- United Kingdom

- /

- Capital Markets

- /

- LSE:TCAP

3 UK Stocks Estimated To Be Up To 48.2% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, though it is up 7.1% over the past year with earnings forecast to grow by 14% annually. In this context, identifying stocks that are significantly undervalued can present compelling opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topps Tiles (LSE:TPT) | £0.45 | £0.88 | 48.9% |

| Gaming Realms (AIM:GMR) | £0.40 | £0.76 | 47.1% |

| Victorian Plumbing Group (AIM:VIC) | £1.03 | £1.85 | 44.3% |

| GlobalData (AIM:DATA) | £2.07 | £3.71 | 44.2% |

| Victrex (LSE:VCT) | £9.32 | £17.25 | 46% |

| Informa (LSE:INF) | £8.332 | £16.27 | 48.8% |

| Redcentric (AIM:RCN) | £1.295 | £2.43 | 46.8% |

| SysGroup (AIM:SYS) | £0.34 | £0.65 | 48% |

| Foxtons Group (LSE:FOXT) | £0.618 | £1.18 | 47.7% |

| Hochschild Mining (LSE:HOC) | £1.824 | £3.52 | 48.2% |

Underneath we present a selection of stocks filtered out by our screen.

Hochschild Mining (LSE:HOC)

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £938.37 million.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

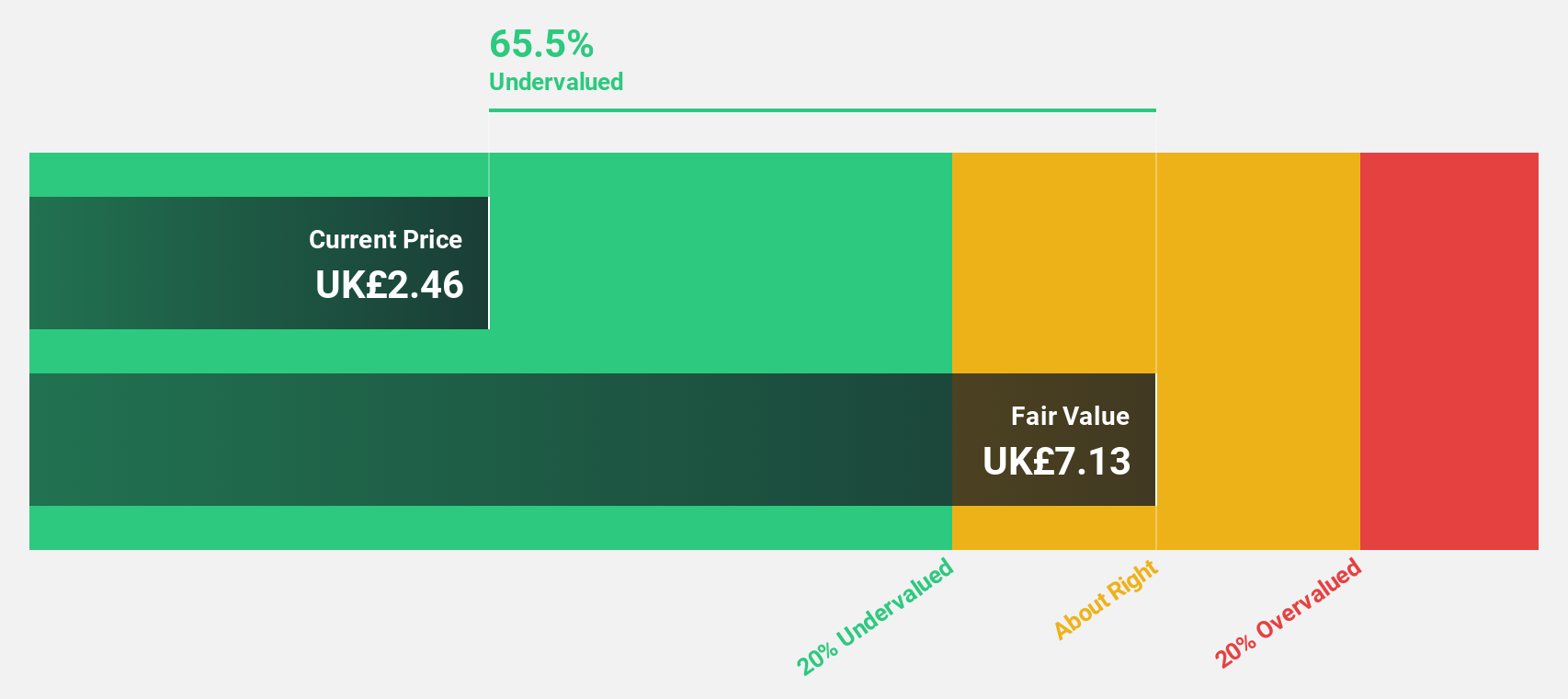

Estimated Discount To Fair Value: 48.2%

Hochschild Mining plc appears undervalued based on cash flows, trading at £1.82, significantly below its estimated fair value of £3.52. The company reported H1 2024 earnings with sales of US$391.74 million and net income of US$39.52 million, a turnaround from a net loss last year. Despite high debt levels and large one-off items impacting results, earnings are forecast to grow 44.63% annually over the next three years, outpacing the UK market's growth rate.

- The growth report we've compiled suggests that Hochschild Mining's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Hochschild Mining.

Stelrad Group (LSE:SRAD)

Overview: Stelrad Group PLC manufactures and distributes radiators in the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £192.94 million.

Operations: The company generates £294.27 million from the manufacture and distribution of radiators across various regions, including the UK, Ireland, Europe, Turkey, and internationally.

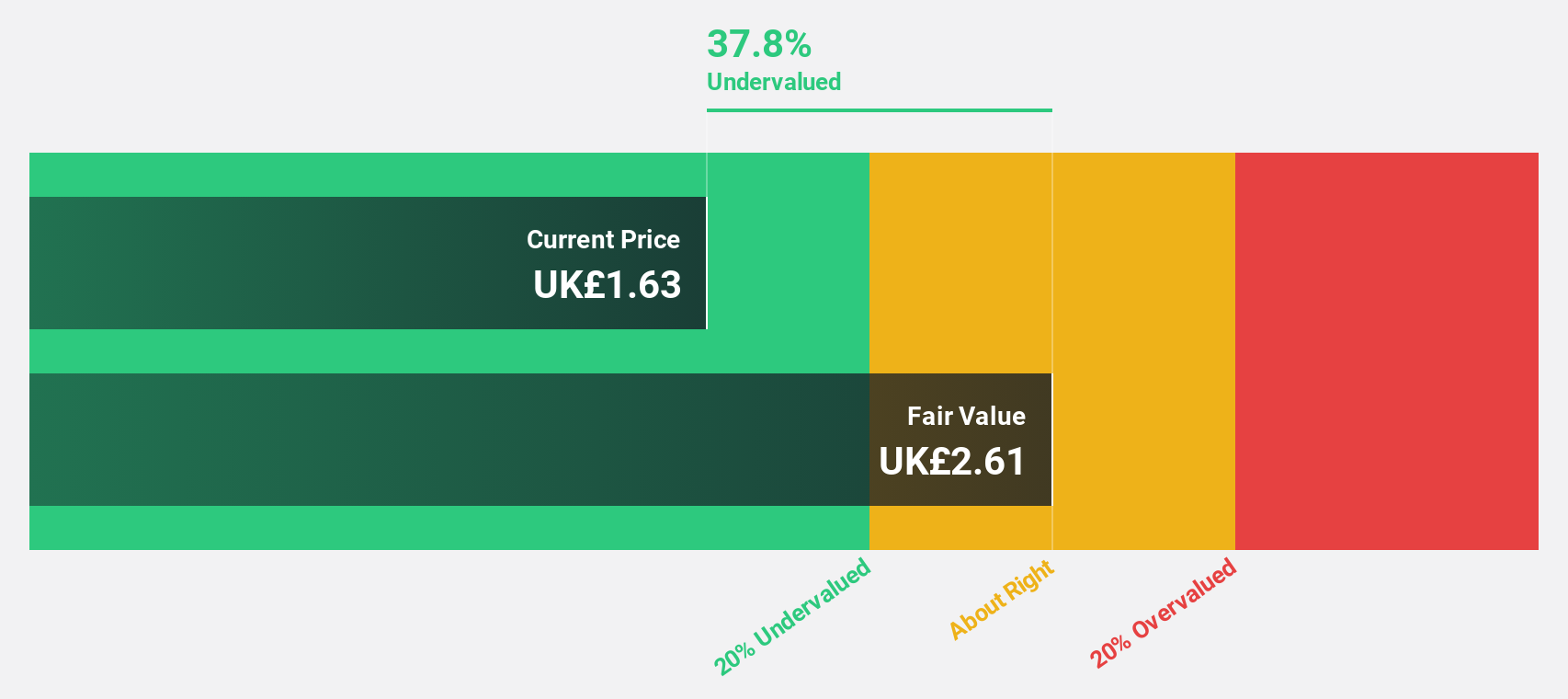

Estimated Discount To Fair Value: 41.2%

Stelrad Group PLC is trading at £1.52, significantly below its estimated fair value of £2.58, indicating it may be undervalued based on cash flows. Despite a decline in H1 2024 sales to £143.12 million from £157.04 million, net income slightly increased to £8.02 million from £7.99 million last year. The company declared an interim dividend increase and forecasts annual earnings growth of 14.52%, though revenue growth remains modest at 5.2% per year amidst high debt levels and recent insider selling activity.

- Upon reviewing our latest growth report, Stelrad Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Stelrad Group with our comprehensive financial health report here.

TP ICAP Group (LSE:TCAP)

Overview: TP ICAP Group PLC offers intermediary services, trade execution, pre-trade and settlement services, and data-led solutions across various regions including Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately £1.77 billion.

Operations: The company's revenue segments include £1.24 billion from Global Broking, £471 million from Energy & Commodities, £323 million from Liquidnet, and £195 million from Parameta Solutions.

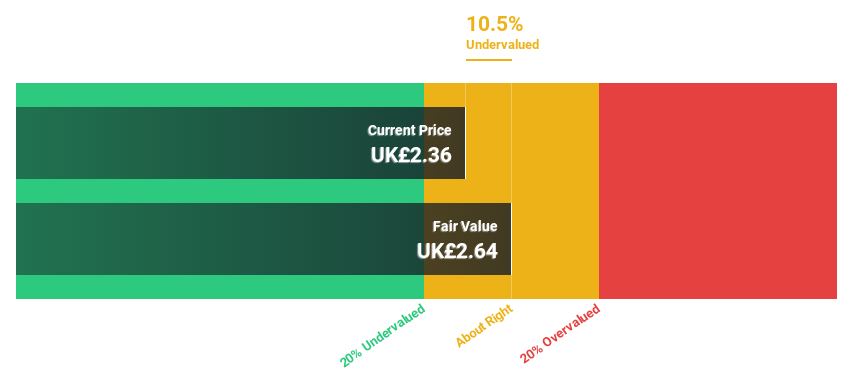

Estimated Discount To Fair Value: 12.3%

TP ICAP Group is trading at £2.35, below its estimated fair value of £2.68, suggesting potential undervaluation based on cash flows. The company reported H1 2024 net income of £91 million, up from £66 million last year, with earnings per share also rising. Despite a dividend yield of 6.31% not fully covered by earnings and revenue growth forecasted at a modest 4% annually, the firm expects significant annual profit growth of 20.5%.

- Our comprehensive growth report raises the possibility that TP ICAP Group is poised for substantial financial growth.

- Get an in-depth perspective on TP ICAP Group's balance sheet by reading our health report here.

Seize The Opportunity

- Get an in-depth perspective on all 59 Undervalued UK Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TP ICAP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TCAP

TP ICAP Group

Provides intermediary services, contextual insights, trade execution, pre-trade and settlement services, and data-led solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.