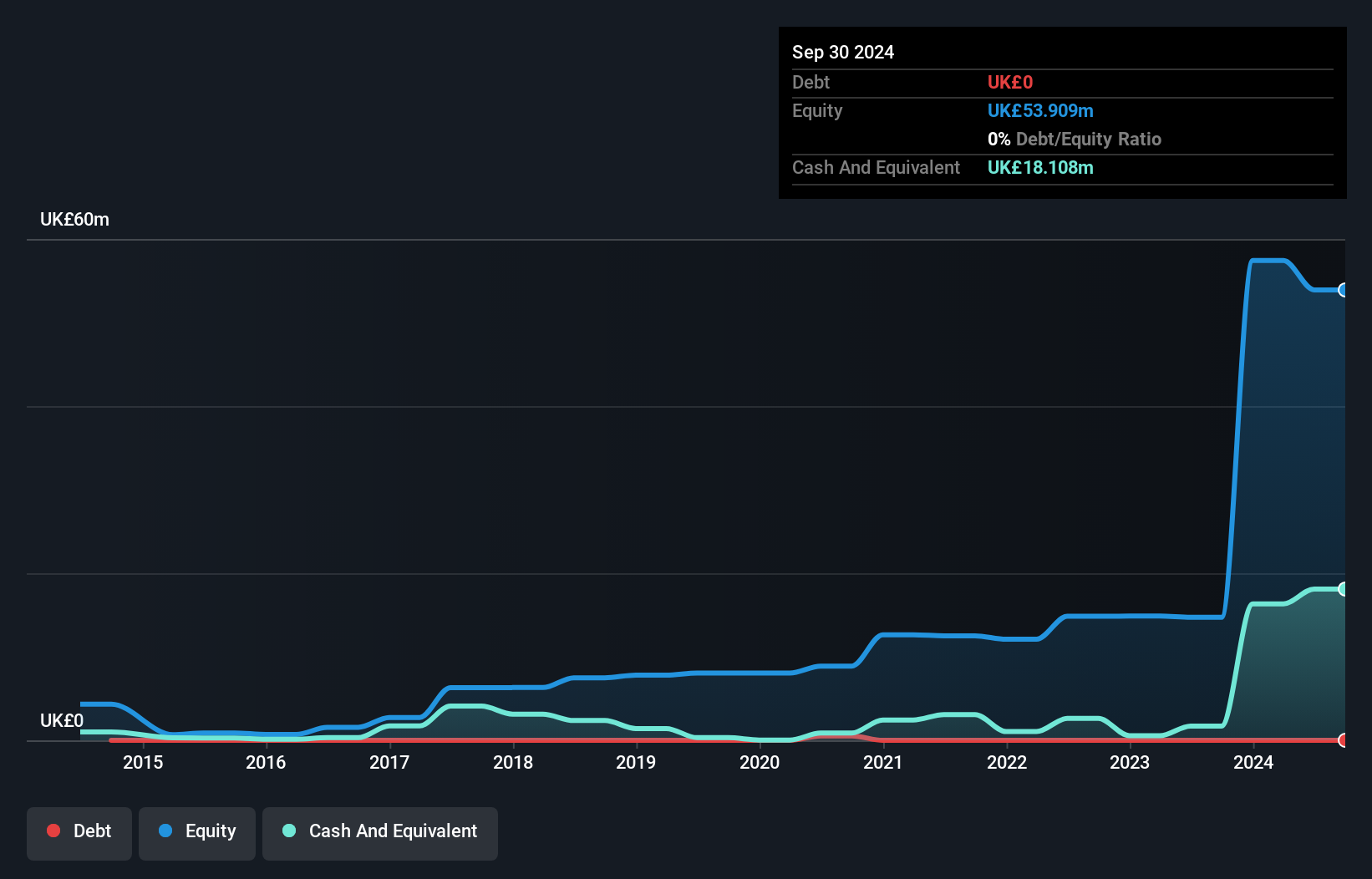

Kodal Minerals, with a market cap of £69.85 million, is pre-revenue and focuses on mineral exploration in the UK and West Africa. The company has no debt and boasts strong short-term asset coverage over liabilities. Its recent profitability marks a significant milestone, yet earnings are forecast to decline significantly over the next three years. Kodal's Bougouni Lithium Project in Mali is advancing well, with construction of processing facilities underway despite minor delays due to weather and logistics issues. The project remains fully funded through a substantial investment partnership, positioning it for potential future revenue generation upon completion.

- Jump into the full analysis health report here for a deeper understanding of Kodal Minerals.

- Gain insights into Kodal Minerals' outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Gain an insight into the universe of 469 UK Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodal Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KOD

Kodal Minerals

Engages in the exploration and evaluation of mineral resources in the United Kingdom and West Africa.

Flawless balance sheet moderate.

Market Insights

Community Narratives