- United Kingdom

- /

- Metals and Mining

- /

- LSE:GLEN

Is There Opportunity in Glencore After 14% Share Price Jump?

Reviewed by Bailey Pemberton

If you’re standing in front of Glencore stock, wondering whether it’s the moment to buy, hold, or move on, you’re definitely not alone. Glencore has a long history of keeping investors on their toes, swinging from double-digit gains to sharp retracements, and always drawing plenty of headlines along the way. In the past 30 days, Glencore shares have popped 14.0%, which stands out after several months of choppy performance. Despite strong long-term gains over the past five years, including an impressive 170.6% rally, the stock is still down 4.6% year to date and sits more than 16% lower than twelve months ago. Market sentiment seems to be shifting as investors respond to changes in the global commodities landscape, particularly around supply chain resilience and demand for metals critical to the energy transition.

So where does value come into all this? If we step back and use a classic valuation scorecard, Glencore checks the box for being undervalued in 3 out of 6 categories, giving the company a value score of 3. That suggests there’s some under-the-surface opportunity, but also that not every box gets a tick.

Let’s break down exactly how Glencore fares according to each of the major valuation measures. Stick around, because there’s an even sharper lens we’ll use at the end to really test whether the stock is genuinely cheap or simply priced just right for its risks and rewards.

Why Glencore is lagging behind its peers

Approach 1: Glencore Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future free cash flows and then discounting them back to today's value. This approach attempts to answer what Glencore would be worth today based on the cash it could generate in the coming years.

Looking at Glencore’s numbers, the company reported trailing twelve month free cash flow of $987 million. Analyst estimates anticipate strong growth over the next several years, with free cash flow projected to climb to approximately $4.2 billion by 2029. Beyond 2029, further projections are extrapolated, reflecting a combination of analyst forecasts and longer-term expectations. Simply Wall St models use these figures, discounted appropriately, to estimate Glencore's fair value today.

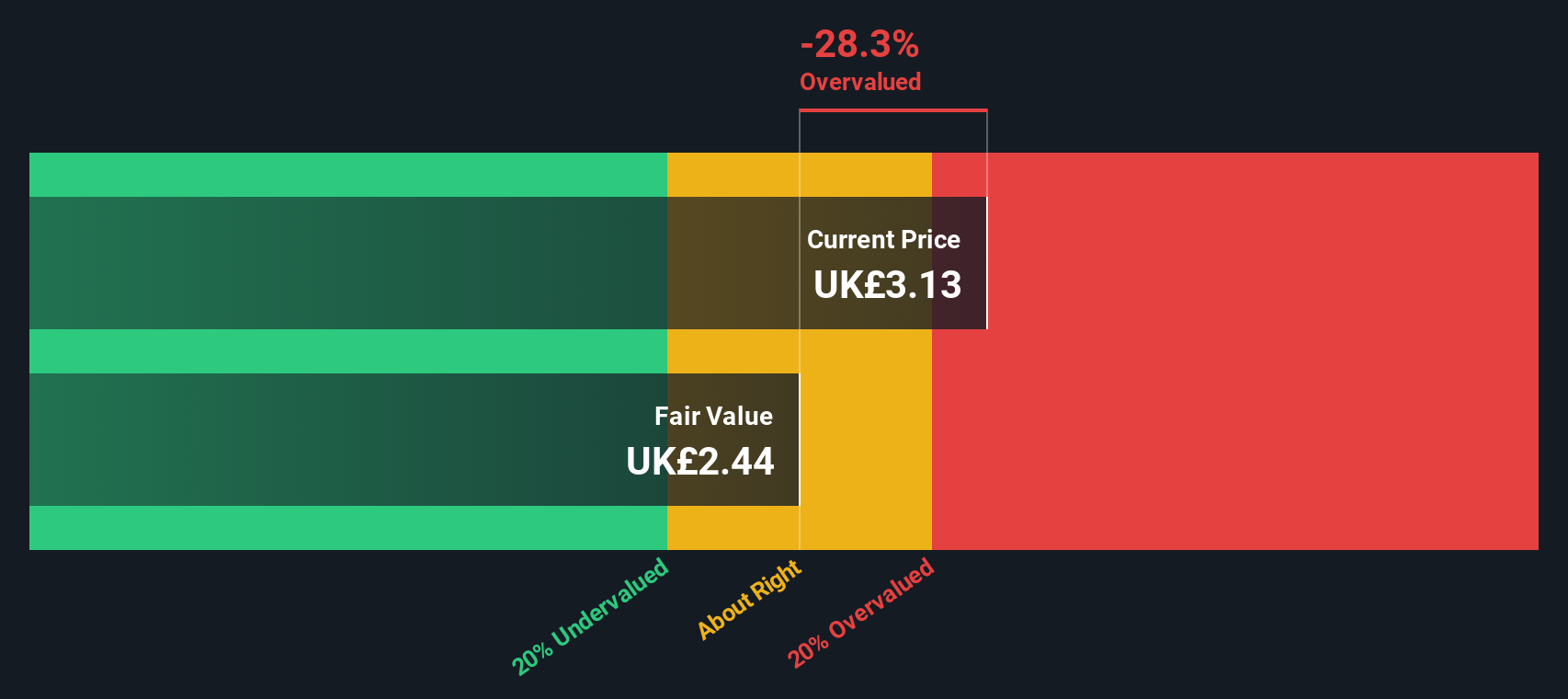

Based on this DCF analysis, Glencore's intrinsic value is $2.50 per share. With the current market price sitting about 38.4% above that level, the stock appears materially overvalued according to the cash flow outlook.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Glencore may be overvalued by 38.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Glencore Price vs Sales

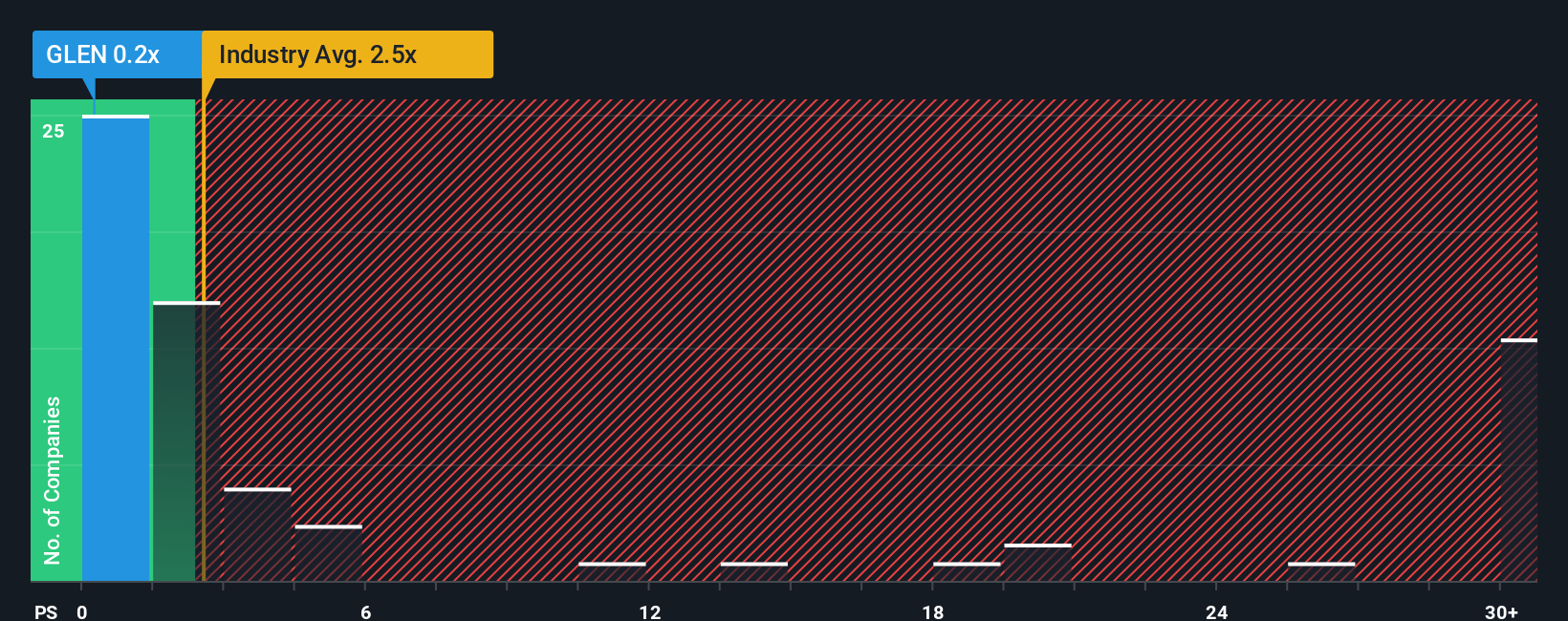

The Price-to-Sales (P/S) ratio is an especially useful metric when evaluating profitable commodity-based companies like Glencore, as it weighs the market’s value of a business relative to its total revenue. For a business built on large-scale trading and extraction, revenue is a decisive indicator of market positioning and operational scale. This makes the P/S ratio a solid tool for quick value checks.

Growth and risk are central to interpreting what a fair P/S multiple should be. Fast-growing, lower-risk companies can typically justify higher multiples, while those with uncertain prospects or greater risk often trade at lower ones. The "right" P/S is shaped not just by a company’s past results, but also by forward-looking expectations about sales, margins, and the broader market cycle.

Glencore’s current P/S multiple is just 0.24x. This is not only dramatically below the average P/S of global Metals and Mining peers (3.56x) and the sector’s broader average (2.53x), but also suggests the market is pricing in considerable caution about Glencore’s top-line potential.

To cut through the noise and get a more individualized view, Simply Wall St also calculates a proprietary Fair Ratio. This ratio tailors the expected P/S for Glencore by considering factors such as its revenue growth, margins, market cap, and sector-specific risks. Unlike peer or industry comparisons, which can gloss over what makes Glencore distinct, the Fair Ratio provides a more specific assessment. In Glencore’s case, the Fair Ratio comes in at 0.82x, indicating what would be a reasonable sales-based valuation when all of those factors are accounted for.

Comparing the Fair Ratio to Glencore’s current P/S, the difference is significant. With the stock’s actual multiple well below both the industry average and its calculated fair level, Glencore is trading at a notable discount on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Glencore Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that allows you to connect your personal view of Glencore’s future, based on your expectations for its revenue growth, margins, and risks, to a specific financial forecast and an estimated fair value.

This approach goes beyond just plugging in analyst assumptions or historical ratios. Instead, you create a "story" for Glencore, outlining what you believe will drive its performance, then see how this translates into numbers and whether the stock looks undervalued or overvalued at current prices.

Available within the Community page on Simply Wall St for millions of investors, Narratives make forecasting and fair value analysis accessible for anyone. As market events, news, or earnings updates emerge, Narratives are refreshed in real time, so your story and valuation stay current with the facts.

For example, one Glencore Narrative might reflect high conviction in copper project success and cost discipline, arriving at a fair value above £4.50. Another, more cautious Narrative could focus on regulatory risks and earnings volatility, yielding a fair value closer to £3.10. Narratives let you compare these views, empowering you to decide whether Glencore’s current market price is a genuine bargain or about right for its risks and rewards.

Do you think there's more to the story for Glencore? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLEN

Glencore

Engages in the production, refinement, processing, storage, transport, and marketing of metals and minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives