- United Kingdom

- /

- Metals and Mining

- /

- AIM:SRB

3 UK Penny Stocks With Market Caps Over £60M To Consider

Reviewed by Simply Wall St

The UK market recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weaker trade data from China, highlighting global economic uncertainties. In such a climate, investors often look for opportunities in smaller companies that can offer potential growth and value. Penny stocks, though an older term, still represent a viable investment area for those interested in exploring smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.195 | £827M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £68.92M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.555 | £181.33M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.465 | £361.6M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.275 | £72.73M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.2325 | £105.22M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.393 | $228.46M | ★★★★★★ |

Click here to see the full list of 462 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Serabi Gold (AIM:SRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Serabi Gold plc is involved in the evaluation, exploration, and development of gold and other metals mining projects in Brazil with a market cap of £68.92 million.

Operations: The company's revenue is primarily derived from its gold mining and exploration activities, totaling $75.85 million.

Market Cap: £68.92M

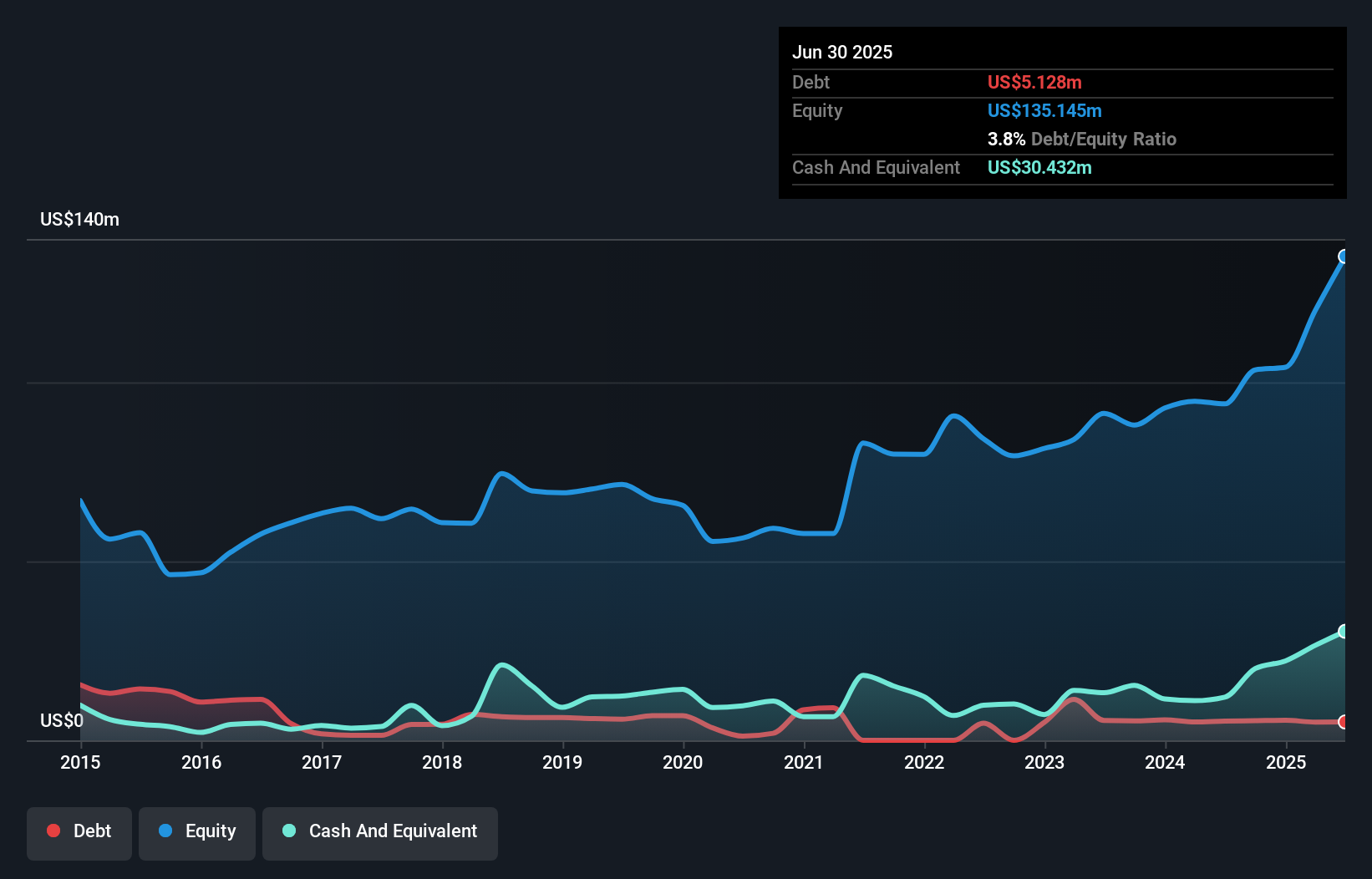

Serabi Gold plc, with a market cap of £68.92 million, has demonstrated significant growth in profitability and revenue, reporting US$75.85 million in sales for the recent period. The company’s earnings have surged by a very large margin over the past year, significantly outpacing industry averages. Its financial health is supported by short-term assets exceeding both short and long-term liabilities and having more cash than total debt. Recent operational updates highlight increased gold production and ongoing exploration efforts at its Brazilian sites, suggesting potential for continued output growth despite recent share price volatility.

- Navigate through the intricacies of Serabi Gold with our comprehensive balance sheet health report here.

- Assess Serabi Gold's future earnings estimates with our detailed growth reports.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the UK, Ireland, and several Nordic countries, with a market cap of approximately £859.21 million.

Operations: The company generates revenue from two main geographical segments: £3.51 billion from the Nordics and £5.02 billion from the UK & Ireland.

Market Cap: £859.21M

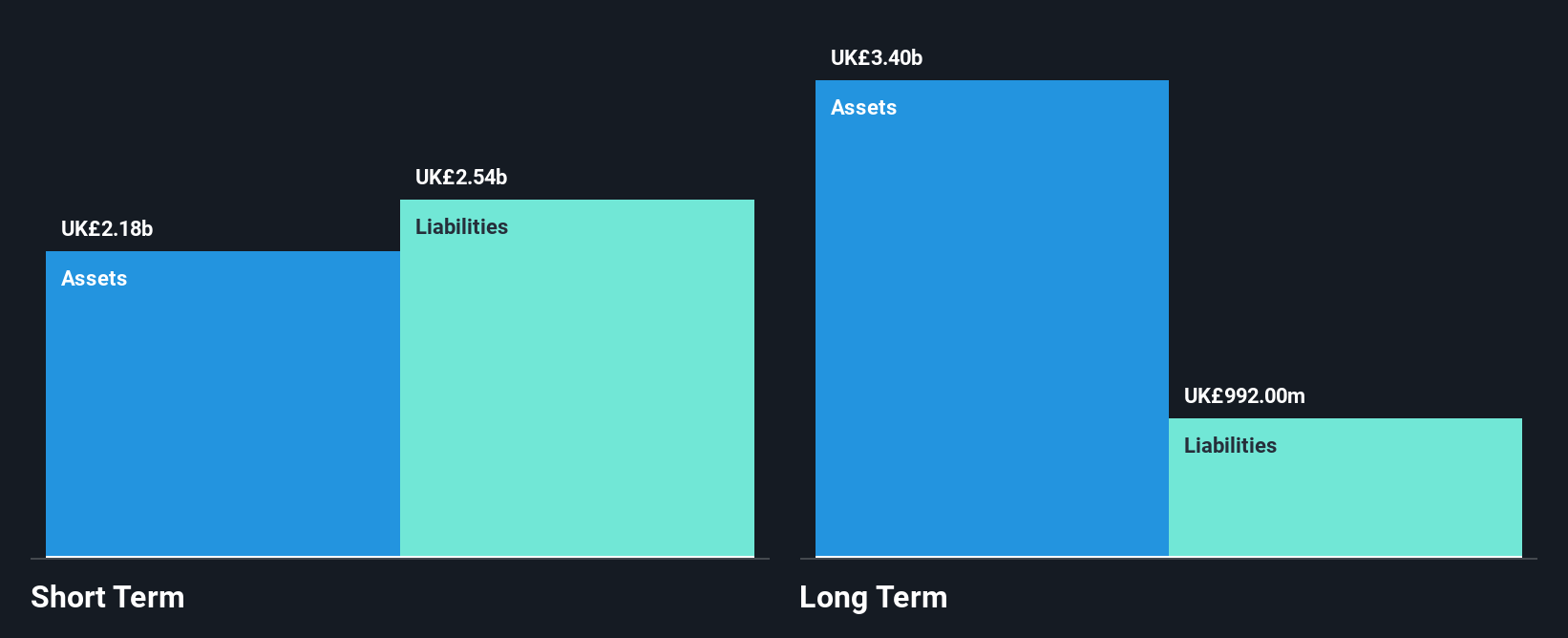

Currys plc, with a market cap of £859.21 million, is navigating the penny stock landscape with both opportunities and challenges. The company has achieved profitability recently but struggles with covering short-term liabilities (£2.1 billion) against assets (£1.8 billion). Despite a low Return on Equity (1.3%), Currys' debt is well covered by operating cash flow, indicating financial resilience. Recent partnerships, such as those with MANSCAPED and LTIMindtree, highlight efforts to enhance retail offerings and digital infrastructure through Salesforce integration, aiming for improved customer experience and operational efficiency amidst evolving market dynamics.

- Unlock comprehensive insights into our analysis of Currys stock in this financial health report.

- Evaluate Currys' prospects by accessing our earnings growth report.

SulNOx Group (OFEX:SNOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SulNOx Group PLC develops and manufactures fuel conditioners and emulsifiers aimed at decarbonizing liquid hydrocarbon fuels globally, with a market cap of £61.38 million.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to £0.54 million.

Market Cap: £61.38M

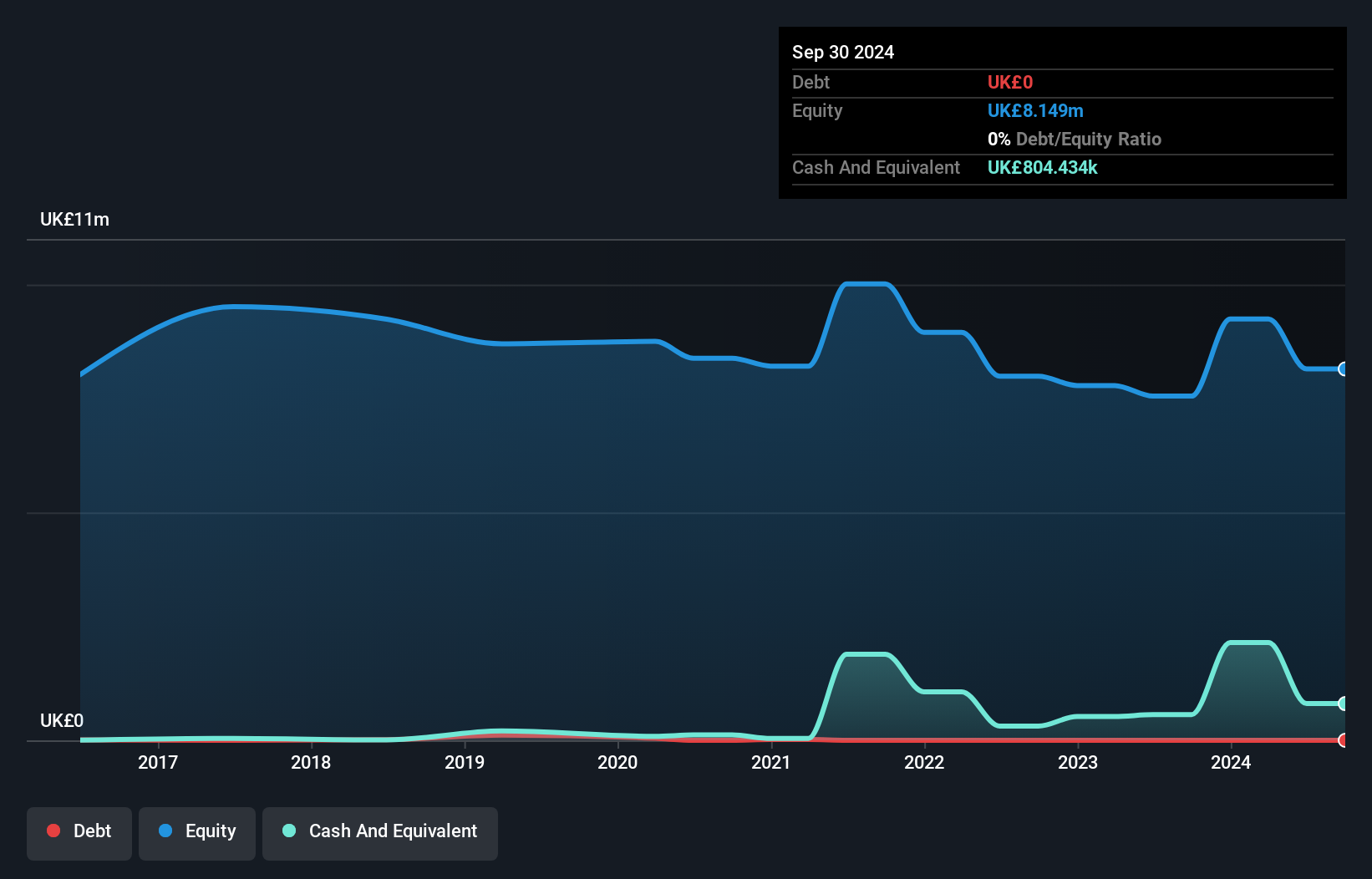

SulNOx Group PLC, with a market cap of £61.38 million, is navigating its pre-revenue stage in the penny stock arena by focusing on innovative fuel conditioners and emulsifiers aimed at decarbonization. Despite reporting sales of £0.54 million and experiencing dilution with shares growing by 7.4%, the company remains unprofitable with a net loss of £1.86 million for the year ended March 31, 2024. Recent developments include a collaboration with Peninsula Yacht Services to implement an APEX-compliant fuel conditioning system in Gibraltar, showcasing potential for future growth despite current financial volatility and challenges in profitability.

- Click to explore a detailed breakdown of our findings in SulNOx Group's financial health report.

- Learn about SulNOx Group's historical performance here.

Make It Happen

- Unlock more gems! Our UK Penny Stocks screener has unearthed 459 more companies for you to explore.Click here to unveil our expertly curated list of 462 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SRB

Serabi Gold

Engages in the evaluation, exploration, and development of gold and other metals mining projects in Brazil.

Flawless balance sheet and undervalued.