- United Kingdom

- /

- Basic Materials

- /

- LSE:IBST

It's Unlikely That Ibstock plc's (LON:IBST) CEO Will See A Huge Pay Rise This Year

Key Insights

- Ibstock will host its Annual General Meeting on 16th of May

- Total pay for CEO Joe Hudson includes UK£514.3k salary

- The total compensation is 393% higher than the average for the industry

- Ibstock's EPS grew by 44% over the past three years while total shareholder loss over the past three years was 21%

Shareholders of Ibstock plc (LON:IBST) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 16th of May could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Ibstock

How Does Total Compensation For Joe Hudson Compare With Other Companies In The Industry?

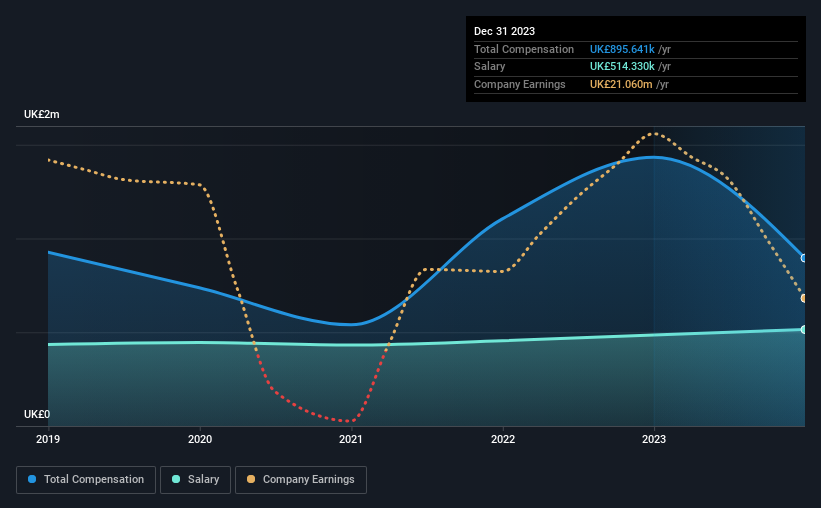

According to our data, Ibstock plc has a market capitalization of UK£592m, and paid its CEO total annual compensation worth UK£896k over the year to December 2023. That's a notable decrease of 38% on last year. In particular, the salary of UK£514.3k, makes up a fairly large portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the British Basic Materials industry with market capitalizations between UK£319m and UK£1.3b, we discovered that the median CEO total compensation of that group was UK£182k. Accordingly, our analysis reveals that Ibstock plc pays Joe Hudson north of the industry median. Furthermore, Joe Hudson directly owns UK£92k worth of shares in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | UK£514k | UK£486k | 57% |

| Other | UK£381k | UK£948k | 43% |

| Total Compensation | UK£896k | UK£1.4m | 100% |

On an industry level, roughly 36% of total compensation represents salary and 64% is other remuneration. According to our research, Ibstock has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Ibstock plc's Growth Numbers

Ibstock plc's earnings per share (EPS) grew 44% per year over the last three years. It saw its revenue drop 21% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Ibstock plc Been A Good Investment?

Since shareholders would have lost about 21% over three years, some Ibstock plc investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Ibstock (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IBST

Ibstock

Manufactures and sells clay and concrete building products and solutions to customers in the residential construction sector in the United Kingdom.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026