- United Kingdom

- /

- Metals and Mining

- /

- OFEX:ORM

UK Exchange Highlights: Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The UK stock market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices both closing lower recently due to weak trade data from China. Despite these broader market challenges, penny stocks continue to capture investor interest as they offer unique opportunities for growth, particularly when backed by strong financials. Though often associated with smaller or newer companies, these stocks can provide a blend of affordability and potential upside that larger firms might not offer.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.99 | £321.93M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £476.68M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.27 | £855.37M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.975 | £13.27M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.74 | £90.4M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.31 | £329.2M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.708 | £2.06B | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

SpaceandPeople (AIM:SAL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SpaceandPeople plc markets and sells promotional and retail licensing space for shopping centers, retail parks, railway stations, and other venues in the UK and Germany, with a market cap of £1.81 million.

Operations: The company's revenue is derived from three segments: £0.574 million from UK retail, £4.002 million from UK promotions, and £2.02 million from German retail activities.

Market Cap: £1.81M

SpaceandPeople, with a market cap of £1.81 million, has demonstrated a strong sales performance, reporting unaudited 2024 revenue of approximately £6.8 million, surpassing market expectations. The company became profitable recently and maintains high-quality earnings supported by operating cash flow that covers its debt well. However, short-term liabilities exceed short-term assets (£5.1M vs £2.7M), which could be a concern for liquidity management. Despite this, the company's strategic investments in staff to secure contracts and drive growth align profitability with market expectations and suggest a focus on long-term expansion within the UK and Germany markets.

- Navigate through the intricacies of SpaceandPeople with our comprehensive balance sheet health report here.

- Learn about SpaceandPeople's historical performance here.

Tialis Essential IT (AIM:TIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tialis Essential IT PLC, with a market cap of £7.91 million, offers network, cloud, and IT managed services to public and private companies in the United Kingdom through its subsidiaries.

Operations: The company generates revenue primarily from its Manage Business segment, which accounts for £21.56 million.

Market Cap: £7.91M

Tialis Essential IT PLC, with a market cap of £7.91 million, is navigating the penny stock landscape by securing significant contract extensions worth £17.8 million, including multi-year agreements that bolster its revenue outlook for 2025. The company remains unprofitable but has reduced losses over five years and maintains a positive cash flow with a runway exceeding three years. Despite high volatility and short-term liabilities surpassing assets (£8M vs £5M), Tialis's debt-to-equity ratio has improved to 71.2%, indicating better financial management. However, challenges persist with negative return on equity and an inexperienced board impacting stability prospects.

- Jump into the full analysis health report here for a deeper understanding of Tialis Essential IT.

- Assess Tialis Essential IT's previous results with our detailed historical performance reports.

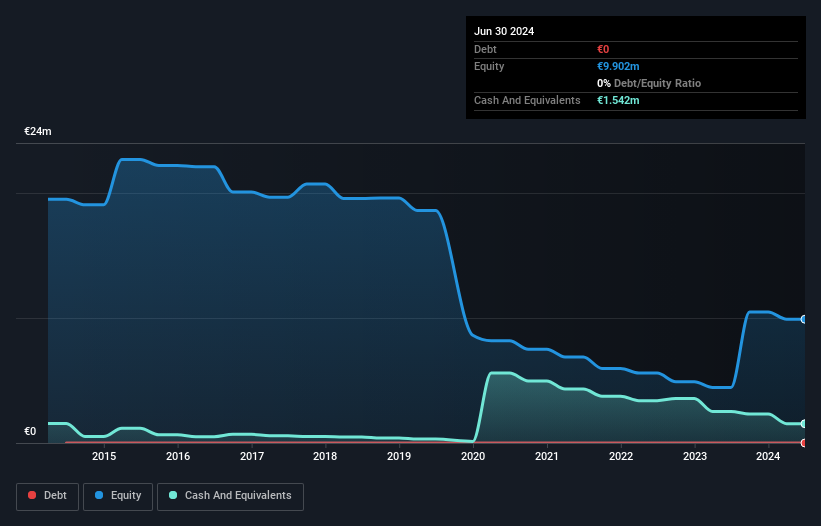

Ormonde Mining (OFEX:ORM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ormonde Mining plc is a natural resource company focused on the exploration and development of mineral resource projects in Ireland, Canada, Spain, and the United Kingdom, with a market cap of £803,262.

Operations: Currently, there are no reported revenue segments for this natural resource company engaged in mineral exploration and development across Ireland, Canada, Spain, and the United Kingdom.

Market Cap: £803.26k

Ormonde Mining plc, with a market cap of £803,262, operates as a pre-revenue entity in the natural resources sector across several countries. Recently becoming profitable, the company has no debt and maintains sufficient short-term assets (€2.1M) to cover its liabilities (€203.0K). Despite its low return on equity (2.3%) and high non-cash earnings, Ormonde's price-to-earnings ratio (4.2x) remains attractive compared to the broader UK market average of 16.1x. The board is experienced with an average tenure of 3.4 years; however, share price volatility remains high over recent months.

- Unlock comprehensive insights into our analysis of Ormonde Mining stock in this financial health report.

- Gain insights into Ormonde Mining's historical outcomes by reviewing our past performance report.

Next Steps

- Unlock more gems! Our UK Penny Stocks screener has unearthed 442 more companies for you to explore.Click here to unveil our expertly curated list of 445 UK Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:ORM

Ormonde Mining

A natural resource company, engages in the exploration and development of mineral resource projects in Ireland, Canada, Spain, and the United Kingdom.

Flawless balance sheet slight.

Market Insights

Community Narratives