- United Kingdom

- /

- Capital Markets

- /

- LSE:FSG

Foresight Group Holdings And 2 Other Growth Stocks With High Insider Ownership On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently shown signs of strain, closing lower amid weak trade data from China and broader global economic concerns. In such a volatile market environment, identifying growth companies with high insider ownership can be particularly valuable, as strong insider stakes often signal confidence in the company's long-term potential.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Tortilla Mexican Grill (AIM:MEX) | 27.4% | 79.5% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

We're going to check out a few of the best picks from our screener tool.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £615.51 million.

Operations: The company's revenue segments are comprised of £84.17 million from Infrastructure, £47.35 million from Private Equity, and £9.80 million from Foresight Capital Management.

Insider Ownership: 31.7%

Earnings Growth Forecast: 27.9% p.a.

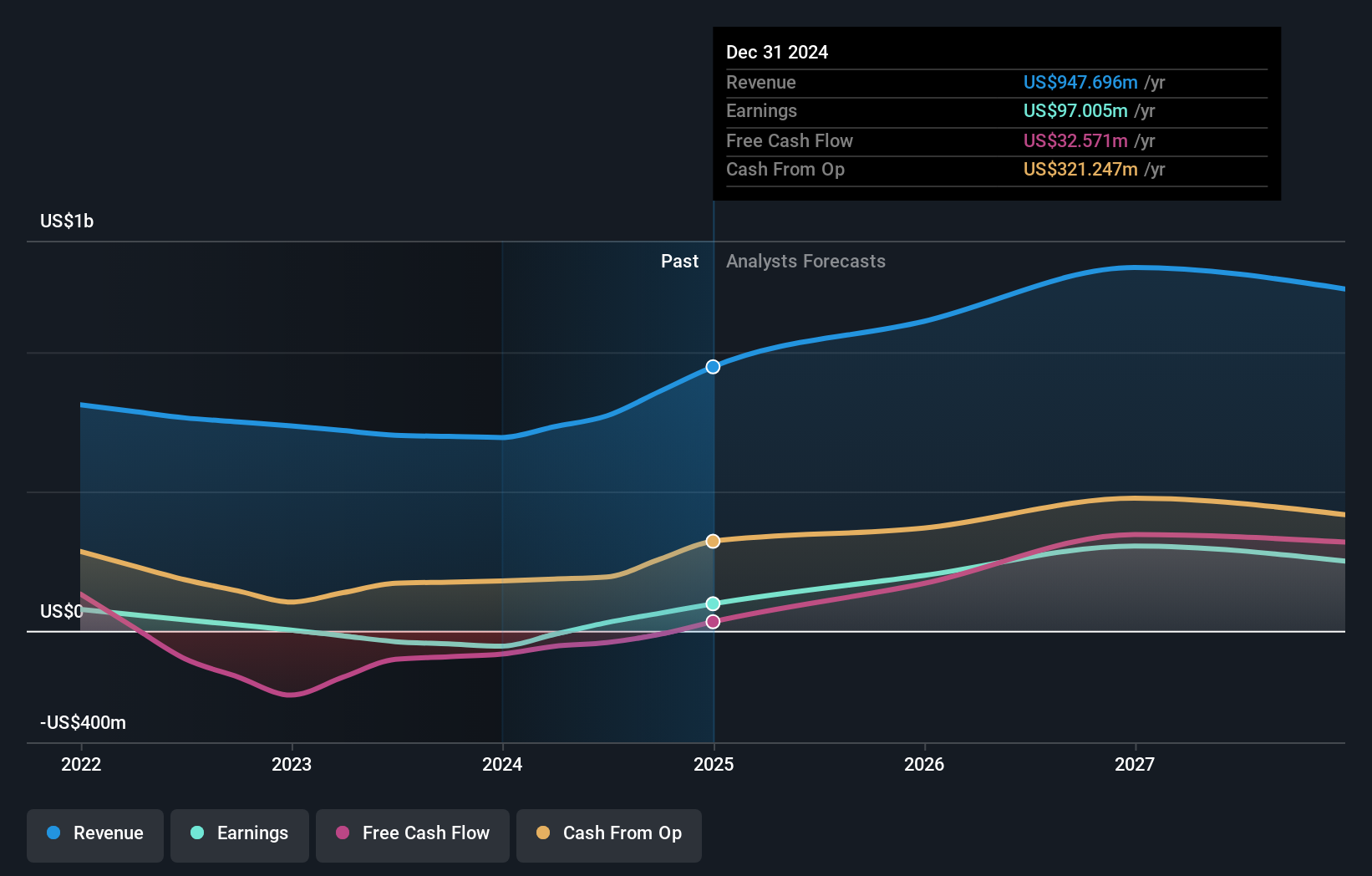

Foresight Group Holdings demonstrates strong growth potential with forecasted annual earnings growth of 27.9%, significantly outpacing the UK market's 14.3%. Despite a dividend yield of 4.17% that isn't well covered by earnings, the company has seen an increase in revenue to £141.33 million and net income to £26.43 million for FY2024. Recent buyback plans and insider ownership further align management interests with shareholders, reinforcing confidence in its sustained performance trajectory.

- Click to explore a detailed breakdown of our findings in Foresight Group Holdings' earnings growth report.

- In light of our recent valuation report, it seems possible that Foresight Group Holdings is trading beyond its estimated value.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across several countries including Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £902.36 million.

Operations: Hochschild Mining's revenue segments are primarily derived from San Jose ($266.70 million) and Inmaculada ($451.91 million), with a segment adjustment of $79.60 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 43.8% p.a.

Hochschild Mining has shown a significant turnaround with H1 2024 net income of US$39.52 million, compared to a net loss last year. Despite high debt levels and volatile share prices, its earnings are forecast to grow significantly at 43.79% annually, outpacing the UK market's 14.3%. The company trades at a substantial discount to its estimated fair value and maintains strong insider ownership, aligning management interests with those of shareholders.

- Navigate through the intricacies of Hochschild Mining with our comprehensive analyst estimates report here.

- The analysis detailed in our Hochschild Mining valuation report hints at an deflated share price compared to its estimated value.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, with a market cap of £1.75 billion, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: Revenue segments (in millions of $): Worka: 400.56, Americas: 1.29 billion, Asia Pacific: 341.30, Europe, Middle East and Africa (EMEA): 1.69 billion

Insider Ownership: 25.2%

Earnings Growth Forecast: 115.8% p.a.

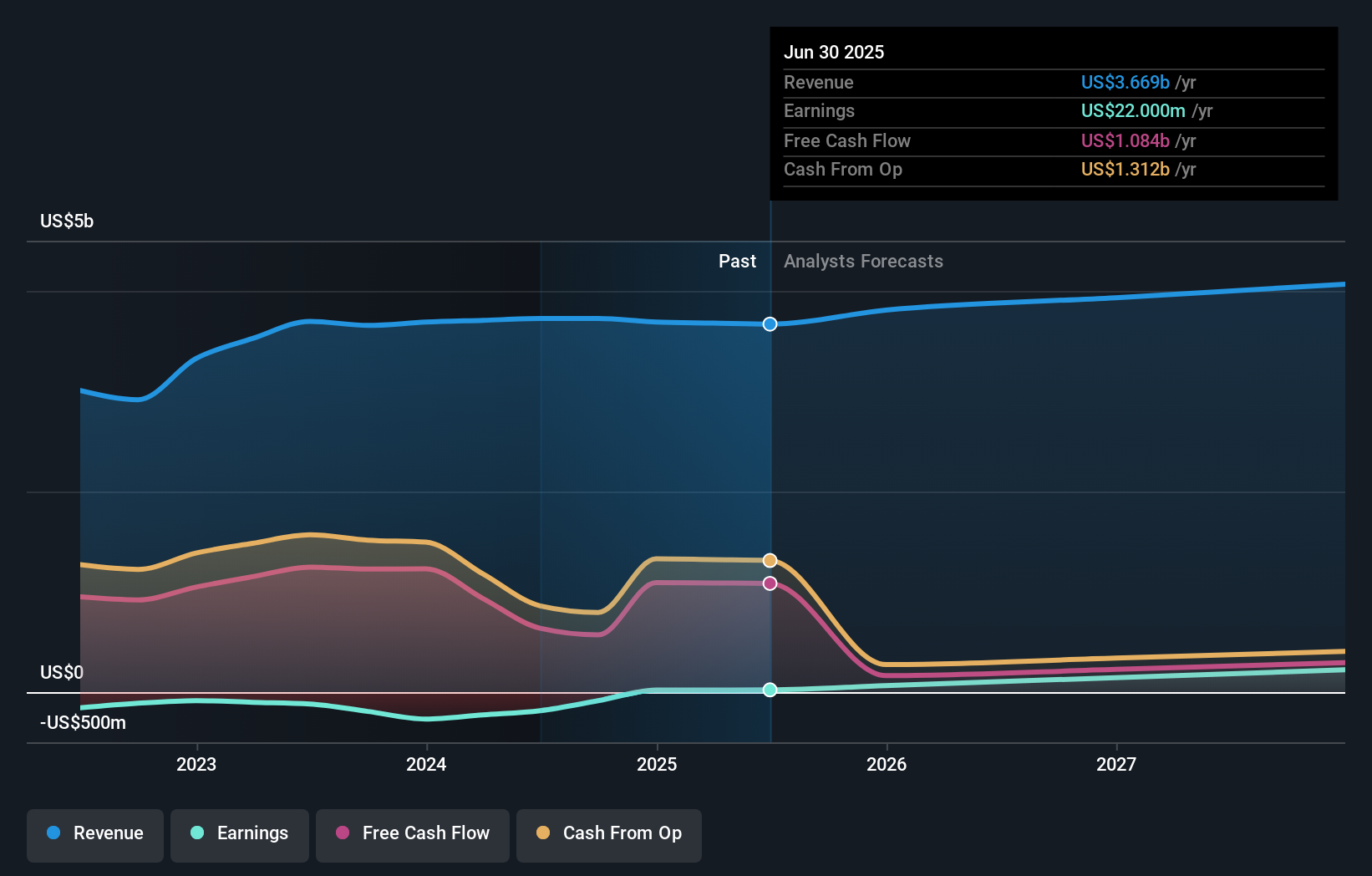

International Workplace Group (IWG) is forecast to grow revenue at 7.7% annually, outpacing the UK market's 3.7%. Insider buying has been more frequent than selling in the past three months, indicating confidence in future prospects. Despite a significant share price decline over five years, recent investor activism suggests potential value unlocking through a US listing and share buyback program. The company reported H1 2024 net income of US$16 million, reversing a previous loss.

- Take a closer look at International Workplace Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that International Workplace Group's share price might be on the cheaper side.

Where To Now?

- Dive into all 65 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FSG

Foresight Group Holdings

Operates as an infrastructure and private equity manager in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia.

Flawless balance sheet with high growth potential.