- United Kingdom

- /

- Chemicals

- /

- LSE:ZTF

Results: Zotefoams plc Beat Earnings Expectations And Analysts Now Have New Forecasts

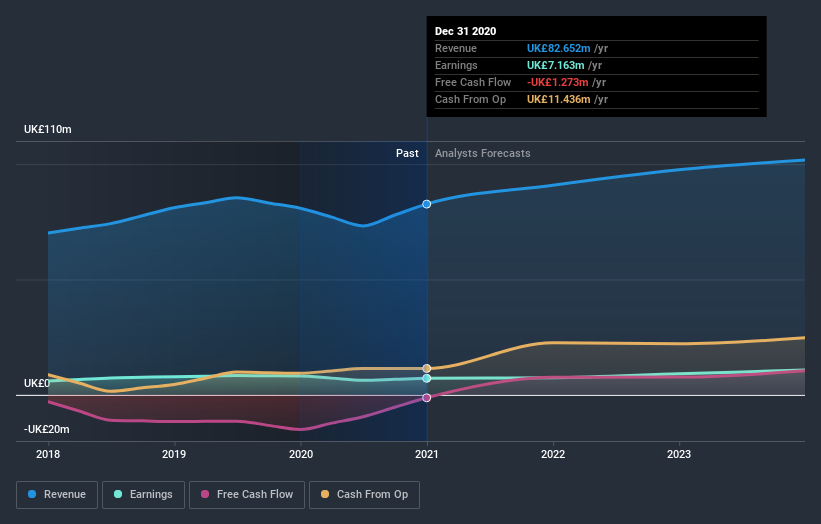

As you might know, Zotefoams plc (LON:ZTF) recently reported its full-year numbers. It looks like a credible result overall - although revenues of UK£83m were in line with what the analysts predicted, Zotefoams surprised by delivering a statutory profit of UK£0.15 per share, a notable 10% above expectations. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Zotefoams

Following the latest results, Zotefoams' three analysts are now forecasting revenues of UK£90.8m in 2021. This would be a decent 9.9% improvement in sales compared to the last 12 months. Statutory per-share earnings are expected to be UK£0.15, roughly flat on the last 12 months. Before this earnings report, the analysts had been forecasting revenues of UK£88.2m and earnings per share (EPS) of UK£0.16 in 2021. Overall it looks as though the analysts were a bit mixed on the latest results. Although there was a a decent to revenue, the consensus also made a small dip in its earnings per share forecasts.

The consensus price target was unchanged at UK£4.80, suggesting the business is performing roughly in line with expectations, despite some adjustments to profit and revenue forecasts. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Zotefoams, with the most bullish analyst valuing it at UK£5.00 and the most bearish at UK£4.60 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Zotefoams is an easy business to forecast or the the analysts are all using similar assumptions.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The period to the end of 2021 brings more of the same, according to the analysts, with revenue forecast to display 9.9% growth on an annualised basis. That is in line with its 8.9% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 4.9% annually. So although Zotefoams is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Zotefoams. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target held steady at UK£4.80, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Zotefoams analysts - going out to 2023, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Zotefoams you should be aware of.

If you decide to trade Zotefoams, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zotefoams might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:ZTF

Zotefoams

Manufactures, distributes, and sells polyolefin block foams in the United Kingdom, rest of Europe, North America, and internationally.

Excellent balance sheet and good value.