- United Kingdom

- /

- Metals and Mining

- /

- LSE:CAPD

Exploring Undervalued Small Caps With Insider Action In May 2024

As the United Kingdom's FTSE 100 continues its downward trajectory for the sixth consecutive day amidst broader global market fluctuations, investors are keenly observing economic indicators and market sentiment that influence investment decisions. In this context, identifying undervalued small-cap stocks with recent insider activity may offer potential opportunities for those looking to diversify their portfolios in a dynamic market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ultimate Products | 10.3x | 0.8x | 23.36% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 34.75% | ★★★★★☆ |

| John Wood Group | NA | 0.3x | 37.55% | ★★★★★☆ |

| THG | NA | 0.5x | 28.56% | ★★★★★☆ |

| Morgan Advanced Materials | 19.6x | 0.8x | 45.87% | ★★★★☆☆ |

| Impax Asset Management Group | 16.4x | 3.6x | 47.44% | ★★★★☆☆ |

| Eurocell | 14.7x | 0.4x | 23.43% | ★★★★☆☆ |

| M&C Saatchi | NA | 0.5x | 48.96% | ★★★★☆☆ |

| Robert Walters | 20.2x | 0.3x | 48.19% | ★★★☆☆☆ |

| Savills | 38.0x | 0.7x | 23.71% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

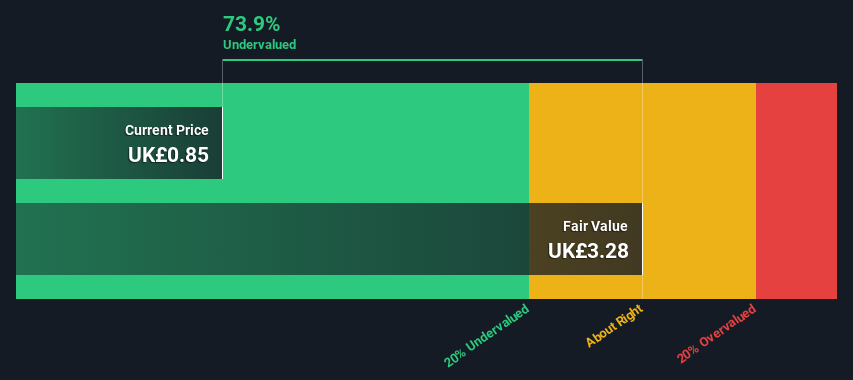

Capital (LSE:CAPD)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital Limited, together with its subsidiaries, offers a range of drilling services to the minerals industry and has a market capitalization of approximately £202.14 million.

Operations: Business Services generates revenue primarily through service offerings, with a recent gross profit margin of 46.13%. The company's cost of goods sold was $171.52 million, indicating significant operational costs relative to its revenue streams.

PE: 7.0x

Capital Limited, a lesser-known entity in the UK market, has demonstrated robust financial growth with a 9.68% increase in sales to US$318.42 million and a significant rise in net income from US$20.99 million to US$36.74 million year-over-year. Despite forecasts predicting a subtle earnings dip over the next three years, insider confidence remains strong, evidenced by consistent dividend payouts and ambitious revenue targets set between US$355 million to US$375 million for 2024 due to expanding contracts and operations. This mix of financial resilience and strategic expansion underpins its potential overlooked value.

- Click here to discover the nuances of Capital with our detailed analytical valuation report.

-

Gain insights into Capital's past trends and performance with our Past report.

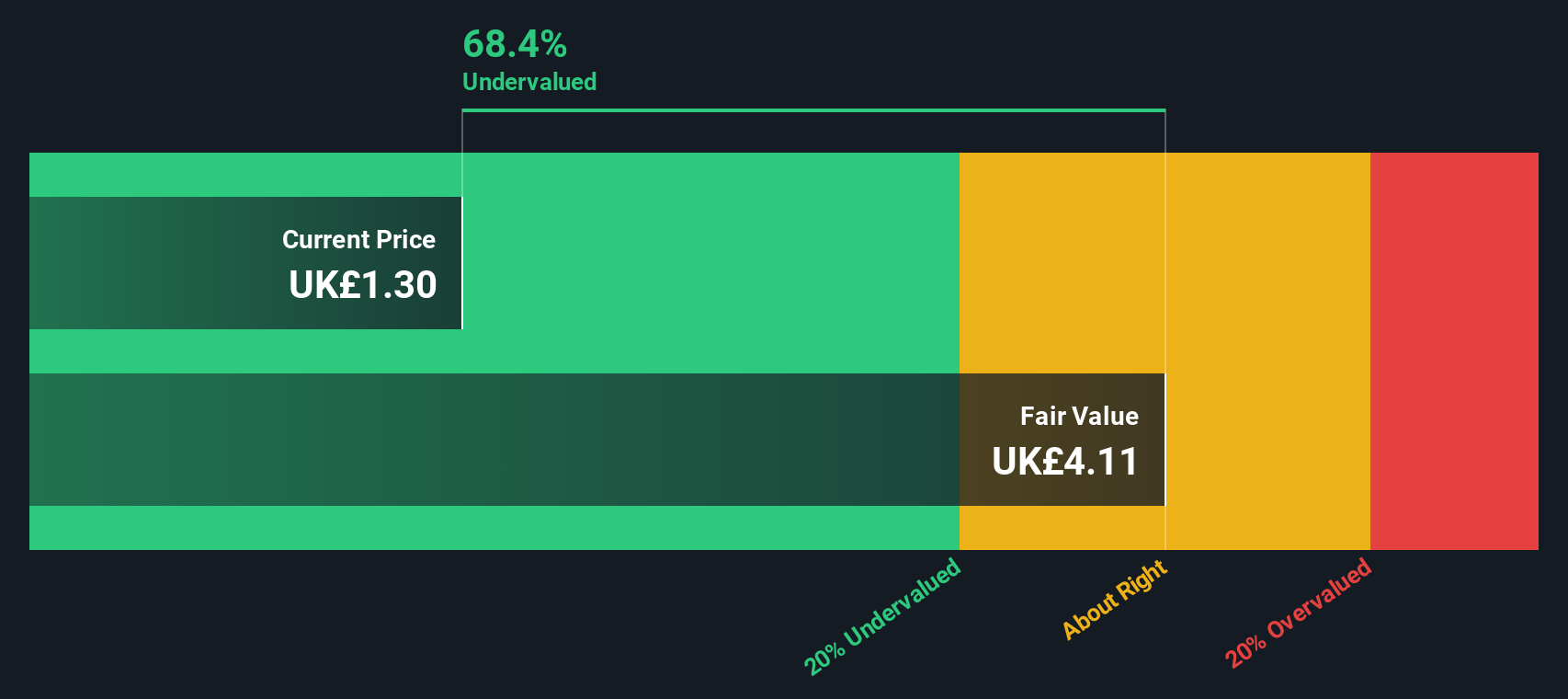

Robert Walters (LSE:RWA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Robert Walters plc operates in the professional recruitment sector, offering services globally through its main brand and its Resource Solutions division, which focuses on recruitment process outsourcing, with a market capitalization of £270.03 million.

Operations: Robert Walters primarily operates in the recruitment sector, generating £836 million from its core activities and an additional £228.1 million from its Recruitment Process Outsourcing (RPO) services under the Resource Solutions brand. The company has demonstrated a gross profit margin consistently above 36% over recent periods, reflecting efficient cost management relative to revenue generation.

PE: 20.2x

Amidst a challenging fiscal landscape, Robert Walters has demonstrated a strategic focus on shareholder returns, notably repurchasing 1.7 million shares for £6.6 million in the latter half of 2023. This move underscores management's belief in the firm's resilience and prospects despite reporting lower profit margins year-over-year and a slight dip in annual sales to £1.06 billion from £1.10 billion previously. With earnings expected to grow significantly, recent insider activities bolster confidence in the company’s trajectory as it navigates through economic uncertainties.

- Navigate through the intricacies of Robert Walters with our comprehensive valuation report here.

-

Evaluate Robert Walters' historical performance by accessing our past performance report.

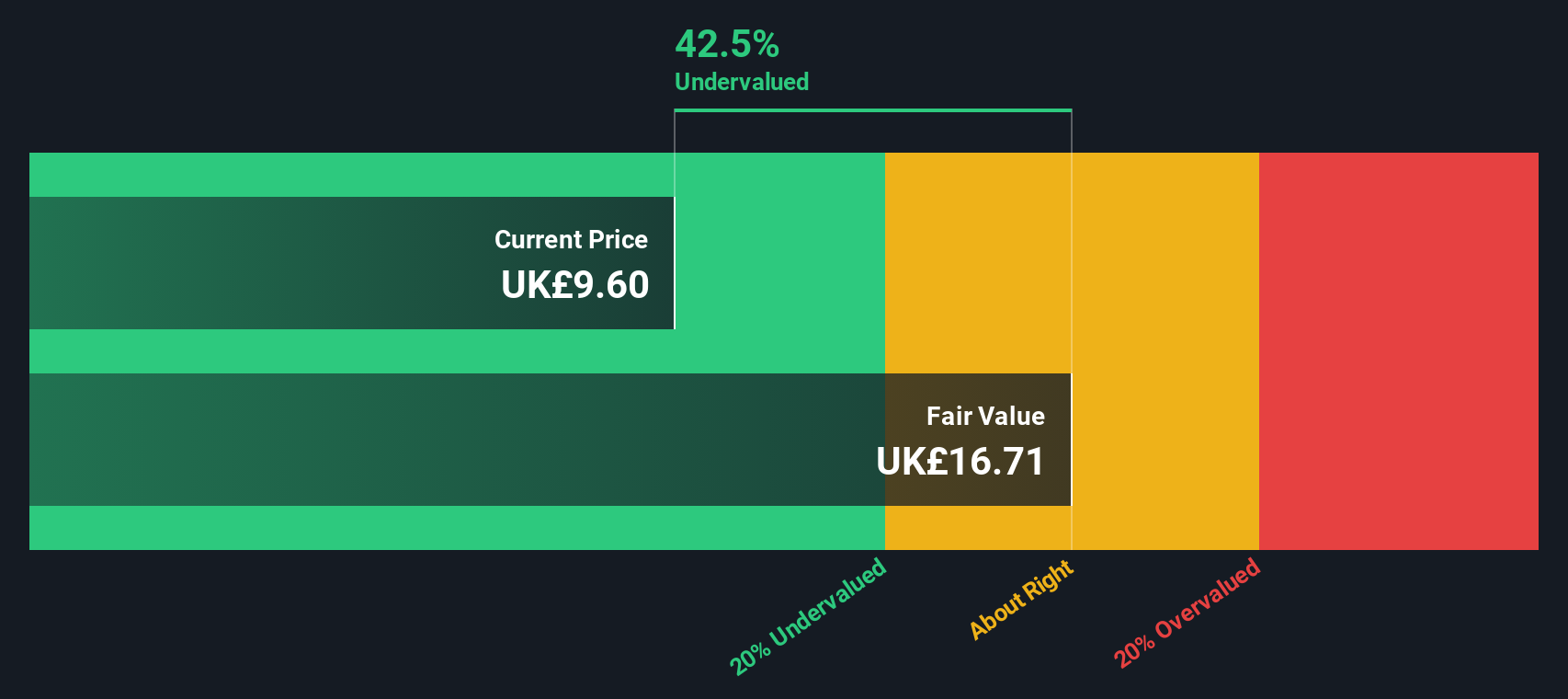

Savills (LSE:SVS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Savills plc is a global real estate services provider operating across various regions, with a market capitalization of £1.55 billion.

Operations: The firm generates its revenue primarily through Property and Facilities Management (£899.50 million), Transaction Advisory (£772.90 million), Consultancy (£459.80 million), and Investment Management (£105.80 million). It consistently reports a gross profit margin of 100%, indicating that direct costs associated with revenue are minimal or absent across the reporting periods observed.

PE: 38.0x

Savills, a UK-based property advisory firm, recently declared a dividend increase and showcased robust insider confidence with strategic hires aimed at expanding its global footprint. Despite a dip in net profit margins from 5.2% to 1.8% over the past year, earnings are projected to grow by nearly 31% annually. The addition of Ruth Fischer as President of Canadian operations underscores Savills' commitment to international growth, particularly in North America, enhancing its appeal among investors looking for potential in overlooked markets.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 31 more companies for you to explore.Click here to unveil our expertly curated list of 34 Undervalued Small Caps With Insider Buying.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company

If you're looking to trade Capital, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAPD

Capital

Provides drilling, mining, mineral assaying, and surveying services.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives