- United Kingdom

- /

- Software

- /

- AIM:ADVT

3 UK Penny Stocks With Market Caps Over £100M To Watch

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, which has impacted companies closely tied to its economic fortunes. Despite these broader market pressures, certain investment opportunities remain attractive, particularly in the realm of penny stocks. Although often seen as a niche area, penny stocks can offer significant growth potential when they are backed by strong financial health and strategic positioning.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.255 | £311.3M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.30 | £347.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.65 | £128.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.88 | £325.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.50 | £125.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.215 | £193.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.835 | £11.5M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.23 | £68.96M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.27 | £856.85M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AdvancedAdvT Limited offers software solutions across Europe, the United Kingdom, North America, and other international markets with a market cap of £226.44 million.

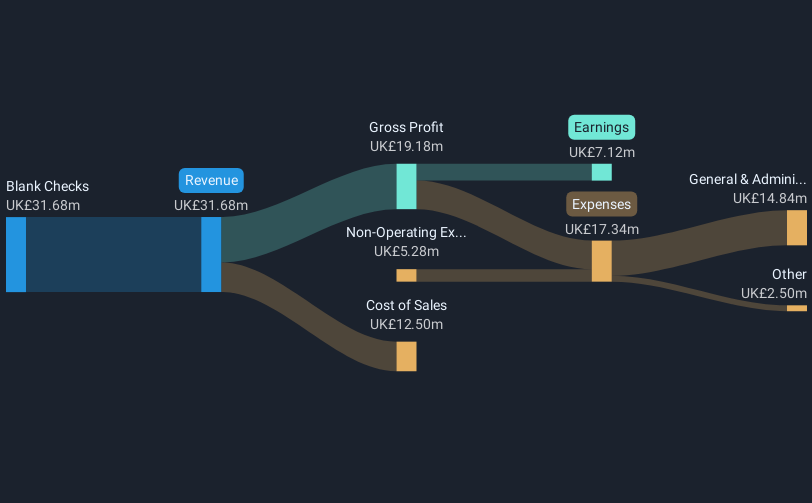

Operations: The company generates £43.27 million in revenue from its Blank Checks segment.

Market Cap: £226.44M

AdvancedAdvT Limited, with a market cap of £226.44 million and revenue of £43.27 million, has demonstrated strong financial health by being debt-free and having short-term assets (£101.2M) that exceed both its short-term (£20.7M) and long-term liabilities (£6.1M). The company reported net income of £10.88 million for the year ended February 28, 2025, reflecting improved profit margins at 25.1%. Despite recent delisting from OTC Equity due to inactivity, AdvancedAdvT's earnings growth outpaced the industry average last year at 53.6%, although it remains below its five-year average growth rate of 90.4%.

- Get an in-depth perspective on AdvancedAdvT's performance by reading our balance sheet health report here.

- Learn about AdvancedAdvT's future growth trajectory here.

Focusrite (AIM:TUNE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Focusrite plc develops, manufactures, and markets professional audio and electronic music products globally, with a market cap of £102.59 million.

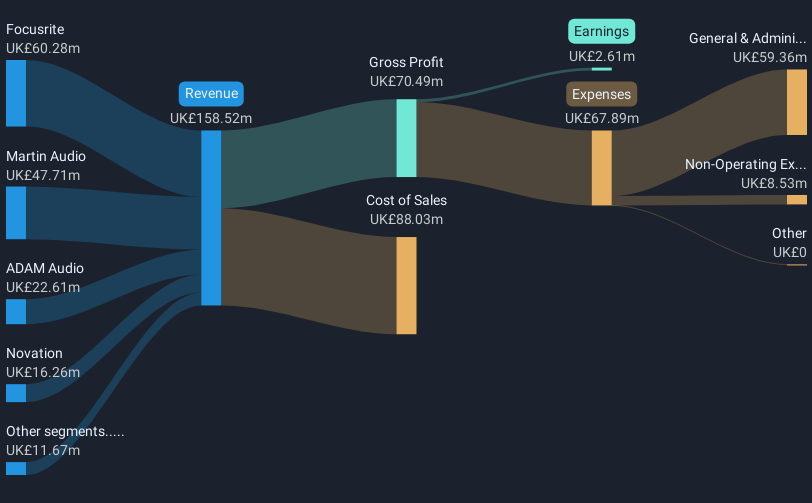

Operations: The company's revenue is derived from its various segments, including Focusrite (£61.79 million), Martin Audio (£46.38 million), ADAM Audio (£24.97 million), Novation (£17.07 million), Sequential (£10.42 million), and Sonnox (£1.92 million).

Market Cap: £102.59M

Focusrite plc, with a market cap of £102.59 million, generates revenue from multiple segments including Focusrite (£61.79M) and Martin Audio (£46.38M). Despite a reduction in debt to equity ratio from 59.4% to 29.1% over five years and satisfactory net debt levels (15.5%), the company faces challenges such as declining earnings growth (-83.3% last year) and lower profit margins (1.2%) compared to the previous year (7%). The dividend yield of 3.77% is not well covered by earnings, but short-term assets (£103M) exceed liabilities, indicating solid liquidity management amidst high share price volatility recently observed.

- Click here and access our complete financial health analysis report to understand the dynamics of Focusrite.

- Examine Focusrite's earnings growth report to understand how analysts expect it to perform.

Pensana (LSE:PRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pensana Plc, with a market cap of £189.54 million, is involved in the exploration and development of mineral properties in the United Kingdom and Angola.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £189.54M

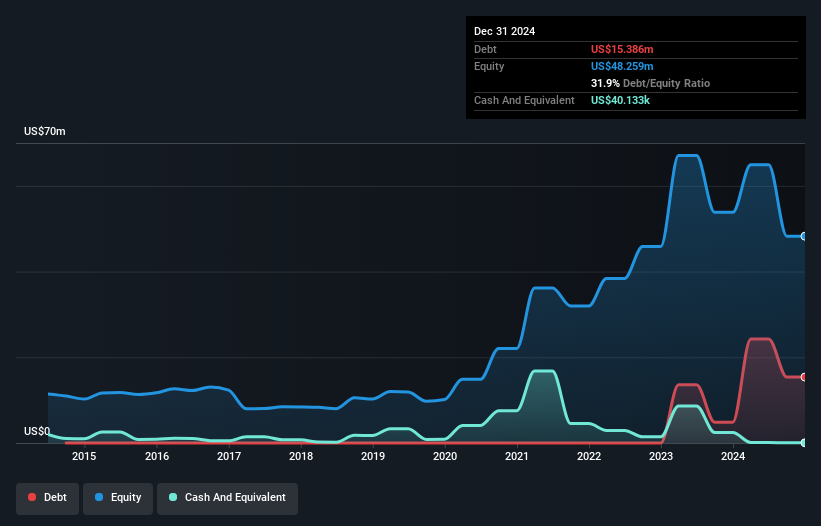

Pensana Plc, with a market cap of £189.54 million, is pre-revenue and has a negative return on equity of -10.89%, reflecting its unprofitability. Despite this, the company's cash runway is sufficient for over three years due to positive free cash flow, even as it shrinks by 4.2% annually. Debt levels are satisfactory with a net debt to equity ratio of 31.8%, though short-term liabilities (£27.5M) outstrip assets (£2M). Recent follow-on equity offerings raised £2 million at £0.35 per share, indicating efforts to bolster financial stability amidst high share price volatility and no significant shareholder dilution recently observed.

- Take a closer look at Pensana's potential here in our financial health report.

- Learn about Pensana's historical performance here.

Make It Happen

- Embark on your investment journey to our 298 UK Penny Stocks selection here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ADVT

AdvancedAdvT

Engages in the provision of software solutions in Europe, the United Kingdom, North America, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives