- United Kingdom

- /

- Metals and Mining

- /

- LSE:RIO

Assessing Rio Tinto Shares as Commodity Prices Climb and Copper Expansion News Breaks

Reviewed by Bailey Pemberton

If you are wondering what to make of Rio Tinto Group stock right now, you are definitely not alone. This is a company that has caught the attention of investors once again, following a steady climb in the past month as investors revisit their assumptions about its value and future prospects. Over the last 30 days, Rio Tinto has gained 6.6%, building on a year-to-date return of 4.8%. Its one-year performance sits flat at 0.0%. However, looking over a five-year period, shares are up an impressive 59.2%.

What is behind these movements? Part of the answer lies in renewed demand for commodities and a shifting global appetite for resources, which tends to elevate companies such as Rio Tinto for investors seeking both stability and growth. When you spot a stock with staying power and periodic surges like this, it is natural to wonder whether the market is properly pricing in its potential, or whether risks have been overlooked or exaggerated.

Quantitative measures indicate that Rio Tinto's current valuation looks compelling. The company rates a 5 out of 6 on a value scorecard, meaning it appears undervalued according to five of the six key checks investors use. While valuation can be as much art as science, reviewing specific methods may reveal how persuasive the case is, or point to any hidden risks. Let us break down the different valuation approaches first, and later, I will share a better way to size up what Rio Tinto is truly worth.

Why Rio Tinto Group is lagging behind its peers

Approach 1: Rio Tinto Group Discounted Cash Flow (DCF) Analysis

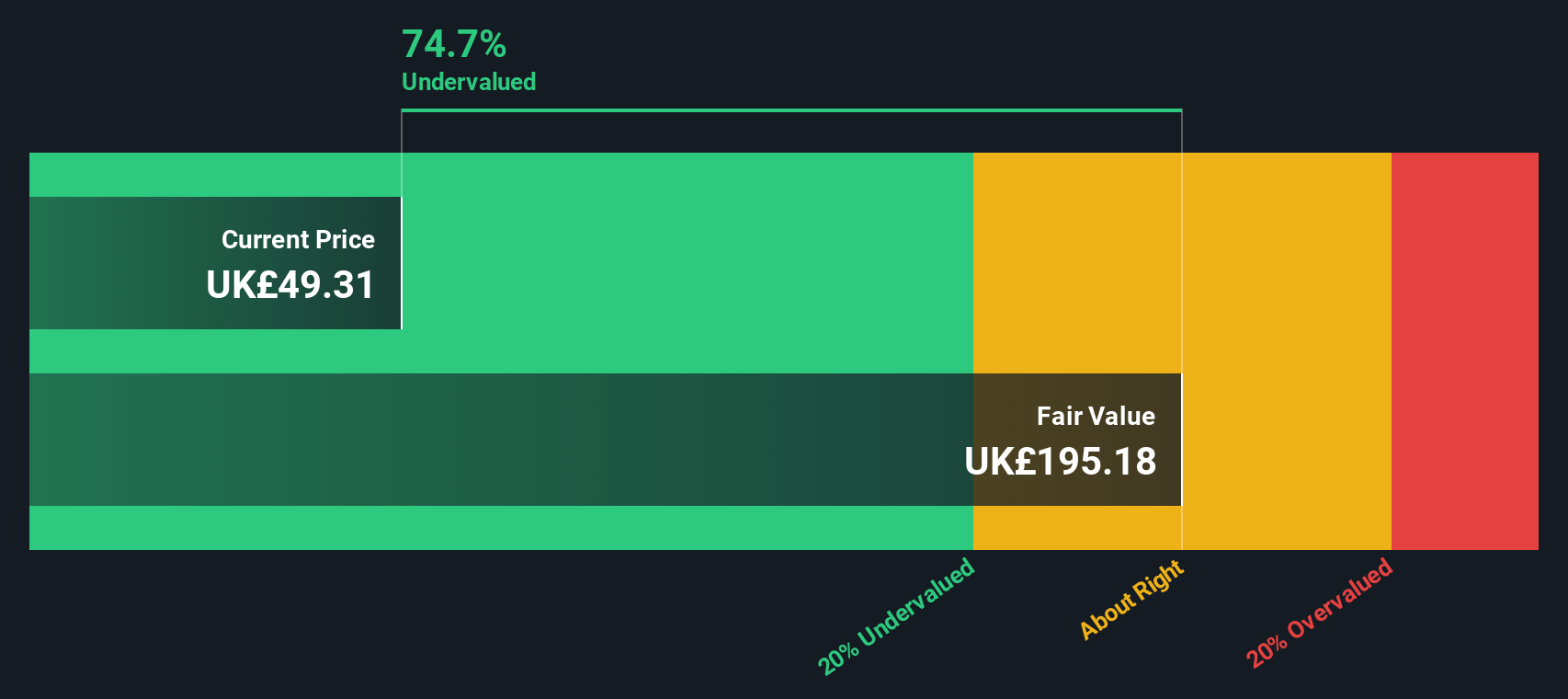

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s value, using current financial performance and expected growth rates. For Rio Tinto Group, the model uses its most recent Free Cash Flow, which stands at $7.08 Billion, as a baseline. Over the next several years, analysts expect cash flows to rise sharply, with projections indicating a leap to $14.60 Billion by 2028. While core analyst coverage provides estimates for the next five years, longer-term forecasts are extended by Simply Wall St’s models, which suggest the possibility of even stronger future growth.

Applying a 2 Stage Free Cash Flow to Equity model, the DCF analysis values Rio Tinto shares at a fair value of $194.27 in comparison to its current market price. This bottom-up approach suggests the stock is trading at a 74.3% discount to its intrinsic value and indicates potential undervaluation.

In summary, the figures suggest a company whose shares may have more upside than the market currently reflects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rio Tinto Group is undervalued by 74.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Rio Tinto Group Price vs Earnings (P/E)

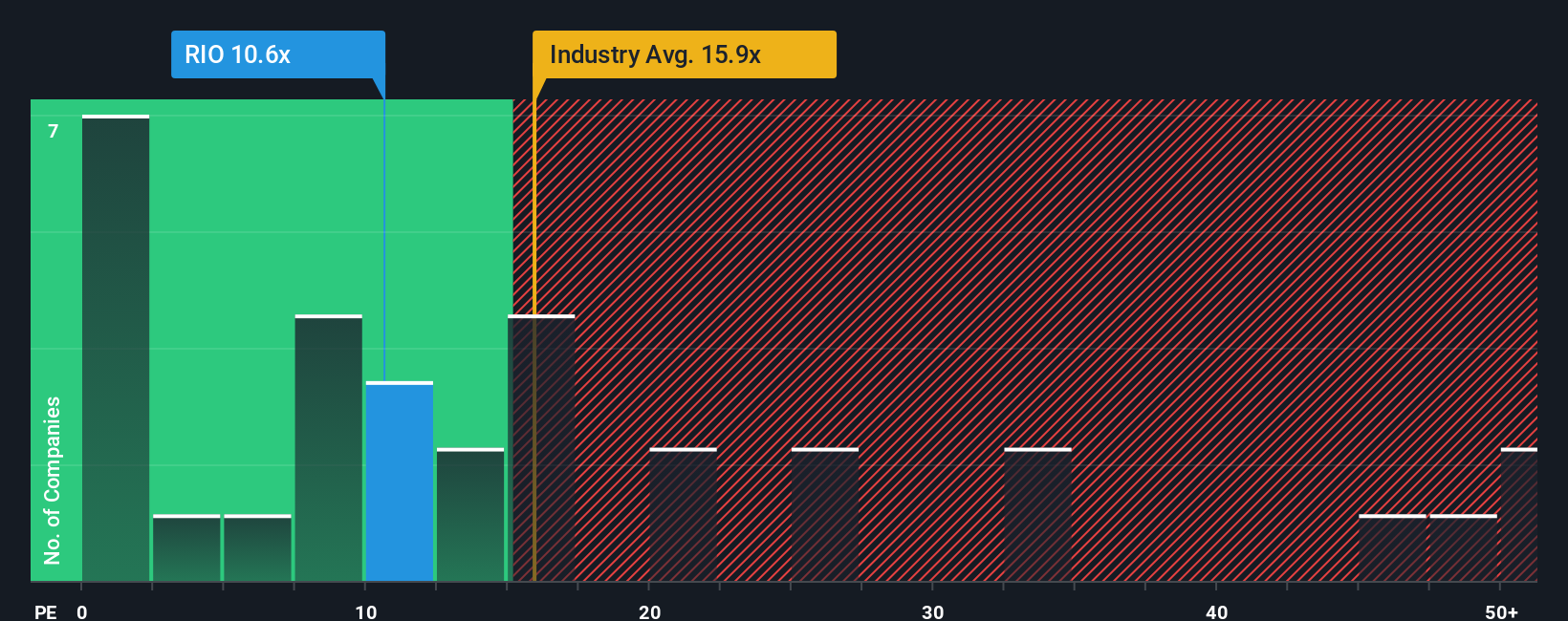

The Price-to-Earnings (P/E) ratio is a widely used valuation metric, especially for profitable companies like Rio Tinto Group. Because Rio Tinto generates consistent earnings, the P/E ratio provides investors with a quick way to gauge how much the market is willing to pay for each pound of those profits. This is particularly helpful for comparing across similar companies in the same sector.

The “right” or fair P/E ratio is influenced by a company’s expected future growth, overall risk profile, size, profit margins, and other industry dynamics. Companies with higher growth prospects or lower risks tend to command a higher P/E, while those facing more uncertainty or slower expansion will usually see lower multiples.

Currently, Rio Tinto trades on a P/E multiple of 10.64x. That is noticeably below both the broader peer average of 36.40x and the metals and mining industry average of 15.18x. While this relative discount might suggest undervaluation, context is key.

This is where the “Fair Ratio,” as calculated by Simply Wall St, comes in. Unlike simple industry or peer comparisons, the Fair Ratio (22.82x for Rio Tinto) tailors its estimate based on the business’s growth, profitability, capital structure, and risks, as well as references to its direct industry and market cap. This approach provides a more personalized and accurate assessment of what multiple the company deserves in today’s market.

With Rio Tinto’s P/E at 10.64x against a Fair Ratio of 22.82x, there appears to be meaningful upside potential based on earnings power alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rio Tinto Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story about a company, combining your view of its future growth and risks with a custom financial forecast and a fair value, making sense of the numbers and linking them to real-world change.

Narratives go beyond static ratios by guiding you to connect what is happening in Rio Tinto Group’s business and industry with how that could impact future earnings or margins, resulting in a dynamic, personalized fair value estimate.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool available for everyone, used by millions, and are specifically designed to help you compare your Fair Value estimate to the current share price, making it clearer whether it might be time to buy or sell.

Unlike traditional models, Narratives update automatically with new data, like fresh news or results, ensuring your story stays up to date.

For example, regarding Rio Tinto Group, some investors believe global electrification and expanded copper and lithium projects justify a Fair Value above £66 per share, while others highlight iron ore risks and see a case for values nearer £41 per share, letting you see the full range of perspectives in one place.

Do you think there's more to the story for Rio Tinto Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RIO

Rio Tinto Group

Engages in exploring, mining, and processing mineral resources worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives