- United Kingdom

- /

- Chemicals

- /

- LSE:TET

UK Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China and its impact on global economic recovery. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to navigate uncertain market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.07% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 5.72% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.93% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.74% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.18% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.71% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.27% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.61% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.27% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.38% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

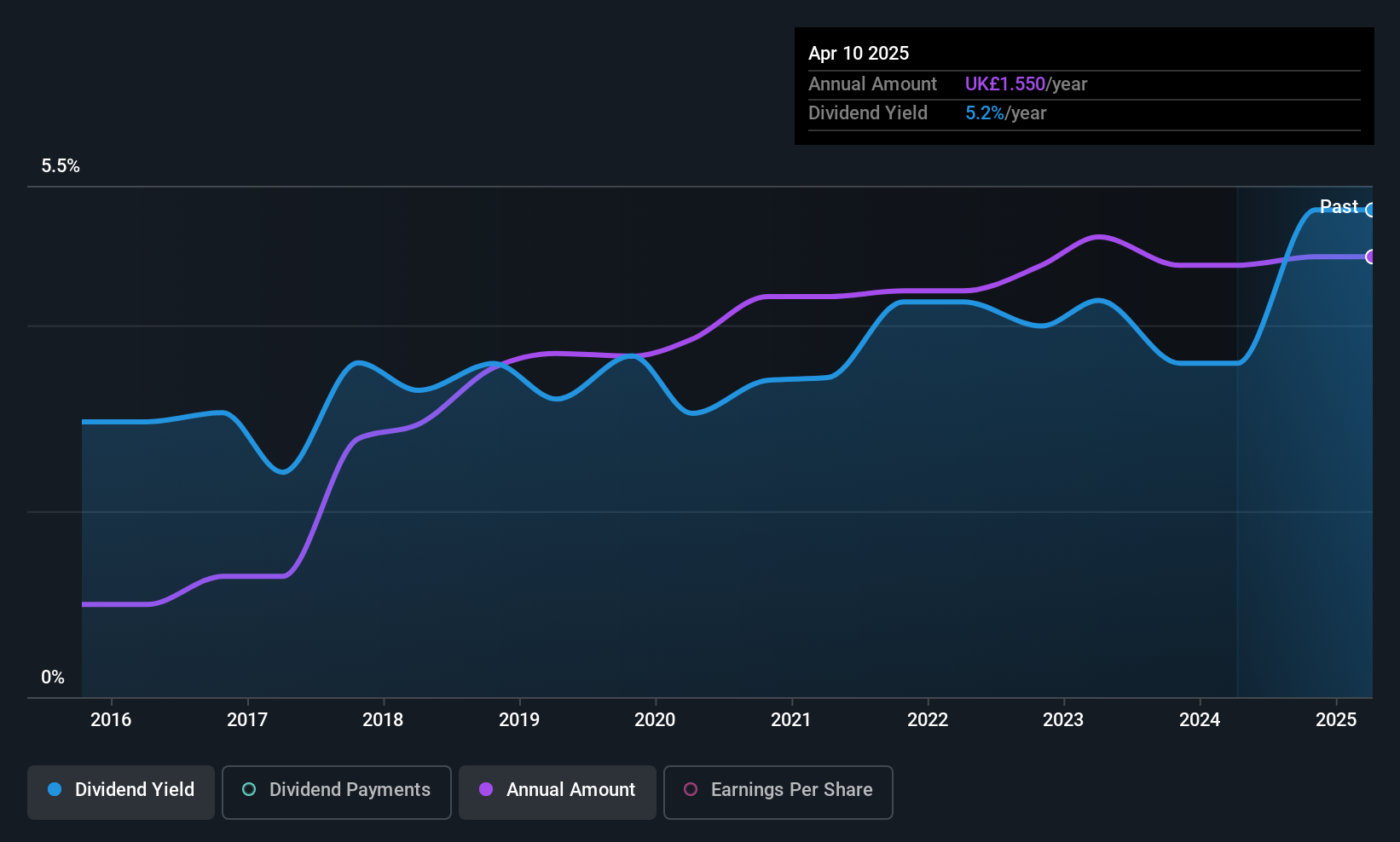

Bioventix (AIM:BVXP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bioventix PLC develops, produces, and distributes sheep monoclonal antibodies for global diagnostic use, with a market cap of £127.49 million.

Operations: Bioventix PLC generates revenue primarily from its biotechnology segment, amounting to £13.66 million.

Dividend Yield: 6.4%

Bioventix offers a compelling dividend yield of 6.35%, placing it in the top 25% of UK dividend payers, but its sustainability is questionable due to high payout ratios (104.5% earnings, 107.8% cash flow). Despite this, dividends have been stable and growing over the past decade with minimal volatility. Trading at 24.3% below estimated fair value suggests potential upside if financial health improves to better support its generous payouts.

- Navigate through the intricacies of Bioventix with our comprehensive dividend report here.

- Our expertly prepared valuation report Bioventix implies its share price may be lower than expected.

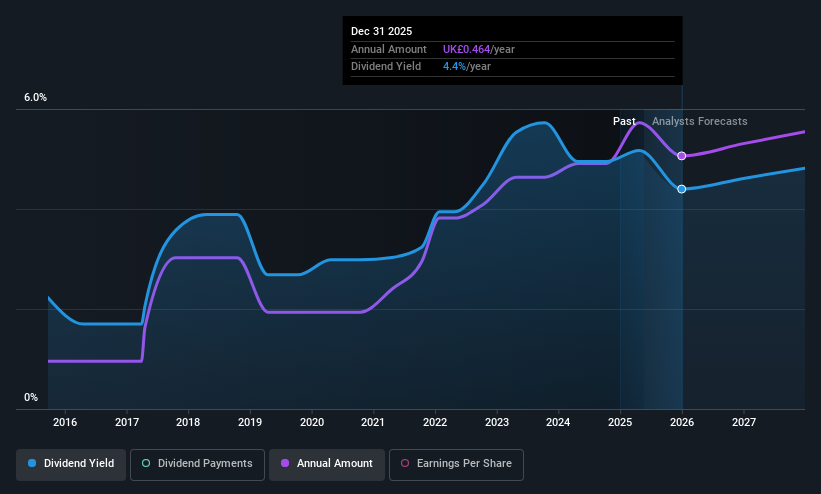

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £701.90 million, operates through its subsidiaries to own and develop oil palm plantations in Indonesia and Malaysia.

Operations: M.P. Evans Group PLC generates revenue primarily from its plantation operations in Indonesia, amounting to $368.49 million.

Dividend Yield: 3.6%

M.P. Evans Group's recent earnings report shows strong financial performance with net income rising to US$48.65 million, supporting its dividend strategy. The company declared an interim dividend of 18 pence per share, covered by a low payout ratio of 35.2% and cash payout ratio of 28%, indicating sustainability despite past volatility in payments. However, the dividend yield of 3.65% is lower than top-tier UK payers, and historical instability may concern some investors seeking reliable income streams.

- Get an in-depth perspective on M.P. Evans Group's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that M.P. Evans Group is priced lower than what may be justified by its financials.

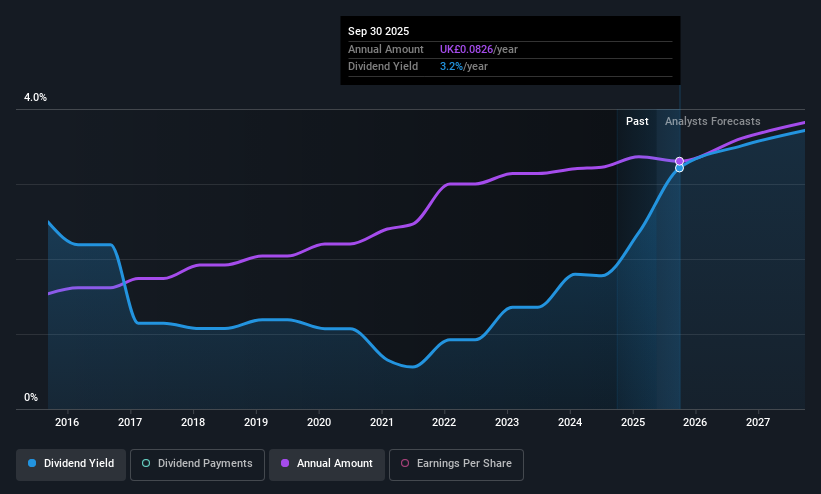

Treatt (LSE:TET)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Treatt plc, along with its subsidiaries, manufactures and supplies a range of natural extracts and ingredients to the beverage, flavor, fragrance, and consumer goods markets, with a market cap of £162.55 million.

Operations: Treatt plc generates revenue of £145.16 million from the manufacture and supply of innovative ingredient solutions.

Dividend Yield: 3.1%

Treatt's dividend payments have been stable and growing over the past decade, supported by a low cash payout ratio of 28.1%, indicating sustainability. However, recent earnings guidance has been lowered due to reduced sales expectations, potentially impacting future dividends. The stock trades at a discount to its estimated fair value but offers a relatively low dividend yield of 3.07% compared to top UK payers. Recent M&A activity with Natara Global Limited may influence Treatt's financial strategy moving forward.

- Click here and access our complete dividend analysis report to understand the dynamics of Treatt.

- Upon reviewing our latest valuation report, Treatt's share price might be too pessimistic.

Taking Advantage

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 44 more companies for you to explore.Click here to unveil our expertly curated list of 47 Top UK Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Treatt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TET

Treatt

Manufactures and supplies various natural extracts and ingredients to beverage, flavor, fragrance, and consumer goods markets.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives