- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

3 UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines due to weak trade data from China, highlighting ongoing economic struggles and their impact on global markets. In such uncertain times, investors often seek growth companies with high insider ownership, as these firms may demonstrate strong alignment between management and shareholder interests, potentially offering resilience amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.8% | 55.7% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 93.9% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 21.5% |

| Foresight Group Holdings (LSE:FSG) | 34.2% | 23.5% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 29.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Underneath we present a selection of stocks filtered out by our screen.

Loungers (AIM:LGRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales, with a market cap of £318.10 million.

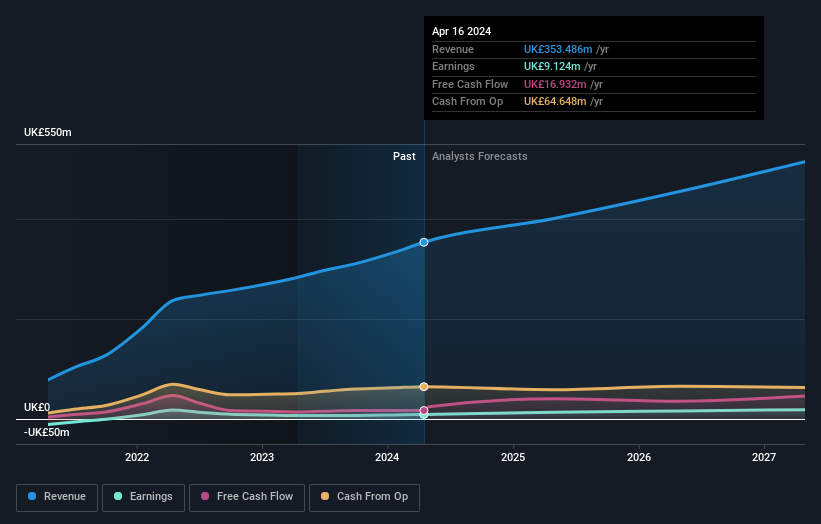

Operations: The company's revenue from its café bars and café restaurants amounts to £353.49 million.

Insider Ownership: 12.4%

Loungers, a UK café-bar chain, is experiencing significant shareholder opposition to a £338 million takeover by Fortress Investment Group. Despite the offer exceeding Loungers' highest-ever closing share price, key stakeholders like Slater Investments and AXA Investment Managers oppose the deal. The company's earnings are forecasted to grow significantly at 23.65% annually, outpacing the UK market's growth rate of 14.8%. Recent earnings showed strong sales growth from £149.62 million to £178.33 million year-on-year.

- Take a closer look at Loungers' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Loungers shares in the market.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £1.10 billion.

Operations: The company's revenue is primarily derived from its San Jose segment, contributing $266.70 million, and the Inmaculada segment, which accounts for $451.91 million.

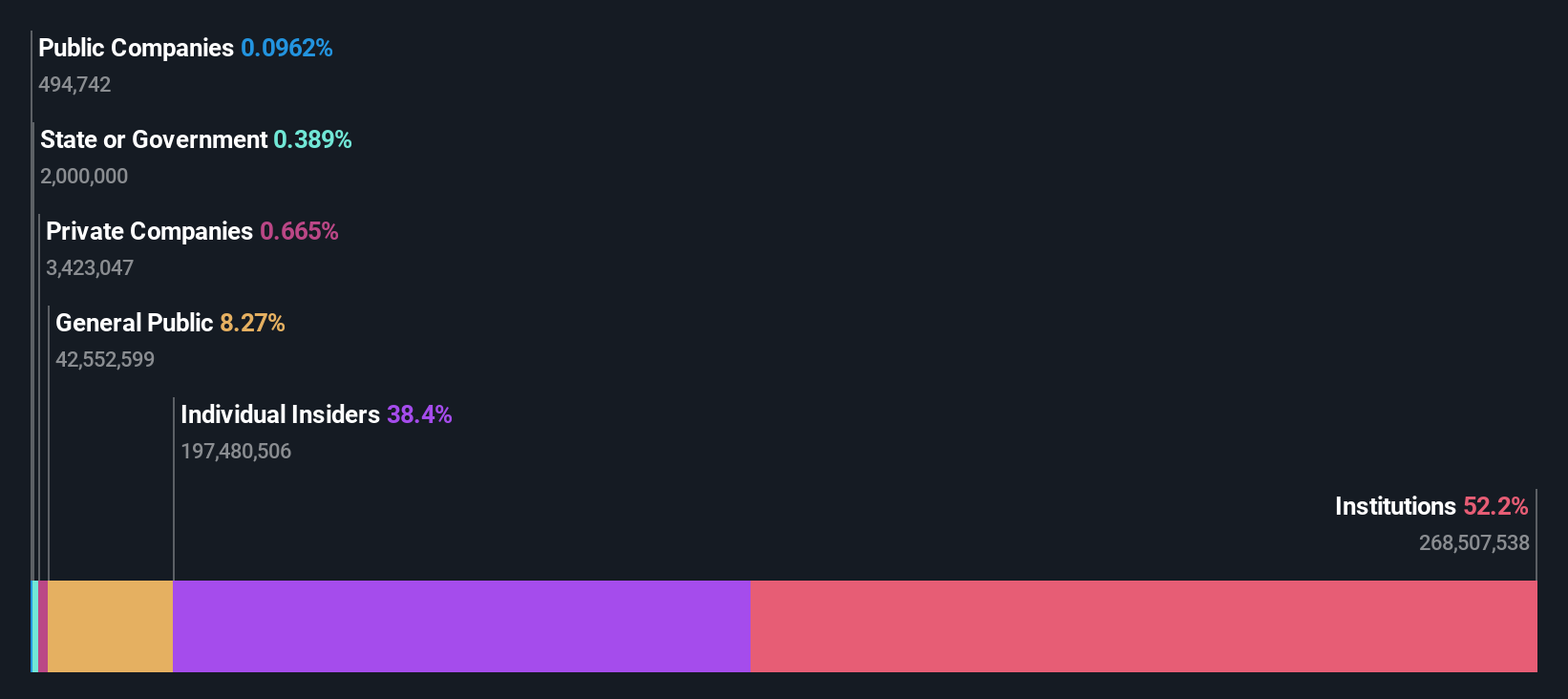

Insider Ownership: 38.4%

Hochschild Mining is poised for significant earnings growth, projected at 53.24% annually, outpacing the UK market. Despite trading at 58.9% below its estimated fair value, it faces challenges with high debt levels and a forecasted low return on equity of 17%. Recent strategic expansion includes acquiring the Monte Do Carmo Project in Brazil, enhancing its growth prospects despite mixed production results in silver and gold over recent quarters.

- Click to explore a detailed breakdown of our findings in Hochschild Mining's earnings growth report.

- Our expertly prepared valuation report Hochschild Mining implies its share price may be lower than expected.

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited is involved in owning, co-owning, developing, leasing, operating, and franchising upscale hotels across several European countries including the Netherlands and the United Kingdom with a market cap of £589.23 million.

Operations: The company's revenue segments include Owned Hotel Operations in the United Kingdom (£236.99 million), Croatia (£81.63 million), the Netherlands (£65.92 million), and Germany, Hungary, and Serbia (£24.10 million), as well as Management and Central Services (£50.09 million).

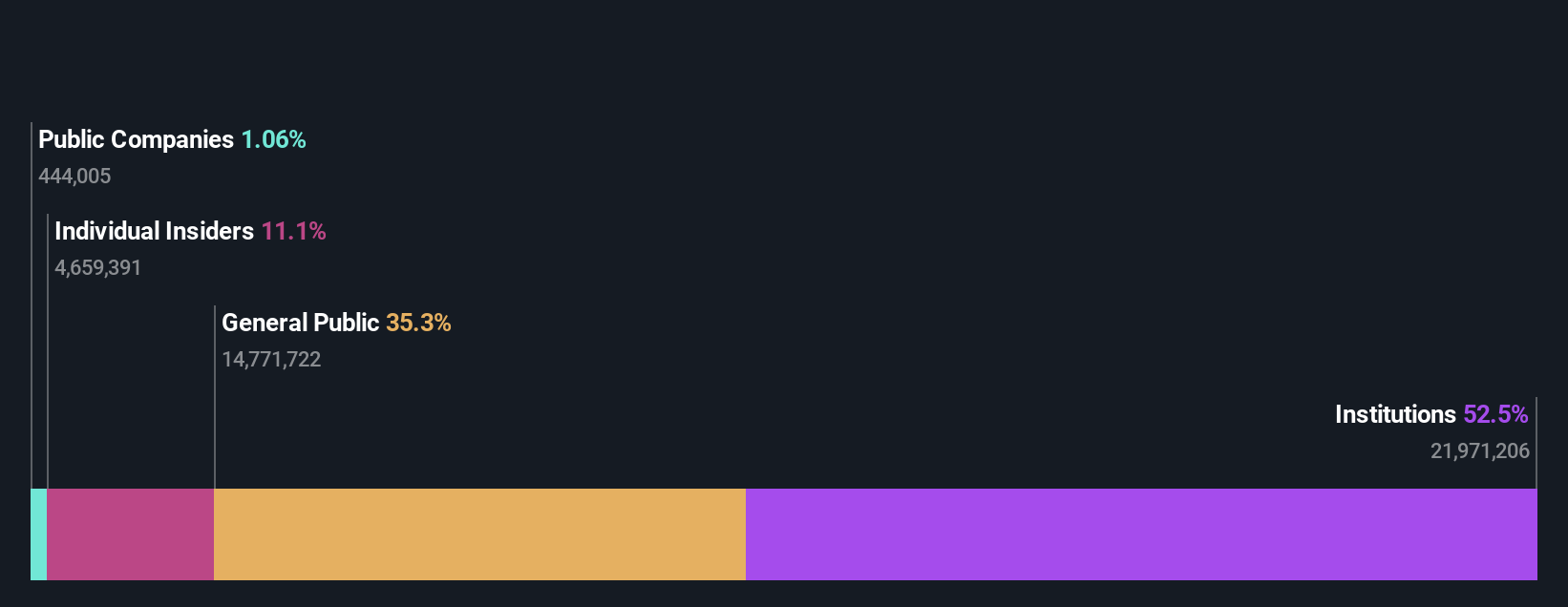

Insider Ownership: 14.8%

PPHE Hotel Group is positioned for substantial earnings growth, forecasted at 27% annually, surpassing the UK market average. Despite trading significantly below its estimated fair value and facing challenges with low profit margins and interest coverage issues, its revenue is expected to grow faster than the market. However, return on equity remains low at 17.6%, and recent financial results have been impacted by large one-off items. Upcoming Q3 results could provide further insights into performance trends.

- Navigate through the intricacies of PPHE Hotel Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that PPHE Hotel Group is trading beyond its estimated value.

Make It Happen

- Investigate our full lineup of 65 Fast Growing UK Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives