Investors Who Bought Brave Bison Group (LON:BBSN) Shares Five Years Ago Are Now Down 90%

While it may not be enough for some shareholders, we think it is good to see the Brave Bison Group plc (LON:BBSN) share price up 18% in a single quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 90% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Brave Bison Group

Given that Brave Bison Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

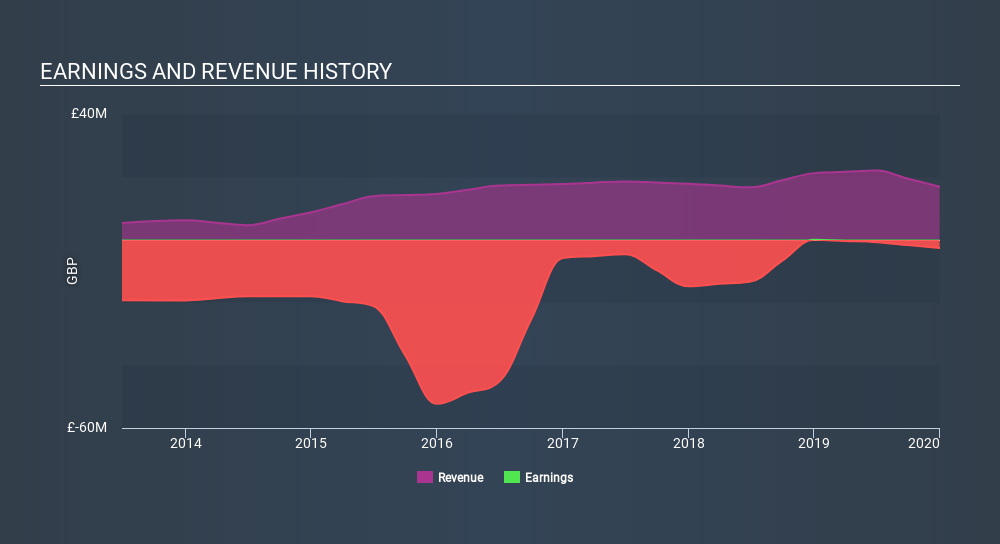

Over five years, Brave Bison Group grew its revenue at 9.9% per year. That's a fairly respectable growth rate. So the stock price fall of 37% per year seems pretty steep. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Brave Bison Group's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Brave Bison Group shareholders are down 13% for the year. Unfortunately, that's worse than the broader market decline of 10%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. However, the loss over the last year isn't as bad as the 37% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Brave Bison Group better, we need to consider many other factors. For instance, we've identified 2 warning signs for Brave Bison Group that you should be aware of.

Of course Brave Bison Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About AIM:BBSN

Brave Bison Group

Provides digital advertising and technology services in the United Kingdom, Europe, the Asia-Pacific, and internationally.

Outstanding track record with excellent balance sheet.