- United Kingdom

- /

- Metals and Mining

- /

- AIM:XTR

3 Promising UK Penny Stocks With Market Caps Over £4M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China impacting global sentiment. In such a climate, investors often seek opportunities in lesser-known areas of the market that might offer untapped potential. Penny stocks, despite being an older term, still represent smaller or less-established companies that can provide value when backed by strong financials and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £149.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.08 | £783.67M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.39 | £177.02M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.20 | £417.71M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.445 | $258.69M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.39 | £305.38M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dianomi (AIM:DNM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dianomi plc, along with its subsidiaries, offers native advertising services across various sectors including financial services, technology, corporates, and lifestyle in regions such as Europe, the Middle East, Africa, the United States, and the Asia Pacific; it has a market cap of £12.76 million.

Operations: The company generates revenue of £29.50 million from its native advertising services across multiple sectors.

Market Cap: £12.76M

Dianomi plc, with a market cap of £12.76 million, operates in the native advertising sector and is currently unprofitable. Despite this, it maintains no debt and has a strong cash runway exceeding three years. Revenue for 2024 is expected to be around £28 million, aligning with market expectations. Recent earnings show sales of £14.18 million for the first half of 2024, though net losses have narrowed significantly compared to the previous year. The company benefits from stable weekly volatility and short-term assets that exceed its liabilities, but management experience remains limited with a relatively new team in place.

- Click here and access our complete financial health analysis report to understand the dynamics of Dianomi.

- Assess Dianomi's future earnings estimates with our detailed growth reports.

Induction Healthcare Group (AIM:INHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Induction Healthcare Group PLC offers software solutions to healthcare professionals in the United Kingdom and has a market cap of £8.45 million.

Operations: The company generates £12.78 million in revenue from its healthcare software segment.

Market Cap: £8.45M

Induction Healthcare Group PLC, with a market cap of £8.45 million, faces challenges as it remains unprofitable and reported declining sales of £5.19 million for the first half of 2024. Despite its financial hurdles, the company is debt-free and holds short-term assets (£7.2M) that surpass both its short-term (£5M) and long-term liabilities (£3.9M). The management team has an average tenure of two years, suggesting some experience in navigating the competitive healthcare software sector. While revenue growth is forecasted at 13% annually, recent losses have increased by 9.1% per year over five years, indicating ongoing profitability struggles.

- Click here to discover the nuances of Induction Healthcare Group with our detailed analytical financial health report.

- Gain insights into Induction Healthcare Group's future direction by reviewing our growth report.

Xtract Resources (AIM:XTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xtract Resources Plc, with a market cap of £4.28 million, operates as a resource, development, and mining company through its subsidiaries.

Operations: Xtract Resources Plc has not reported any revenue segments.

Market Cap: £4.28M

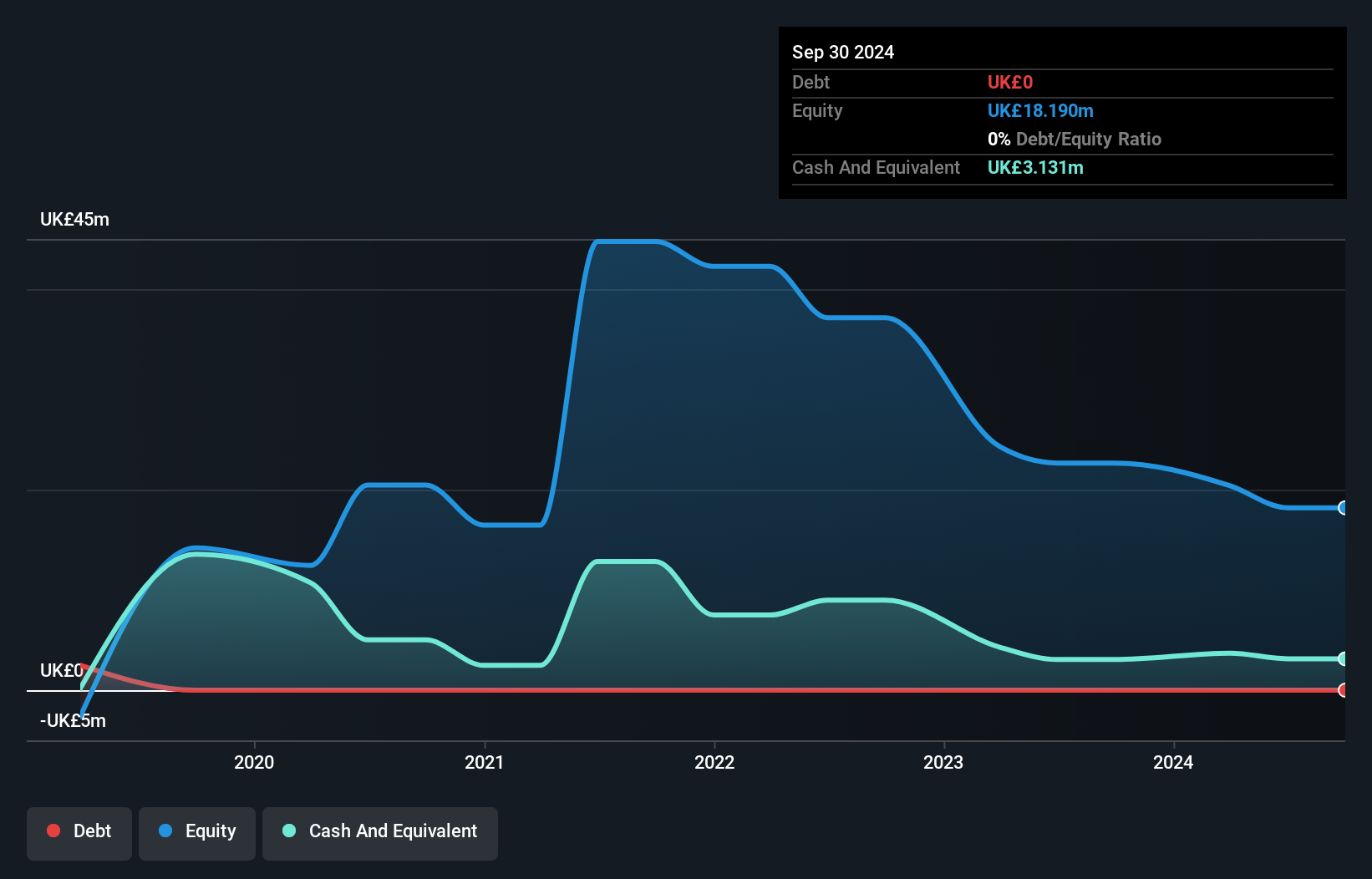

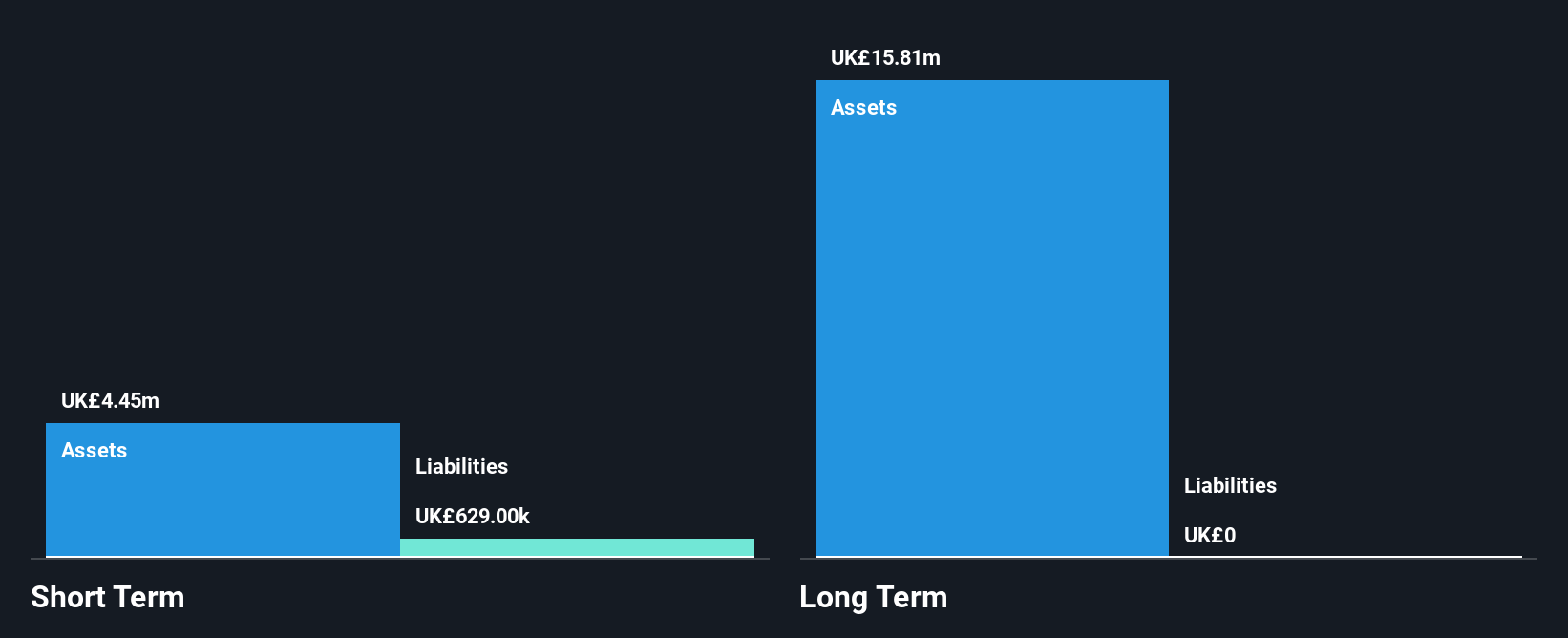

Xtract Resources Plc, with a market cap of £4.28 million, is pre-revenue and unprofitable but remains debt-free with sufficient cash runway for over three years. The company's board of directors is experienced, and its short-term assets (£4.4M) significantly exceed liabilities (£629K). Recent developments include an exclusive collaboration agreement with Chilibwe Mining Limited in Zambia for a large-scale exploration project involving copper, cobalt, gold, and nickel. However, the project faces legal challenges due to ongoing court proceedings. Metallurgical studies on the Bushranger Project show promising results using NovaCell Coarse Particle Flotation technology to enhance copper-gold mineralisation economics.

- Click to explore a detailed breakdown of our findings in Xtract Resources' financial health report.

- Examine Xtract Resources' past performance report to understand how it has performed in prior years.

Taking Advantage

- Take a closer look at our UK Penny Stocks list of 465 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:XTR

Xtract Resources

Operates as a resource, development, and mining company.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives