- United Kingdom

- /

- Metals and Mining

- /

- LSE:GEMD

Gem Diamonds Limited's (LON:GEMD) Shares Bounce 49% But Its Business Still Trails The Industry

Gem Diamonds Limited (LON:GEMD) shareholders would be excited to see that the share price has had a great month, posting a 49% gain and recovering from prior weakness. But the last month did very little to improve the 50% share price decline over the last year.

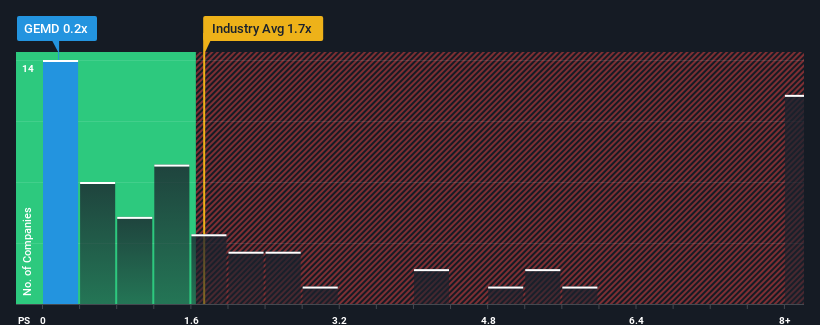

Although its price has surged higher, Gem Diamonds' price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Metals and Mining industry in the United Kingdom, where around half of the companies have P/S ratios above 1.7x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Gem Diamonds

What Does Gem Diamonds' P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Gem Diamonds has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Gem Diamonds.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Gem Diamonds' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. This means it has also seen a slide in revenue over the longer-term as revenue is down 26% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 2.5% per annum as estimated by the two analysts watching the company. Meanwhile, the broader industry is forecast to expand by 247% each year, which paints a poor picture.

With this in consideration, we find it intriguing that Gem Diamonds' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Gem Diamonds' P/S Mean For Investors?

Gem Diamonds' stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Gem Diamonds maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Gem Diamonds (including 1 which is a bit unpleasant).

If these risks are making you reconsider your opinion on Gem Diamonds, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GEMD

Undervalued with low risk.

Market Insights

Community Narratives